The top-rated telecom stocks have taken varying trajectories in recent years, as top performers are spoiling their shareholders with big gains while rival telecoms are struggling to keep up. Undoubtedly, the telecom scene is incredibly competitive, leaving a “winner-takes-most” type of scenario.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

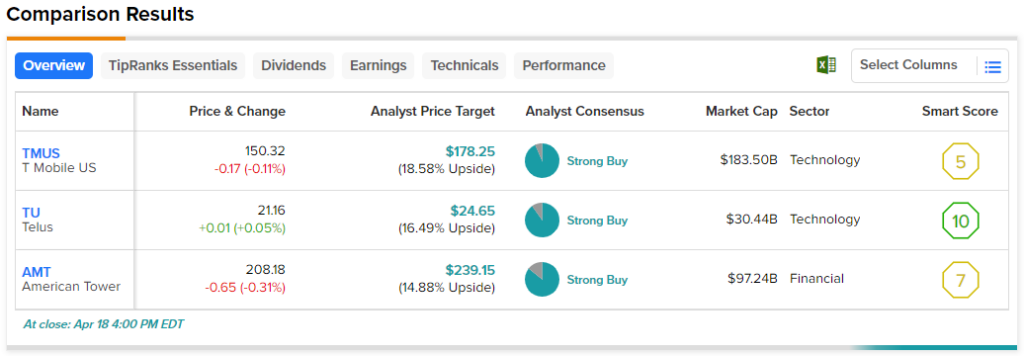

Therefore, let’s check in with TipRanks’ Comparison Tool to get a glimpse of three very different Strong-Buy-rated telecom plays to see if any are worth being in your portfolio.

T-Mobile (NASDAQ:TMUS)

First up, we have T-Mobile, a telecom titan that’s really outshined its peers recently en route to an impressive 139% gain over the past five years. T-Mobile is a full-on growth play that doesn’t pay a dividend. Still, with such strong subscriber growth momentum behind it, I find it hard to believe that T-Mobile’s rivals will have what it takes to turn the tides back in their favor.

T-Mobile’s strong network is getting stronger through a perfect combo of infrastructure investments and M&A. With exceptional growth-focused managers running the show, I continue to stay bullish on TMUS stock, even at today’s seemingly frothy heights.

At writing, T-Mobile stock trades at 64.7 times trailing earnings. That’s slightly higher than the wireless telecom service industry average of around 58.2 times. However, I believe the slight premium is justified, given T-Mobile has really been the top dog to beat.

The telecom scene may be competitive, but it’s T-Mobile that seems to still be calling the shots. Recently, the company acquired Ka’ena Corporation, the firm behind Mint Mobile, in a cash-and-stock deal (39% cash, 61% stock) worth $1.35 billion. Hollywood star Ryan Reynolds, the co-founder and ambassador standing behind Mint Mobile, will also be joining the T-Mobile team.

Mint was a virtual network operator that strived to offer better value for wireless users. Though it may have been too small to be a serious threat to T-Mobile’s throne, I do believe that, in time, Mint would have evolved to become an intriguing challenger to keep tabs on.

T-Mobile may not have the best mobile network in the world, but its pace of improvement is remarkable. With Mint and Sprint (which it acquired three years ago) in the bag, it’s not hard to imagine the firm making even bigger strides over its competitors.

Personally, I view T-Mobile as a winner that’ll keep on winning. Most analysts agree.

What is the Price Target for TMUS Stock?

On Wall Street, T-Mobile comes in as a Strong Buy based on 14 Buys and one Hold. The average TMUS stock price target of $178.25 implies 18.6% upside potential from here.

Telus (NYSE:TU) (TSE:T)

For those seeking deeper value and a juicy dividend yield, it may be worth wandering north of the border. Canadian telecom stocks look very interesting right now after falling from their highs. Canadian consumers pay some of the highest fees in the world, and the Big Three Canadian telecoms, as they’re often referred to, benefit from a relative lack of competition. After an overexaggerated decline, I remain bullish on Telus stock.

