The consumer has been pressured to cut back over the past year, and many retailers have muted expectations for the holiday shopping season. Still, such a low bar could set the stage for better-than-feared results that may precede some form of consumer recovery. Either way, the pains from a weakening consumer have not been spread evenly among retailers. Analysts are bullish on a few plays in the scene (LULU, TJX, and SONO) that could benefit significantly once the consumer is ready to spend money again.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indeed, the much-anticipated recession has proven quite elusive. And if it never materializes in the coming months, the coasts may finally be clear for the average consumer to start spending a bit more again.

Therefore, in this piece, we’ll check in with three stocks using TipRanks’ Comparison Tool that the Wall Street community is staying optimistic about as we move into and through the holiday season.

Lululemon (NASDAQ:LULU)

Lululemon has been bucking the trend as consumers pull back on discretionary spending. Indeed, it’s remarkable how resilient the yoga-wear maker has been over the past two years. Though shares of LULU are still off around 15% from their 2021 highs, recent weakness is much less pronounced versus the likes of other apparel makers, like Nike (NYSE:NKE) — down more than 40% from its peak — that are also leaning heavily on their brand power.

The price of admission to LULU still seems steep, with the stock going for around 51 times trailing price-to-earnings (P/E), well above the apparel retail industry average of 25.5 times. That said, such a multiple may be warranted, given how much runway remains in the athleisure space. Lululemon is an athleisure pioneer, and it’s continuing to sprint with the ball, even as new rivals emerge across all corners of the apparel scene.

Though Lululemon may have made the same mistakes as other lockdown-era beneficiaries during the stay-at-home boom (think acquiring Mirror, which it’s now throwing in the towel on), it’s pretty remarkable that the firm has been able to stage a decent recovery, with new highs now within striking distance.

That’s a testament to just how strong the brand is and how sizeable the market opportunity in athleisure could be. Indeed, many peers who over-stretched (forgive the pun) during the pandemic tailwind days were not nearly as fortunate as Lululemon.

As the newest member of the S&P 500 (SPX), I view Lululemon as a worthy growth story that could continue to prove its doubters wrong, especially if we’re in for a consumer spending recovery. I was previously a LULU stock doubter, citing valuation concerns. Now, I’m ready to change my tune and take on a more bullish stance as the firm continues to hang in there despite the rise of new competitors like Alo Yoga and Athleta.

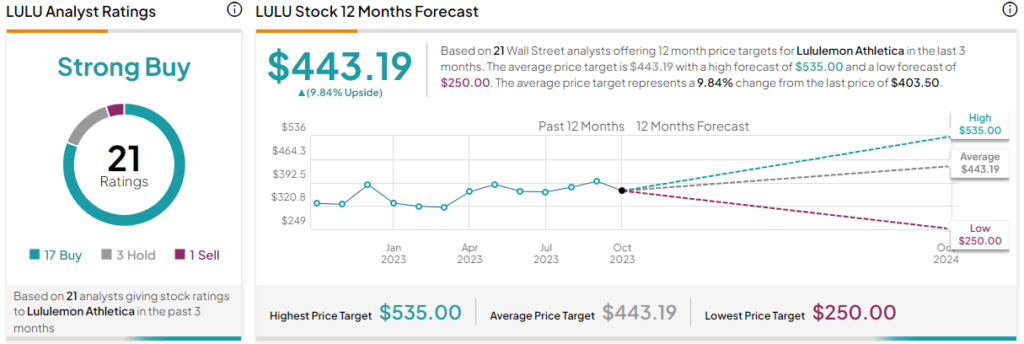

What is the Price Target for LULU Stock?

Lululemon’s a Strong Buy, according to analysts, with 17 Buys, three Holds, and one Sell rating assigned in the past three months. The average LULU stock price target of $443.19 implies 9.8% upside potential.

TJX (NYSE:TJX)

TJX is an apparel play that’s just 4% off from its all-time high. While TJX-owned stores (TJMaxx and Marshalls) are very much discretionary, they’re a more defensive “flavor” of discretionary. Off-price clothing has been faring incredibly well as consumers seek to maximize value with every purchase.

Even if the consumer heals, I’m not so sure they’ll suddenly take their business elsewhere — not when they’ve saved a great deal from shopping at a TJX-owned store. A rougher economy may give way to consumer bargain-hunting. However, as the economy bounces back, don’t expect to see a reversion. In fact, we may very well see consumers spending more at TJMaxx than opting to pay full price for discretionary goods at a pricier place. Indeed, bargain hunting can be quite addictive. As such, I remain bullish on TJX.

At writing, shares trade at 26.4 times trailing P/E, just a tad higher than the apparel retail industry average of 25.5 times.

