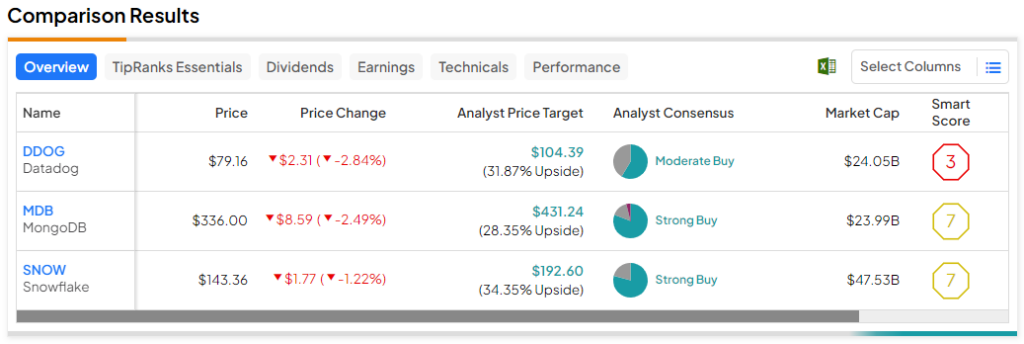

Tech stocks have cooled off recently, as investors are wary about the economy and rising interest rates. However, it’s possible that interest rates might stabilize and even move lower in the next year, which could make tech stocks a top investment choice today. Still, investors must identify quality companies with widening profit margins that are trading at reasonable valuations. Here are three such tech stocks I am bullish on — DDOG, MDB, and SNOW — that have upside potential of 28%+, according to analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s use TipRank’s Comparison Tool to compare these stocks.

Datadog (NASDAQ:DDOG)

Down 59% from all-time highs, Datadog is valued at a market cap of $26 billion. Datadog provides an enterprise-facing observability and security platform for cloud applications. Its SaaS (software-as-service) platform integrates and automates processes such as infrastructure monitoring, log management, performance monitoring, real-time observability, and more.

Despite lower enterprise spending in recent months, Datadog increased its revenue by 25% year-over-year to $509.5 million in Q2. It ended the June quarter with 26,100 customers, up from 21,210 in the year-ago period. Further, 2,990 customers now spend at least $100,000 annually on the Datadog platform compared to 2,420 last year.

These large customers now account for 85% of the company’s annual recurring revenue, allowing Datadog to report a free cash flow of $141.7 million in Q2, indicating a margin of 28%.

The key drivers for Datadog’s top line include the expansion of its customer base and the increase in usage growth. Datadog has successfully expanded its customer base over the years, given that the company ended Fiscal 2017 with 5,403 customers. Moreover, its dollar-based net retention rate stood at 120% in Q2, which suggests existing customers increased spending by 20% in the last 12 months.

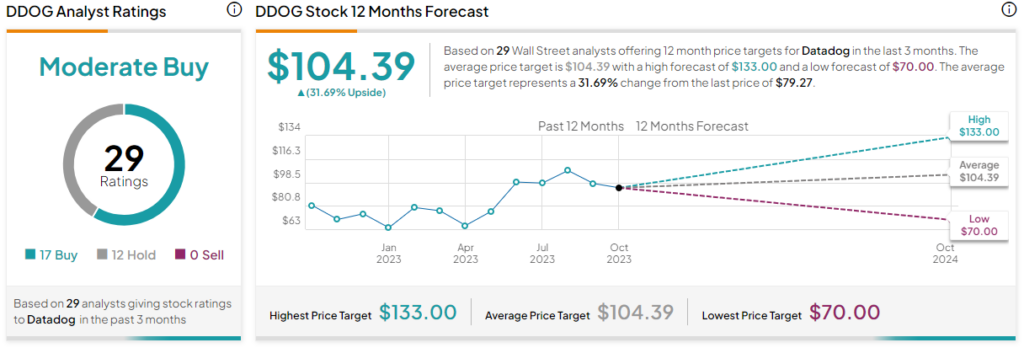

What is the Price Target for Datadog Stock?

Datadog is a Moderate Buy on TipRanks, with 17 Buys and 12 Holds assigned by analysts in the past three months. The average DDOG stock price target is $104.39, indicating upside potential of 31.7% from current levels.

