Let’s talk about stock returns, it’s a favorite topic for investors. After all, returns make investing worth the effort. Finding them, however, isn’t always easy. It’s tempting to buy into the big-name mega-companies, the Apples and Amazons with trillion-dollar valuation, high share prices, and solid earnings – but that’s not necessarily where the best returns are going to be found.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Logically, the best returns in the market will be found in fundamentally sound, low-cost stocks – especially if they have some catalysts ahead. The reasoning is simple. The solid business gives it good prospects, while the low share price will quickly turn even a small absolute gain into a high-percentage return.

With this in mind, we’ve used the TipRanks database to find three stocks that fit a profile: a market cap under $800 million and a share price below $10. Even better, these small-cap tickers have Strong Buy consensus ratings from the analyst community, and boast strong upside potential.

Sequans Communications (SQNS)

We’ll start in the chip industry, the heart of everything in the digital world. Sequans is a leader in both 4G and 5G chips needed for wireless networking of handheld devices, and especially of those chips used in IoT applications. The company has a global reach, and its products have been approved for use by numerous major wireless operators around the world: AT&T, Sprint, and Verizon in the US; Axtel in Mexico; Orange in France; and both China Mobile and China Telecom. That’s just a small sampling of the list.

Sequans’ shares peaked in February of this year, and the company’s stock has slipped in the face of serious headwinds affecting the chip industry. Supply and distribution chains have still not recovered from the COVID disruptions, and the chip industry generally is finding it difficult to keep up with the pent-up customer demand.

Even so, Sequans reported a year-over-year gain in revenue for Q2, and beat the EPS forecast. At the top line, revenue came in at $12.8 million, a 5% gain from the year-ago quarter. EPS, at a net loss of 4 cents per share, was better than the 17-cent loss expected, and far better than the 70-cent loss reported in 2Q20. Company management attributed the results to ‘massive’ growth in IoT chips; revenue in that segment grew 14% yoy.

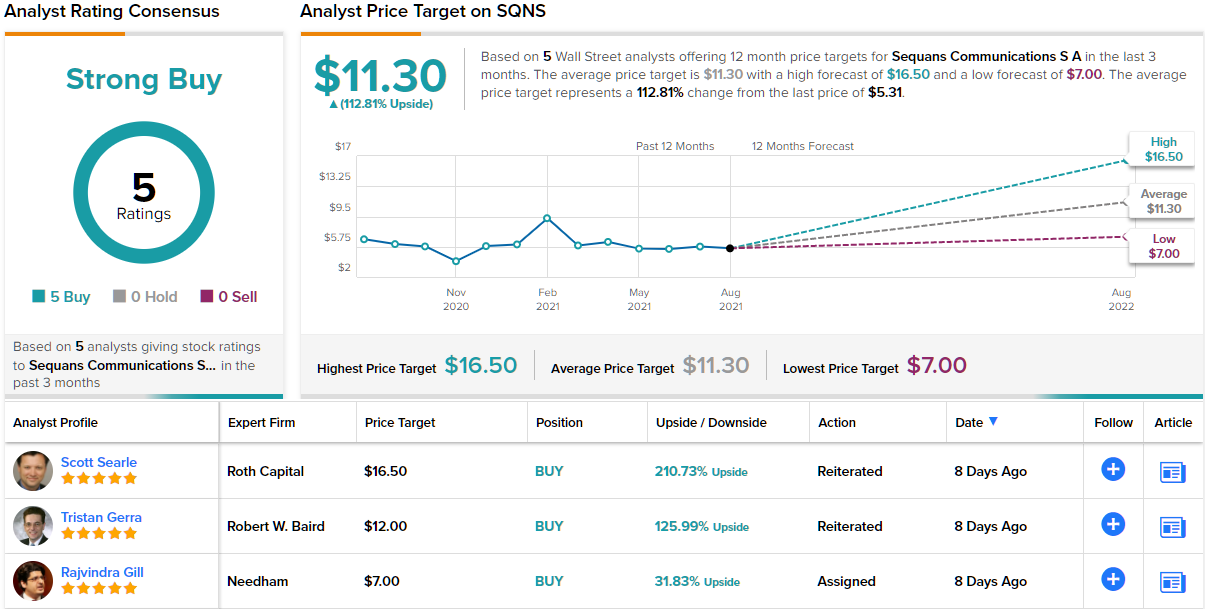

5-star analyst Scott Searle of Roth Capital doesn’t dodge the headwinds on Sequans, but he outlines a clear path forward for the company.

“Supply constraints (substrates) impact both 2Q and the near-term outlook. More importantly, demand remains at record levels, and 2022 supply actions position the company for growth targets of a 50% CAGR. Key 2Q21 notables include IoT sales increased 120% y/y, record design wins were up 18% seq to $280M (with a $600M+ pipeline) and 2022 unconstrained sales would approach $100M based on current visibility,” Searle wrote.

