Insiders are an interesting lot. From an investor’s perspective, corporate officers have access to information – and information has always been the key to successful investing. Company CEOs, exec VPs, board members – these are ‘insider’ positions, officers in position to know what is happening, or likely to happen, to a company and its stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

And yes, they do trade their company’s stock. They are privy to the inner workings of their companies, and that knowledge puts them in a far better position than the general public to make purchase decisions on their own corporate stock.

To keep the market’s playing field level, Federal regulators require that corporate officers – the insiders – publicly disclose their trading in the companies they administer. In short, following the corporate insiders is a viable path toward profitable stock moves.

To make that search easier, the TipRanks Insiders’ Hot Stocks tool gets the footwork started – identifying stocks that have seen informative moves by insiders, highlighting several common strategies used by the insiders, and collecting the data all in one place.

Fresh from that database, here are the details on three Strong Buy stocks showing ‘informative buys’ in recent days.

Vistra Energy (VST)

The first insider pick here, Vistra Energy, is a Texas-based utility company. Vistra offers a full range of electricity services, including power generation, transmission, and distribution. The company is, of course, an essential industry, giving it an edge during the ongoing corona crisis, and Vistra’s revenues made a fast recovery from a modest dip in Q2.

That recovery was substantial. Q3 revenues came in at $3.55 billion, up 40% from Q2 and 11% from the year-ago quarter. The company’s earnings were also solid, at 90 cents per share, and were the best in over two years.

Two of Vistra’s officers have made recent insider stock buys – the President and CFO, James Burke, and Board of Directors member Scott Helm. Burke purchased 17,000 shares for which he paid over $310,000. Helm, for his part, paid over $356,000 for two blocs of 10,000 shares each.

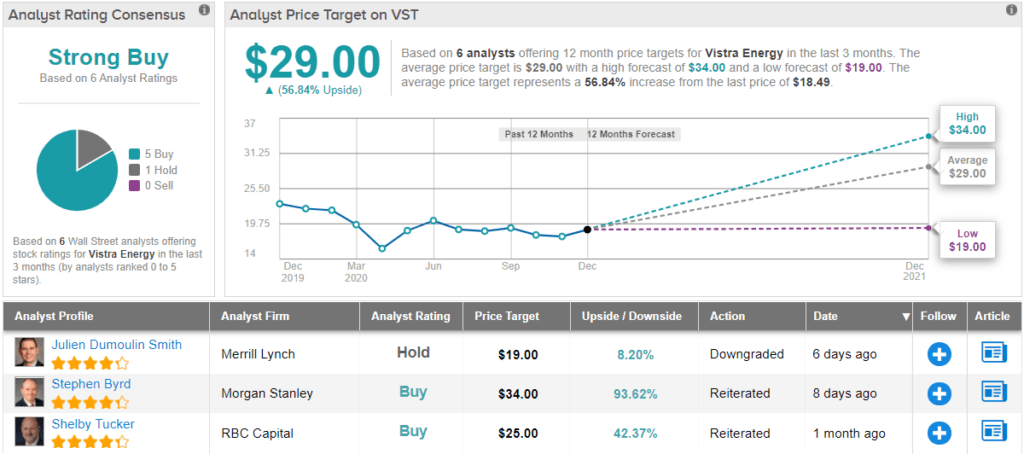

Among the supporters is BMO analyst James Thalacker who rates VST an Outperform (i.e. Buy) along with a $29 price target. This figure suggests a 57% one-year upside. (To watch Thalacker’s track record, click here)

Thalacker takes note of the company’s solid Q3 performance, and its potential for a strong finish to the year, noting: “We ascribe the strong performance at generation to a more favorable hedging environment last summer when the company entered into its 2020 hedges. In addition, with a very mild summer in ERCOT we suspect VST may have had the opportunity to optimize its generation portfolio by running less of its own higher heat rate power units and procuring power in the spot market.”

The analyst added, “We are maintaining our $3.590 billion estimate (already on the upper half) as we wait to see how power conditions develop over the next few weeks.”

