3M (NYSE:MMM) stock is currently attached to a dividend yield of 6% — nearly the highest yield the company has ever traded at (it has only reached 6.1%, the all-time high, twice — once in 1982 and once in 1996). This is because, despite the market’s partial recovery in recent months, the decline of 3M’s stock has persisted uninterrupted for over a year, with no sign of reaching a floor.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is a rather polarizing case. There are definitely strong arguments that support 3M’s bearish case and, thus, the recent sell-off. Nevertheless, there is a compelling case to be bullish on the stock, including the fact that 3M is a legendary dividend-growth stock, boasting 65 years of consecutive payout increases. Combined with its dividend yield and valuation hovering at all-time highs and lows, respectively, it could be worth embracing an optimistic stance. Nonetheless, I am neutral on 3M stock.

Why Has 3M Stock Plunged?

3M stock has plunged by about 50% from its 2021 highs. Investors have yet to decide on what feels like a fair bottom for the stock, as the decline has yet to lose its continued steam for several quarters now. In my view, here are the main factors that have contributed to the bearish sentiment dominating 3M’s investment case.

1. Ongoing Earplug Lawsuit

Over the past year, 3M has been embroiled in a legal battle, including nearly 300,000 claims that its earplugs utilized by U.S. combat troops and produced by a subsidiary (Aearo Technologies) of the company were defective. While said subsidiary filed for bankruptcy last summer, back in August of last year, a U.S. judge ruled that this would not stop lawsuits against the parent company.

The firm is now fighting the case in a federal appeals court, hoping to reach a global settlement agreement that will help stabilize its stock and relieve all of the ongoing uncertainty involved. Still, due to the possibility of 3M incurring billions of dollars in liabilities, it’s no surprise that investors are abandoning the stock like passengers fleeing a sinking ship.

2. Lackluster Financial Results

Another catalyst that has been contributing to the stock’s bearish case is the company’s lackluster financial results. In 3M’s most recent Q1 results, total sales landed at $8.0 billion, down 9% year-over-year, including an organic sales decline of 4.9%. Margins were also down across the board, with GAAP and adjusted operating margins falling from 18.6% and 22%, to 15.3% and 17.9% compared to last year, respectively. The company’s guidance also projects declining sales through the rest of 2023 to persist, expecting adjusted sales to decline by anywhere between -6% and -2% for the full year.

3. Rising Interest Rates

Last but not least, I believe that shares of 3M are currently being pressured by rising interest rates. This element operates in two distinct ways. Firstly, in the medium term, 3M is likely to have to pay higher interest expenses on its debt as it seeks to refinance its debt at elevated rates. Despite the company’s recent aggressive deleveraging efforts, its balance sheet still carries a significant amount of debt — approximately $17 billion in total.

Secondly, as interest rates continue to climb, 3M’s cost of equity has also risen. Consequently, investors now demand a greater return on their investment, particularly given the significant risks that 3M currently faces. This clarifies why the market is keen on pushing the stock’s yield to higher levels that more accurately reflect 3M’s underlying risks.

What About the Stock’s Bullish Case?

3M’s bearish case may seem somewhat scary. That said, as long as the company does not suffer a devastating loss from the ongoing legal proceedings, we are looking at a highly-profitable business that is trading at quite a cheap valuation while paying a hefty dividend.

Despite 3M’s weakening sales and underwhelming outlook, management still expects to achieve adjusted earnings per share between $8.50 and $9.00 in Fiscal 2023. The midpoint of this range translates to a decline of 11.4% compared to last year. In the meantime, it also implies a rather safe payout ratio of 69%, protecting the stock’s 6% yield and multi-decade dividend growth track record.

Finally, it implies that the stock’s forward P/E is currently standing close to 11.5 (its five-year average forward P/E is 17.4), thus providing a notable margin of safety and even the potential for a notable valuation expansion. Again, this is assuming the company isn’t blasted with catastrophic damages.

Is MMM Stock a Buy, According to Analysts?

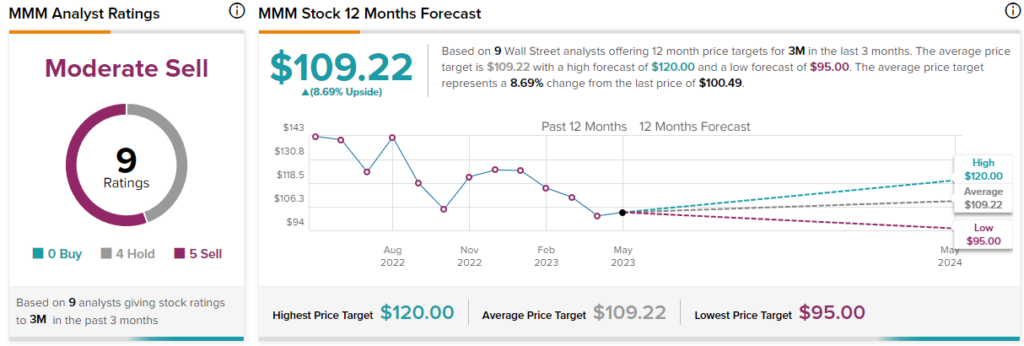

Turning to Wall Street, 3M has a Moderate Sell consensus rating based on zero Buys, four Holds, and five Sell ratings assigned in the past three months. At $109.22, the average 3M stock price target suggests 8.7% upside potential, nonetheless.

The Takeaway

Overall, while 3M’s ongoing legal proceedings and recent financial results are concerning, the company’s dividend yield and valuation hovering at all-time highs and lows, respectively, make it an appealing option for investors willing to embrace an optimistic stance. However, it is important to keep in mind the potential for significant liabilities due to the earplug lawsuits, among other risks.