With a potential recession and a wide number of risks ahead that could concentrate volatility in the tech and banking sectors, it seems wise to rotate back into value stocks. Indeed, the risk-off appetite of investors has been ongoing for well over a year now.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Though the beginning of the year saw a rotation back into risk-on names, it may be prudent to fasten one’s seatbelts for more of the same as we move through the last of the Fed’s rate hikes.

Last week’s SVB Financial failure was the first (and hopefully last) thing to break due to pressure caused by the Fed’s aggressive rate hikes. The risks may be mostly contained, but it’s not hard to imagine that many investors remain just a bit shaken up.

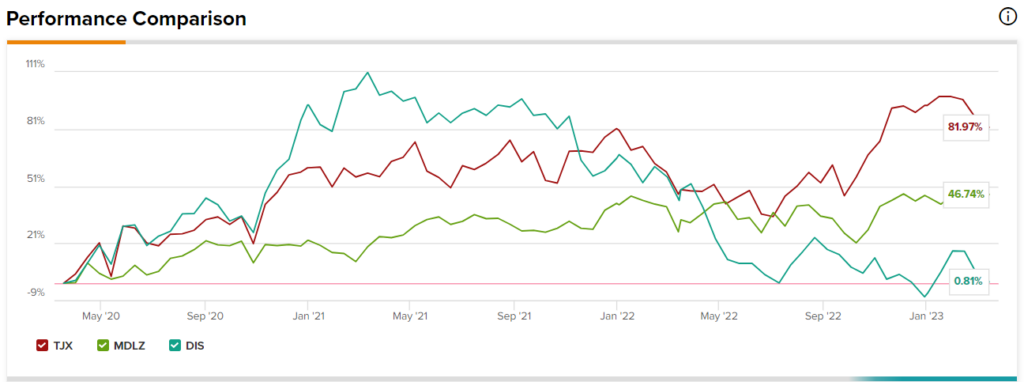

In any case, this piece will look at three value stocks still favored by analysts. Let’s see how they stack up using TipRanks’ Comparison Tool.

Walt Disney (NYSE:DIS)

Walt Disney stock is hovering around multi-year lows at $93 and change. Undoubtedly, the list of woes for the legendary media company is long, and it’s about to get longer as the House of Mouse wanders into a recession year with its old top boss Bob Iger who’s looking to clean up the mess. The bar is already set low, with the stock trading at 1.8 times book value and 2.0 times sales (both about 40% lower than their five-year averages). As a value option with turnaround potential, it’s hard to be anything other than bullish.

The return of Iger may be seen as a catalyst for some. However, Disney stock was stuck in a rut well before he handed the reigns over to Bob Chapek, the man Iger replaced amid the worst of the pandemic.

While Disney’s brand implies pricing power, even Iger admitted theme park price increases were “too aggressive.” Disney’s brand power can only take the firm so far, even as theme parks fill again after many quarters weighed down by COVID-19.

With the cash-losing streaming business Disney+ running out of steam, Disney needs to pull some levers to improve profitability prospects while reinvigorating growth. It’s not an easy task, and it’s unclear if Iger’s latest plans will bear fruit.

One lever Disney may consider pulling is content creation for rival streaming platforms. Still, it’s unclear how licensing content for third parties will spark a turnaround. In any case, such a move, I believe, isn’t a huge vote of confidence in the Disney+ platform.

Indeed, it’s hard to tell where Disney heads from here. There are a lot of unknowns as Iger seeks to explore new growth options. Despite the issues and ugly macro, analysts remain upbeat.

Sure, Iger has made mistakes in the past (most notably overpaying for acquisitions), but he has all the skills to help turn a corner. For Iger, it will be a ride of a lifetime as the stock continues its stomach-churning plunge. However, as mentioned above, its low valuation makes up for its woes.

