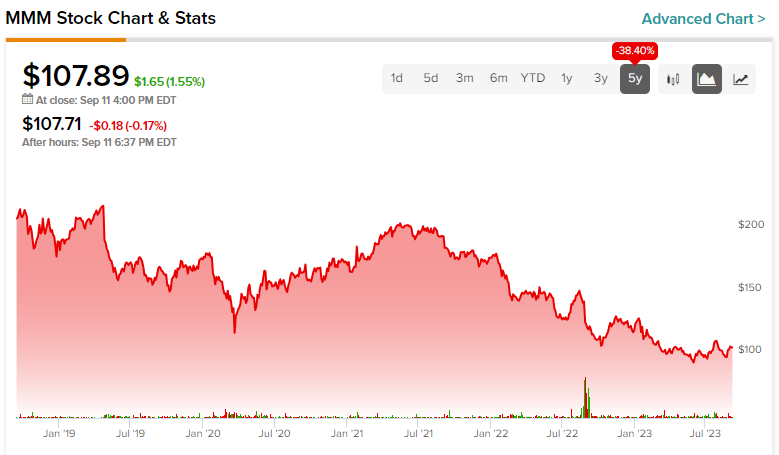

3M Stock (NYSE:MMM) has faced uncertainty for years. That’s because the tools and equipment giant, known for its numerous patented products, has been grappling with challenges, including the earplugs lawsuit, increasing interest rates, and recent underwhelming performance. Consequently, shares have fallen by nearly 40% in the last five years. Fortunately, much of this uncertainty is softening, hinting at good upside potential at MMM’s current price. Thus, I am bullish on the stock.

Ongoing Earplug Lawsuit Progressing Relatively Favorably

Since the initial claims surfaced in 2016, 3M has found itself entangled in a protracted legal dispute, entailing nearly 300,000 allegations that its earplugs, which were employed by U.S. combat troops and manufactured by its subsidiary, Aearo Technologies, were flawed. Despite the subsidiary filing for bankruptcy the previous summer, a U.S. judge ruled in August of the previous year that this would not halt the litigation targeting the parent company.

3M vigorously contested the case in a federal appeals court, striving for a comprehensive settlement agreement that would not only bolster its stock but also alleviate the persistent uncertainty surrounding the matter. The moment of resolution finally arrived in late August, as evidenced by an announcement that 3M has committed to a substantial $6.01 billion settlement to resolve the lawsuits.

While the settlement could fail if veterans refuse to accept it, it appears that the end result won’t be as fatal as many had predicted. Even if veterans demand slightly more cash, it seems that the amount won’t be such a huge deal for 3M to deal with.

As of the end of Q2, 3M had about $4.3 billion in cash. At its current market cap (almost $60 billion) and overall financial state, raising a few more billion dollars via either debt or equity shouldn’t be too dilutive or too harsh for its balance sheet. 3M shares having stabilized lately reflects this notion.

Underwhelming Results are Not as Bad as Perceived

3M’s recent results have undoubtedly been rather underwhelming. That said, they are not as bad as many investors portray them to be. In its most recent Q2 results, 3M’s net sales landed at $8.33 billion, down 4.3% year-over-year. The decline in net sales was driven by 2.2% lower organic sales, a 1.3% drop from divestitures, and a 0.9% foreign exchange headwind, only marginally offset by acquisition-driven growth of 0.1%.

3M’s decline in net sales resulted in weaker margins across the board. Specifically, its adjusted operating and adjusted EBITDA margins declined from 21.6% and 26.9% to 19.3% and 24.5% compared to last year, respectively. Consequently, adjusted EPS plunged to just $2.17 from $2.45 in the prior year period.

However, the company’s management believes that operational execution and cost discipline should allow for improving results in the second half of the year. Management’s conviction is reflected in its guidance, which got boosted.

In particular, the company expects total sales to decline by around 5% to 1%, better than the previously anticipated decline of 6% to 2%. Adjusted EPS is also expected to land between $8.60 and $9.10 vs. the previous range of $8.50 to $9.00. At the midpoint of $8.85, it implies a decline of just 12.4% compared to Fiscal 2022’s $10.10 – not such a disaster.

Continuous Deleveraging Counters Rising Interest Rates

Rising rates have been a major contributor to 3M shares being under pressure over the past few years. Given that the company’s debt load is certainly not negligible, investors fear that future refinancings will put 3M in a tough spot. That said, 3M’s continuous efforts to pay down its long-term notes have reduced its indebtedness lately. At the end of Q2, 3M’s long-term debt stood at roughly $12.95 billion, down from $14.00 billion last year. Accordingly, interest expenses net of income fell from $117 million to $96 million.

What is the Outlook for MMM Stock?

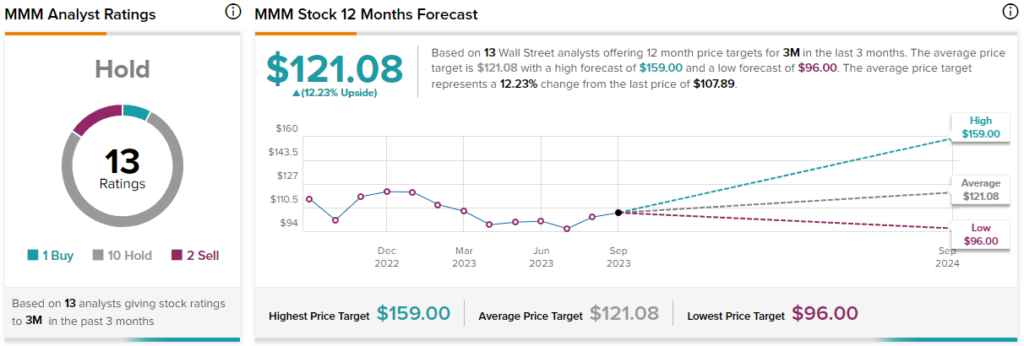

Turning to Wall Street, 3M features a Hold consensus rating based on one Buy, 10 Holds, and two Sell ratings assigned in the past three months. At $121.08, the average 3M stock forecast suggests 12.2% upside potential.

Conclusion

In conclusion, 3M has weathered a storm of uncertainty in recent years, but signs of a brighter future are emerging. The resolution of the earplug lawsuit, with a $6.01 billion settlement, is a significant step towards stability. While there may be some negotiations ahead, 3M’s financial strength can handle any additional demands.

Furthermore, the underwhelming recent results, though disappointing, are not as dire as they may seem. Management’s commitment to operational efficiency and cost discipline should lead to improved performance in the second half of the year.

Additionally, 3M’s efforts to reduce its debt and counter rising interest rates are commendable, as they enhance the company’s financial resilience. As the uncertainty softens, MMM stock appears poised for upside. Hence, the 5.6%-yielding Dividend King’s investment case is likely to appear rather attractive at the stock’s current depressed levels — especially to income-oriented investors.