MongoDB (NASDAQ:MDB)

MongoDB aims to equip enterprises with the power of software and data. Built by developers, the MongoDB platform offers a database with an integrated set of services that allow its clients to deploy the database in the cloud, on-premise, or in a hybrid environment. The database allows enterprises to build and modernize applications rapidly at a lower cost across various use cases.

MongoDB stock is down 42.5% from all-time highs and is valued at $24 billion by market cap. For its Fiscal Q2 2024 (ended in July), the company reported sales of $423.8 million, an increase of 40% year-over-year. It also reported an adjusted gross margin of 78% compared to 73% in the year-ago period, showcasing that MongoDB enjoys pricing power.

MongoDB’s improving profit margins allowed it to end Q2 with a net income of $76.7 million or $0.93 per share compared to a loss of $15.6 million or $0.23 per share in the year-ago period.

MongoDB’s stellar performance in Q2 was driven by strength in new workload acquisition and new business efforts across its sales channels. It is also in the early stages of integrating artificial intelligence with the next wave of application development. MongoDB is optimistic that its unified platform supports the demands of AI-specific applications, potentially increasing its competitive moat in the upcoming years.

What is the Price Target for MongoDB Stock?

MongoDB is a Strong Buy, according to the analyst consensus rating, with 21 Buys, four Holds, and one Sell. The average MDB stock price target is $431.24, indicating an upside potential of 28.3% from current levels.

Snowflake Stock (NYSE:SNOW)

The final tech stock on my list is Snowflake, which pioneered the Data Cloud, a network where enterprises can mobilize data easily. Using the capabilities of the Data Cloud, companies can unite siloed data and execute diverse analytic workloads at scale. Valued at a market cap of $47.5 billion, Snowflake stock trades 64% below record highs.

In Fiscal Q2 2024 (ended in July), Snowflake increased its sales by 36% year-over-year. Further, its remaining performance obligations increased by 30% to $3.5 billion, providing investors with revenue visibility in the near term. Snowflake expects 57% of its RPO to be recognized as revenue in the next 12 months, an increase of 32% year-over-year.

Snowflake ended Q2 with a net revenue retention rate of 142%, showing that its customers have increased spending on the platform significantly in the past year. The SaaS giant also has 402 customers that have spent over $1 million on the Snowflake platform in the last 12 months. With a gross margin of almost 78%, Snowflake ended Q2 with an operating margin of 8% and a free cash flow margin of 13%.

Snowflake has $4.9 billion in cash, which can be deployed towards research and development, accretive acquisitions, and expanding its product portfolio. The company also expects to report a free cash flow margin of 26% in Fiscal 2024.

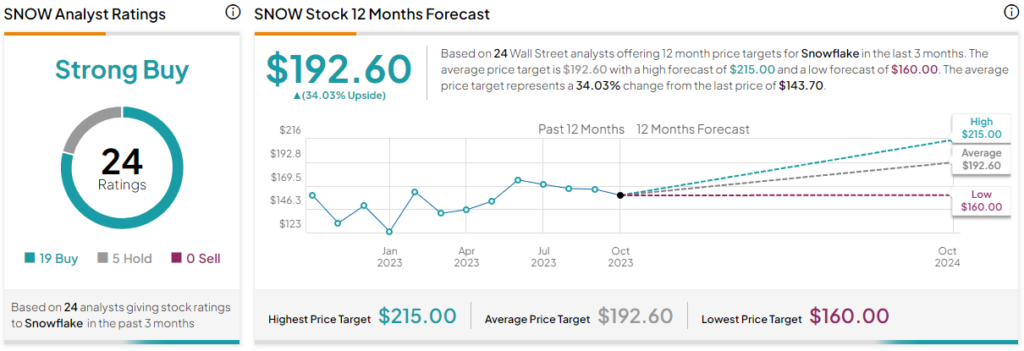

What is the Price Target for Snowflake Stock?

Snowflake is a Strong Buy, according to the analyst consensus, with 19 Buys and five Holds. The average SNOW stock price target is $192.60, indicating an upside potential of 34% from current levels.

The Key Takeaway

Each tech stock discussed here operates on a subscription-based model, allowing them to generate recurring cash flows across market cycles. Further, all three companies are generating consistent profits and should benefit from operating leverage in the upcoming decade, driving cash-flow growth higher.

Analysts, too, remain bullish on these growth stocks and expect the most upside from Snowflake in the next year.