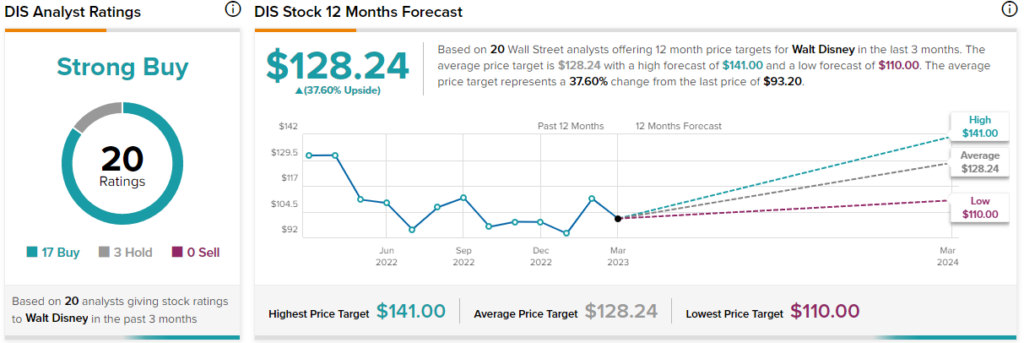

What is the Price Target for DIS Stock?

Despite its troubles, a “Strong Buy” consensus rating remains on the name, with 17 Buys and three Holds. The average DIS stock price target of $128.24 suggests 37.6% upside potential.

Mondelez (NASDAQ:MDLZ)

Confectionary kingpin Mondelez didn’t get the memo that the economy could tilt into a recession this year. The consumer staple stock is just shy of 3% from its all-time high. As rates continue to eat away at corporate profits, I view the Oreo maker as one of the better ways to weather the storm. I am bullish.

For the fourth quarter, Mondelez saw sales climb by 14% to $8.7 billion, thanks to price hikes in cookies and chocolates. That’s an impressive number for such a “boring” stalwart. Amid turbulent times, consumers still have a sweet tooth and an appetite that warrants higher prices.

As inflation lingers, look for more of the same — price hikes without suffering from a drastic reduction in demand. Indeed, Mondelez makes a strong case for why it’s one of the most durable consumer staple stocks out there.

Recent M&A could also help Mondelez keep growth going, regardless of the economy’s next move. For instance, the firm’s $2.9 billion Clif Bar acquisition from last year adds another powerful brand to Mondelez’s arsenal. It may also extend the firm’s growth runway.

Though MDLZ stock is trading at a seemingly-lofty 34.2 times trailing earnings multiple (22.5 times on a non-GAAP basis, 16% higher than the industry median), I do think investors are getting a sweet deal. That’s because few consumer-packaged goods firms can continue to power forward in a recession year as strong as Mondelez.

What is the Price Target for MDLZ Stock?

Mondelez has a “Strong Buy” consensus, with 14 Buys and one Hold rating assigned in the past three months. The average MDLZ stock price target of $75.47 implies 13.7% upside potential.

TJX Companies (NYSE:TJX)

TJX Companies stock recently corrected about 10% after hitting new highs of around $82. The off-price department store giant has fared far better than most retailers amid macro headwinds. Indeed, the pain of inflation and layoffs could keep the bargain-hunting spirit alive among consumers. Therefore, I remain bullish.

Retail inventory gluts, which have been a problem in recent times, could become even more prominent through 2023 as consumers feel the pinch. Such gluts are a plus for TJX, which could continue to enjoy a high availability of quality branded merchandise.

The company had a decent holiday season. As the firm looks to keep taking market share in a choppy economy, there’s reason to believe TJX can continue to outperform the broader market. In fact, CEO Ernie Herrman thinks TJX can keep taking share while improving profits, going forward.

With a 13% dividend hike in the books, I think it’s tough to pass up what I view as a value gem in retail. The stock trades at 25.1 times trailing earnings, just below the discount store industry average of around 28.4 times.

What is the Price Target for TJX Stock?

Analysts view TJX as a Strong Buy, with 11 unanimous Buy ratings assigned in the past three months. Further, the average TJX stock price target of $90.73 implies 21.8% upside potential.

Conclusion

Analysts love the following three value plays. At this juncture, though, Disney has the most upside potential of the names mentioned (according to analysts). I agree. The “Iger upside” could be pronounced from here.