Overall, Vistra Energy holds a Strong Buy rating from the analyst consensus, based on 6 recent reviews breaking down 5 to 1 Buy vs. Hold. The stock’s $18.47 share price and $29 average price target make the upside ~57%, matching Thalacker’s for the coming year. (See VST stock analysis on TipRanks)

Grid Dynamics Holdings (GDYN)

Next up, Grid Dynamics, is a hi-tech company offering digital transformation services. Grid’s services include solving the problems of legacy replatforming, technology engineering, and moving to the cloud. The company has a global customer base, and is headquartered in Silicon Valley.

Grid went public on the NASDAQ index in March of this year, through a merger with a special purpose acquisition company, ChaSerg Technology Acquisition Corporation. When the transaction closed, Grid boasted a market cap of $660 million. The stock fell sharply in the early days of its trading, coinciding with COVID’s impact on the economy and stock markets at that time. Since then, GDYN shares have rallied, and the shares are up more than 120% from their March trough.

The corona impact can still be felt for Grid, however. While revenues in Q3 were up 18% sequentially from Q2, the $26.33 million reported was still lower than Q1. The company reported strong revenue growth in its non-retail industry and technology verticals.

The notable insider move here comes from Victoria Livshitz, EVP of Customer Success, who purchased 126,000 shares last week. She shelled out $1.48 million for the bloc of shares, and now has a holding in GDYN worth $10.65 million.

Canaccord’s Joseph Vafi is impressed by Grid’s forward prospects. The 5-star analyst noted, “We believe the Grid customer set will be more robust and growthy versus pre-pandemic, boosted by strong spend on digital transformation by healthy and growing customers in TMT and CPG. Retail, de-risked, retains attractive option value, but no longer will Grid be weighed down by material revenue exposure in a somewhat hamstrung and defensive vertical.”

To this end, Vafi rates GDYN a Buy along with a $15 price target. At current levels, his target implies a 12-month upside potential of 21%. (To watch Vafi’s track record, click here)

Survey says… Wall Street agrees. A grand total of four out of four ratings published in the past few weeks say GDYN is a Strong Buy. However, the stock’s $12.75 average price target suggests a modest upside of 3% and a change from the current share price. (See GYDN stock analysis on TipRanks)

Arvinas Holding Company (ARVN)

From hi-tech we shift to biotech, where Arvinas is an innovator in the biopharmaceutical field. The company is working on protein degradation therapeutics, a new class of drugs that targets disease-related proteins and uses the body’s own natural protein disposal systems to break down and remove problem proteins.

As with most research-based biopharma companies, Arvinas is all about the pipeline. The pipeline here is early stage, but robust, featuring no fewer than 13 programs in the fields of oncology, immune-oncology, and neuroscience. The drug candidates under developments are in various stages of early research, ranging from the exploratory to Phase 1 clinical trials.

In recent days, ARVN shares have spiked, more than doubling their share price. The jump came after the company released clinical data showing the potential efficacy of two pipeline drugs; ARV-471 for the treatment of patients with locally advanced or metastatic ER+/HER2- breast cancer, and ARV-110 for the treatment of men with metastatic castrate-resistant prostate cancer.

Also in recent days, Arvinas announced the pricing on a new issue common stock. The company is putting 5.714 million shares on the market at $70 each, in a move to raise $400 million in new capital.

And this brings us to the insider trading. Board member Liam Ratcliffe spent $9.99 million on 142,857 shares during the new common stock offering. His total holding in ARVN is now $58.46 million.

In a note from Roth Capital, 5-star analyst Zegbeh Jallah writes, “We like management’s outline of important next steps, which we believe highlights how Arvinas plans to develop [ARV-110 and ARV-471] to drive value, and build out its early-stage pipeline… The company’s robust preclinical pipeline is a nice addition to its strong leading clinical candidates.”

Jallah gives the stock a Buy rating, and his $120 price target implies a strong one-year upside of 50%. (To watch Jallah’s track record, click here)

It’s not often that the analysts all agree on a stock, so when it does happen, take note. ARVN’s Strong Buy consensus rating is based on a unanimous 9 Buys. The stock’s $102.44 average price target suggests it has 28% growth ahead of it in the coming year. Shares currently trade at $79.74. (See ARVN stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.