The analyst summed up, “We believe that recent company actions have secured sufficient supply beginning in 1H22 (wafers and substrates) to return SQNS to a more normalized growth curve in 2022.”

Overall, Searle is bullish here, and rates the stock a Buy. His price target, at $16.50, suggests the stock has plenty of room for growth, on the order of 211% in the year ahead. (To watch Searle’s track record, click here)

While Searle may be particularly bullish here, he is hardly an outlier. This small-cap chip company has a unanimous Strong Buy consensus rating, based on 5 analyst reviews. The shares are priced at $5.31 and have an average target of $11.30, implying a 12-month upside of ~113%. (See SQNS stock analysis on TipRanks)

Sunlight Financial Holdings (SUNL)

Next up, Sunlight Financial, is a consumer credit company with a twist. It focuses on loans for home improvement, especially home improvements involving ‘green’ tech upgrades and solar power installations. The company has funded over $4 billion in such loans, providing financing for over 154,000 installations.

This company went public on Wall Street last month, through a SPAC merger with Spartan Acquisition Corporation II. The merger was completed on July 9, and the SUNL ticker started trading on July 12. Spartan brought $250 million in cash proceeds to the combination, and one month after opening on the market, Sunlight Financial now has a market cap of $723 million.

Sunlight has been quick to make use of its new capital, and in the first week of August announced new loan products. These feature no- and ultra-low interest on long-term financing for residential solar power and storage systems. Interest rates on the new financing are tiered, at 0.0% for a 12-year loan, 0.49% for a 20-year loan, and 1.49% for a 25-year loan. Sunlight will report 2Q21 results on August 16; the report will be its first as a publicly traded company.

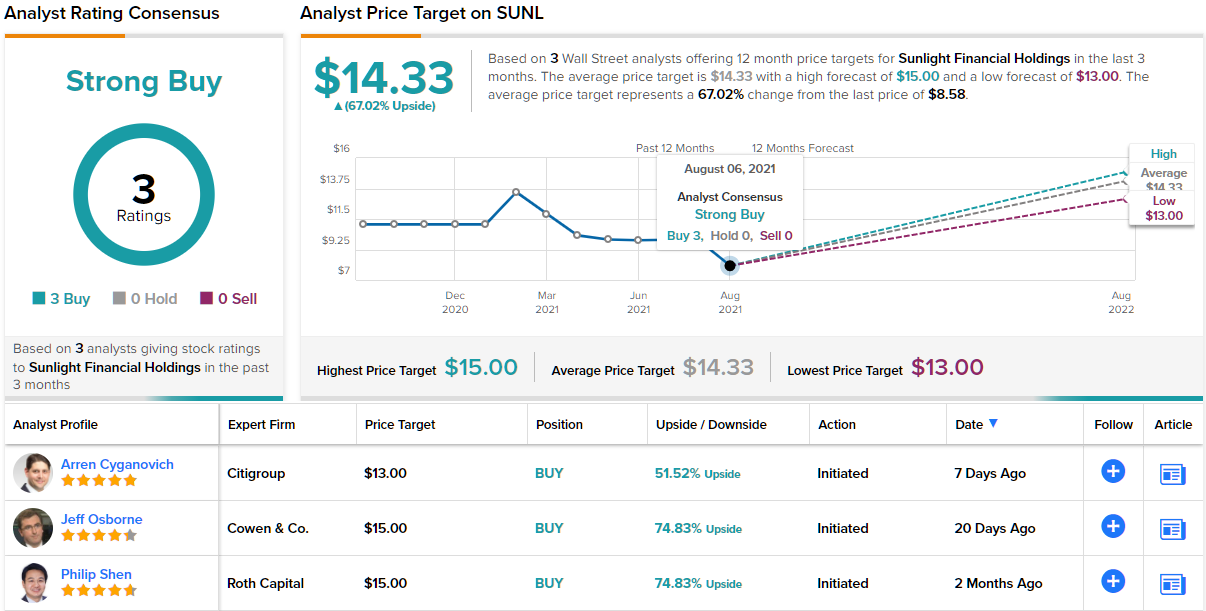

Turning to the analyst community, Cowen analyst Jeffrey Osborne believes the company has a lot going for it and a bright future.

“Sunlight’s relationships with a diverse network of capital providers and track record of having the strongest credit quality in the industry has enabled them to access low-cost capital to offer attractive returns for homeowners. The company has a simple revenue model and operates in a capital light manner. Revenue is recognized upfront as the difference between the price the capital provider is willing to pay for the loan and the price the contractor is willing to accept for the solar system. The management team has deep experience in credit, capital markets, and solar and can leverage their tailored financing solution to capitalize on the expansion in the solar loan market and overall residential solar market,” Osborne opined.