The Canadian telecom scene may be somewhat competitive. However, I believe that the Big Three take careful steps to ensure they’re not stepping on each other’s toes. In that regard, I view Canadian telecoms very favorably. Also, though the Canadian government wants better value for Canadians, it’s not been easy for up-and-comers (like Freedom Mobile) to challenge the status quo.

With a safe and growing ~5% dividend yield, Telus stock looks like a great mix of value and long-term dividend growth. In a way, I like to view Telus as the T-Mobile of the Canadian telecom industry. It doesn’t have the biggest dividend payout of the pack, but it does get high marks for customer service and network reliability.

Undoubtedly, Telus’s single-digit sales growth (which averaged 7.8% in the last three years) falls shy of T-Mobile’s high double-digit rate (averaged 20.9% over the same timespan). In any case, Telus is much cheaper than T-Mobile at just 24.6 times trailing price/earnings.

Only time will tell if an up-and-comer will rise up and challenge the high rates of the Big Three. A firm named Quebecor wishes to drive Canadian wireless prices down over time, but for now, it seems like a daunting task.

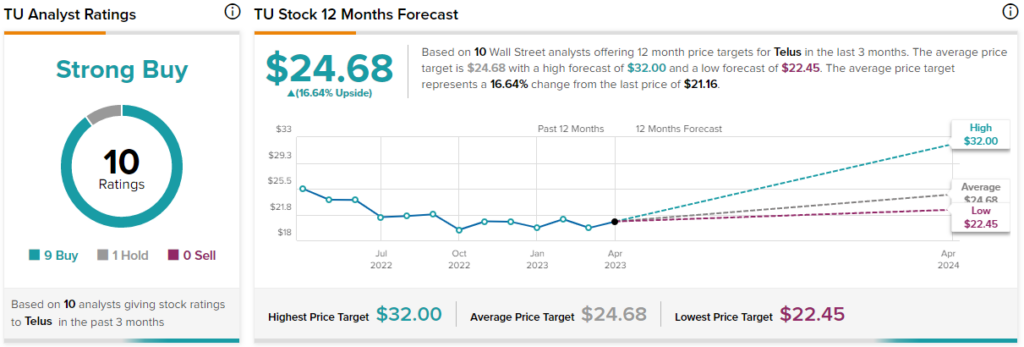

What is the Price Target for TU Stock?

Telus has a Strong Buy consensus rating, with nine Buys and one Hold. Further, the average TU stock price target of $24.68 implies 16.6% upside potential.

American Tower (NYSE:AMT)

American Tower is a cell-tower REIT that also offers a solid dividend yield and capital gains potential over time. It sports a 3% yield and 70% in gains in the books over the last five years. Therefore, AMT seems like the perfect way to play defense in the face of a recession.

With a strong fourth quarter behind it and the market’s reaction to a mixed 2023 outlook (calling for AFFO to fall in the $9.49-$9.72 range, down around 2% year over year) already digested by jittery investors, I remain bullish on AMT as it looks to recover from a 39% peak-to-trough drop.

The tower leasing industry isn’t super-competitive. As it turns out, it’s not so easy to start your own tower firm. It requires ample investment and partnerships that take time to make. With a wealth of assets and a pretty resilient cash flow stream, I do view American Tower as having a wide moat.

Despite AMT’s “moat” (competitive advantage), it’s worth remembering that technologies change with time. Over the next decade, we’ll see how demand for cell towers holds up as small cells begin popping up in more urban areas. Personally, I believe towers will always be a more effective way of getting signals in locations that don’t have high population densities. In that regard, American Tower is an intriguing long-term pick while it looks to move on from 2019 share-price levels.

What is the Price Target for AMT Stock?

American Tower stock is a Strong Buy, according to analysts, with 12 Buys and two Holds assigned in the past three months. The average AMT stock price target of $239.85 implies 14.9% upside potential.

Conclusion

With a recession coming in fast, the telecoms could wobble, but likely not as hard as the broader market. Further, the 5G boom is still in the cards. In the meantime, macro headwinds will diminish the nearer-term strength of longer-term secular tailwinds to be had from the ongoing 5G rollout.

Regardless, those with long-term investment horizons may do well with the following telecom plays that analysts continue to view favorably.