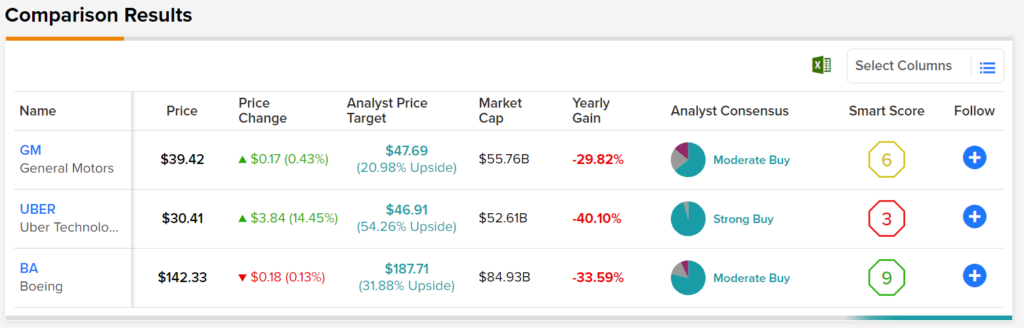

In this piece, we’ll use TipRanks’ Comparison Tool to see which transportation stock may be best suited for the year ahead. The market sell-off has decimated shares of automaker General Motors (NYSE:GM), transportation-as-a-service company Uber (NYSE:UBER), and plane-maker Boeing (NYSE:BA) this year. Despite hefty expenditures and a potential recession, Wall Street has stuck by its Buy ratings. However, that’s not to say each stock hasn’t been dealt its fair share of price target downgrades.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

With grim expectations and mounting recession fears, each stock may already be in the latter innings of their plunges. Though it’s tough to tell when the market-wide tides will lift higher again, I do view each stock as a great value for investors willing to endure another few quarters of pain. In return, investors will receive a shot at scoring a great company with terrific turnaround prospects.

General Motors (GM)

General Motors is an old-school automaker that’s embraced the EV (electric vehicle) trend with open arms. Unlike most other traditional automakers, which are merely dabbling with EVs while continuing to innovate on ICE (internal combustion engine) vehicles, GM is making an aggressive pivot. If anything, GM should be viewed as a potential EV kingpin 10 years down the road.

GM recently clocked in a solid third-quarter earnings report, with record revenues just shy of $42 billion. The company reaffirmed full-year guidance (net income to fall between $9.6 billion to $11.2 billion) and increased production of its Chevrolet Bolt.

As we enter a harsher economic environment, EV demand could easily slip. Regardless, GM is going for broke with its EV shift. In due time, I expect the firm’s efforts to pay off, but in the meantime, hefty expenditures are likely to be viewed less favorably as the Fed rate-hikes our way into a downturn.

Looking way ahead, management envisions itself selling entirely zero-emission vehicles by 2035. Indeed, there’s quite some time to make the shift, but don’t expect the firm to pull the brakes on its EV initiatives depending on the economic climate. If anything, GM may welcome a mild recession, as it’s a chance to gain ground on rivals.

At writing, GM shares trade at a mere 6.6 times trailing earnings and 0.4 times sales. The stock is attempting to sustain a recovery from a 50% peak-to-trough haircut (now off 39% from its highs). This partial recovery off lows was fuelled by its recent quarterly earnings beat ($2.25 EPS vs. $1.88 consensus). Though recession headwinds could intensify, I do think GM stock is already priced with downbeat expectations in mind.

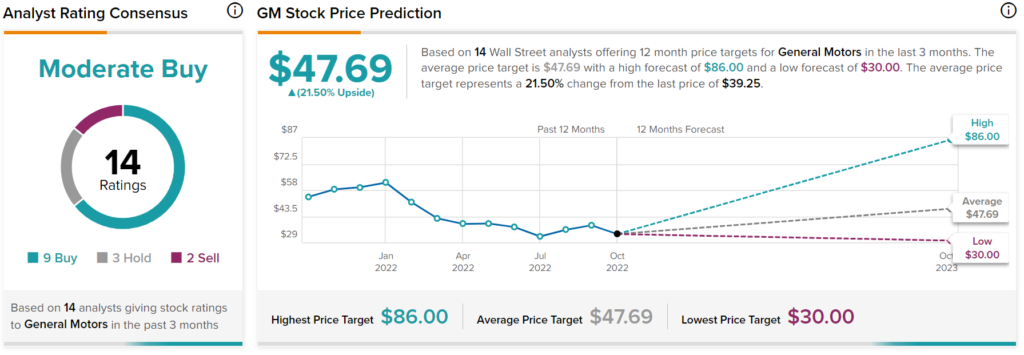

Is GM a Good Stock to Buy?

