The past few days have been painful, as the broader basket of bank stocks sunk on the back of the fall of SVB Financial (NASDAQ:SIVB) or Silicon Valley Bank. Undoubtedly, the heat of rate hikes seems to be spreading to areas beyond tech.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As investors bite their nails over the banking crisis while the Federal Reserve stays hawkish, it’s easy to dismiss 2023 as another year that could see steep market losses.

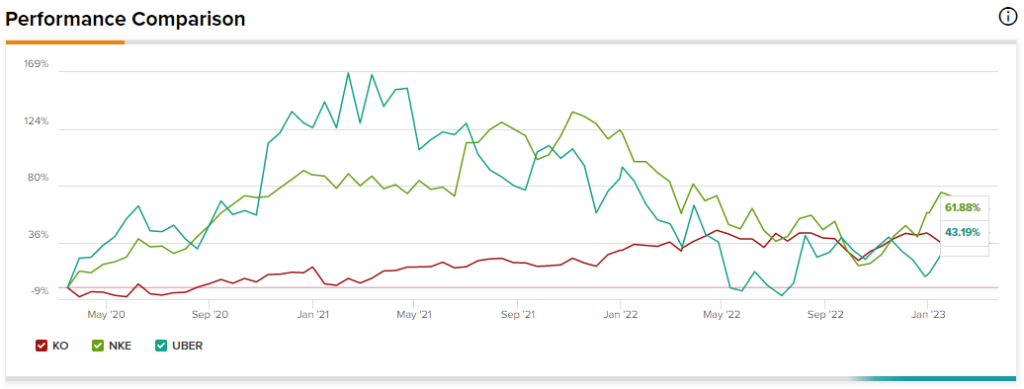

Despite rising uncertainties and approaching economic headwinds, Wall Street analysts still remain upbeat on a wide number of names. Therefore, in this piece, we’ll use TipRanks’ Comparison Tool to look at three stocks that are expected to gain, even as a potential recession and other headwinds take hold.

In order from most defensive to choppiest, let’s have a look at the names.

Coca-Cola (NASDAQ:KO)

After last week’s bloodbath, now seems like a pretty good time to think about playing defense. In terms of defensives, it’s tough to stack up against Coca-Cola, one of Warren Buffett‘s largest holdings. Sure, sugary sodas aren’t at all subject to much growth, but they can bring relative stability to investors’ portfolios as we head into a potential economic hurricane. As a result, I am bullish.

KO stock is less volatile than the market (its 0.54 beta implies a lower market correlation). Still, the stock’s sitting down around 10% from its high and could be at risk of sliding alongside almost everything else if last week’s bank jitters continue to send shockwaves across markets.

Therefore, if Coke slumps, I see a shot for investors to get a slightly better yield for a slightly lower price. At the end of the day, bank failures are less impactful to the beverage giant than they are to other firms.

The stock trades at 24.2 times trailing earnings (about 2% lower than its five-year average), with a 3.1% dividend yield. I’d say that’s a fair price for a resilient, wide-moat firm that’s averaged 3.2% dividend growth in the past three challenging years.

What is the Price Target for KO Stock?

Coke stock is a “Strong Buy,” according to Wall Street, with 10 Buys and two Holds. The average KO stock price target of $68.45 implies a solid 14.5% gain from here.

Nike (NYSE:NKE)

Nike is a sneaker giant fresh off one of its worst declines in decades. From peak to trough, the stock lost more than 53% of its value. Indeed, that’s horrid for one of the bluest blue chips in the Dow Jones. However, I’m staying bullish on the name.

Inflation headwinds, supply issues, and overstock have weighed heavily in recent years. Now, it’s the demand side that could be a problem as the company looks for ways to reduce inventory without taking too much of a hit to margins.

Nevertheless, Nike is a great brand that can endure these tough times, even as consumers look to put away their wallets as a recession hits. As Nike moves through a tough macro environment, look for the firm to continue investing in the long haul; its higher-margin direct-to-consumer (DTC) push is still in play. Also, as rival Adidas (OTC:ADDYY) feels the pinch from its Kanye West split, look for Nike to move in to take market share.

Currently, NKE stock is down around 33% from its peak. At 32.6 times trailing earnings, NKE is about 3% cheaper than its five-year average earnings multiple. Longer-term tailwinds may be offset by near-term macro headwinds, but Nike is still a legendary brand that can survive even a hard-landing recession.

What is the Price Target for NKE Stock?

Wall Street has a “Strong Buy” on the name, with 20 Buys and five Holds assigned in the past three months. The average NKE stock price target of $132.79 implies 12.8% upside potential from here.

Uber (NASDAQ:UBER)

UBER stock has been attempting to stage a bottom for years now. The stock’s off around 48% from its high, but analysts are still major fans of the story, even as a recession hits. I remain bullish on Uber.

The company plans to push towards GAAP profitability over the coming quarters. Further, ride-hailing may prove surprisingly recession-resilient. With subscription offerings like Uber One, ride-hailing seems to be a decent value for riders who value convenience.

Ultimately, it’s too soon to say that Uber is a recession-resilient stock. In any case, Wall Street praises the company, with a lot of incredibly bullish analysts who expect great things from the firm as it pushes into high gear.

With strong network effects and a great management team, UBER stock may be a great ride for investors while shares go for 2.0 times sales (53% lower than its average since IPO). For such an innovator, a 2.0 times sales multiple doesn’t do the stock justice.

What is the Price Target for UBER Stock?

Uber’s also a “Strong Buy,” with 26 Buys and only one Hold assigned in the past three months. The average UBER stock price target of $47.62 implies 48.6% upside potential.

Conclusion

Coke, Nike, and Uber all have what it takes to power through a recession. Nonetheless, Wall Street expects the most upside (over 48%) from UBER stock.