To this end, Osborne gives SUNL an Outperform (i.e. Buy) rating, and his $15 price target implies a one-year upside potential of ~75%. (To watch Osborne’s track record, click here)

In its short time as a public company so far, Sunlight has picked up 3 analyst reviews – and they all agree that the stock is a Buy proposition, making the consensus a Strong Buy. SUNL is trading at $8.58 and its $14.33 average price target suggests it has a 67% upside in the year ahead. (See SUNL stock analysis on TipRanks)

Digital Media Solutions (DMS)

Let’s wrap up with an online ad company. Digital Media works in adtech, applying tech solutions to online ads. The company uses performance-based online branding and marketing to connect advertisers with potential customers. Digital Media has a consumer intelligence database backing its campaigns, allowing it to fine-tune customer acquisition, advertiser accountability, and project budgets to get clients the best results for their dollars.

Digital Media went public last summer, through a SPAC merger, which was completed in July 2020. The enterprise value of the transaction at the time was $757 million and the DMS ticker started trading on July 16, 2020. Over the past year, the stock has poked above $14 per share several times in February and March of this year, and has fallen back down. The company’s market cap currently stands at $468 million.

While the stock has been volatile, the company’s quarterly reports show a steady gain. 2Q21 top-line revenue came in at $105.1 million, company record, and up 39% year-over-year. Net income also grew year-over-year, from $2.1 million to $4.9 million. EPS, which was a negative 1-cent per share in the year-ago quarter, came in at a profit of 7 cents per share in the current report. DMS management noted that the Brand-Direct Solutions and Marketplace Solutions brought in the bulk of the gain, increasing by $14.5 million and $22.5 million respectively.

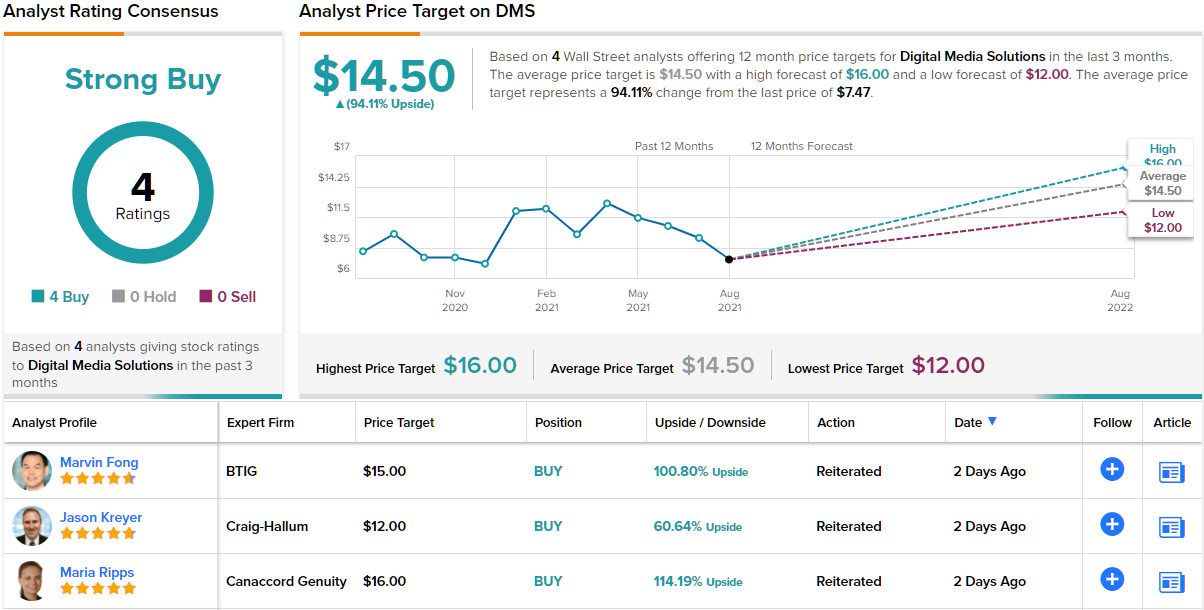

This was all enough to catch the attention of Marvin Fong, 5-star analyst from BTIG. Fong maintained his Buy rating on the stock, and set a $15 price target indicative of a 96% one-year upside. (To watch Fong’s track record, click here)

Backing his stance, Fong wrote: “We believe this was a constructive quarter as it showed DMS is beginning to deliver on margins while still delivering healthy double-digit organic growth. We believe investors have been waiting for a quarter where DMS demonstrated strength on both growth and margins and 2Q21 results should go a long way to getting investors comfortable on DMS’s ability to manage those two KPIs. We believe the increase in CES, while a bit hard to translate to a direct financial impact, was nonetheless a very positive indicator that DMS is delivering strong results for clients while also navigating a turbulent, COVID-impact ad environment.”

All in all, there are 4 recent ratings on DMS shares, and once again we are looking at a stock with a unanimous Strong Buy consensus view. The average price target is $14.50, suggesting ~94% upside this year from the $7.47 trading price. (See DMS stock analysis on TipRanks)

To find “Strong Buy” stocks trading under $10, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.