The slight premium is warranted, given that it seems to be a winning stock to play a “soft landing” for the economy. A soft landing would entail less disposable income in consumer pockets but just enough to allow for the justification of discretionary purchases, perhaps if there’s a good deal to be had!

All considered, TJX stands out as a great stock to consider. Analysts agree. Long live bargain hunting.

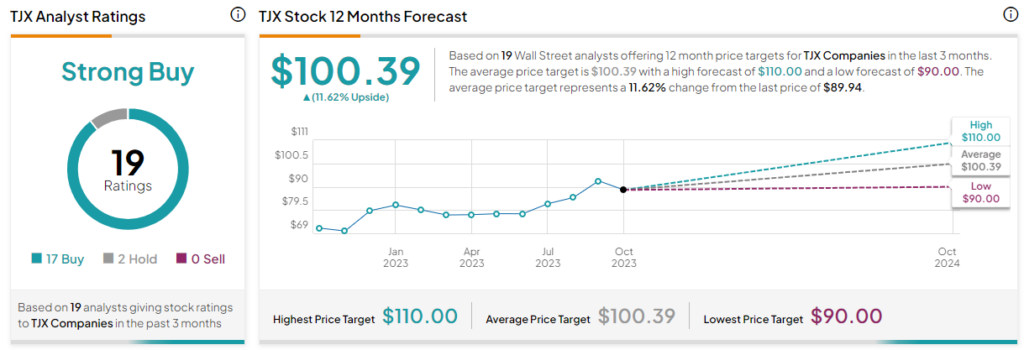

What is the Price Target for TJX Stock?

TJX sits at a Strong Buy, according to analysts, with 17 Buys and two Holds. The average TJX stock price target entails modest 11.6% upside potential from current levels.

Sonos (NASDAQ:SONO)

Unsurprisingly, audio equipment maker Sonos has been the worst performer in the trio of consumer stocks presented in this piece. The stock is down nearly 75% from its 2021 peak, which is starting to look out of reach, as the stock would need to quadruple to see new highs again. Though new highs are probably out of the question, analysts remain confident the firm can deliver solid returns over the year ahead. For now, I’m staying bullish due to the modest valuation and what I view as a strong brand in the consumer audio products scene.

Though Sonos has a reputation for delivering high-quality sound systems, the space has grown competitive in recent years, with many big-tech firms launching their own speakers, fully equipped with AI assistants. Indeed, Sonos goods are quite expensive compared to a run-of-the-mill Echo. That said, I do think the premium side of the market could be Sonos’s for the taking.

Rosenblatt Securities recently initiated Sonos stock as a Buy, citing innovation as a key differentiator that could help drive sales growth as margins also look to improve. I think Rosenblatt is right on the money. However, I believe the consumer will need to heal further before they look to splurge on pricy audio equipment. In an economy like this, it’s more of a nice-to-have. And of late, consumers seem more than willing to wait before buying.

Though the holiday season could bring forth a few surprises, I wouldn’t get my hopes up. Longer term, though, Rosenblatt will probably be proven right. Things will eventually look up for the once-bustling audio firm.

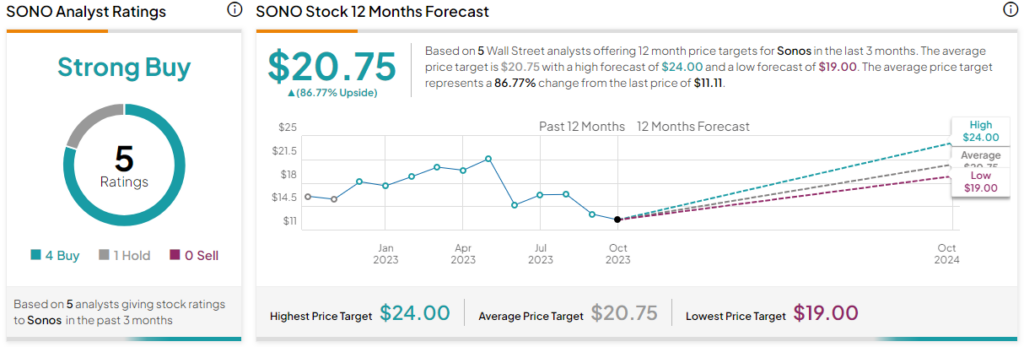

What is the Price Target for SONO Stock?

Sonos is a Strong Buy, according to analysts, with four Buys and one Hold assigned in the past three months. The average SONO stock price target of $20.75 implies a whopping 86.8% in upside from here.

Conclusion

Don’t discount the resilience of the consumer. While consumers remain more selective and deliberate about spending money on discretionary goods, retailers can still find a way to march higher if they’re able to outdo the competition. Of the trio of stocks mentioned, analysts see the most upside potential (86.8%) from SONO stock.