Wall Street remains quite upbeat on the automaker, with a Moderate Buy consensus rating based on nine Buys, three Holds, and two Sells assigned in the past three months. The average GM stock price target is $47.69. Such a target suggests a 21.5% gain over the next year.

Uber (UBER)

Moving on to the gig economy, Uber has been under a considerable amount of pressure. The popular ride-hailing firm is expanding its delivery capabilities and is en route to becoming a go-to “super app” for all of one’s transportation needs.

As management aims to enter GAAP profitability within the near future, I do think the firm has the means to win back the hearts of investors in this high-rate environment. The company has moved on from the supply-side woes it experienced a year ago. With an intriguing Uber One subscription offering, Uber seems well on its way to sustainably padding its margins.

Indeed, mobility and delivery services have been quite inflation-resilient thus far. As we enter a recession, my guess is we’ll discover Uber is also pretty recession-resilient. If anything, an uptick in unemployment could increase the number of drivers and provide downside pressure on prices. A recession may also cause many riders to forego vehicle ownership, resulting in a potentially unforeseen jolt in Uber rides.

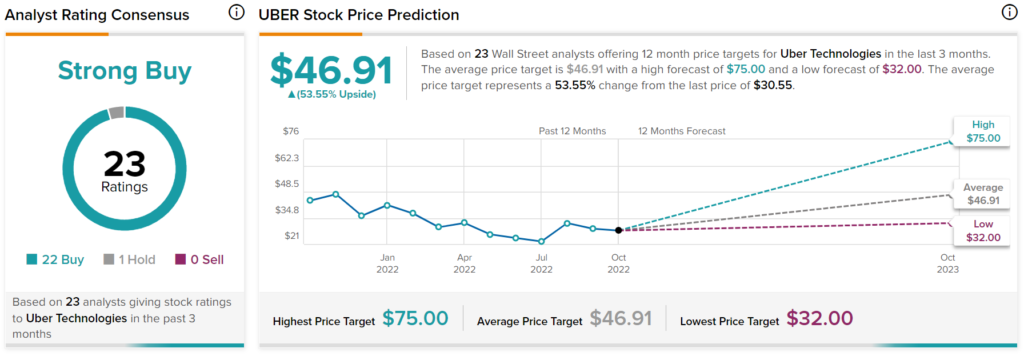

What is Uber Stock’s Prediction?

Analysts have been incredibly bullish on Uber for quite some time now. They’ve been wrong thus far, but I think they’re right to stand by their Buy ratings. Indeed, it’s impressive that 22 out of 23 analysts have Buy recommendations despite the recent downfall in the stock. The average UBER stock price target of $46.91 suggests 53.55% upside.

Boeing (BA)

Boeing is a plane maker trying to move on from the Boeing 737 Max crisis and pandemic-induced air-travel industry headwinds. The company has yet to show it can turn a corner, though. As we enter a recession, things will only get harder for a company with a history of shooting itself in the foot.

The latest quarter was quite bleak, with $6.18 in per-share losses falling short of estimates calling for a positive $0.13. Supply chain issues persist, and cost overruns in defense have only added more salt to the firm’s wound.

Though it seems like nothing can go right for the plane maker, it does stand to benefit from being a member of a global duopoly. Airplanes are not easy to make, and many firms seeking new aircraft will have to wait for their orders to be fulfilled.

Even as Boeing and its suppliers get things back to normal, it’s unclear what the fate of demand will be over the next two years. At 1.3 times sales, Boeing stock may seem cheap, but investors should expect nothing but choppy moves from the name.

What is the Target Price for BA?

Wall Street is confident Boeing can get back on track, with a Strong Buy consensus rating based on 13 Buys, two Holds, and one Sell. BA stock has a price target of $192.57, which equates to upside potential of 32.7%.

Conclusion: Wall Street Expects the Most from UBER Stock

Of the three mobility stocks outlined in this piece, Wall Street strongly favors Uber stock. The company’s on the cusp of a profitability push, and a recession may not be able to stop it.