The technology sector has really heated up in recent months. Whether or not recent gains are sustainable remains the big question. As the final rate hikes come in, the Federal Reserve may have nowhere to go but lower (or sideways) regarding rates. In such a scenario, the broader basket of tech plays in the Nasdaq 100 (NDX) may be in a spot to hang onto recent gains.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Of course, profitability and valuation remain key areas of focus, given the days of near-zero rates may still be far off due to inflation’s stubborn stickiness.

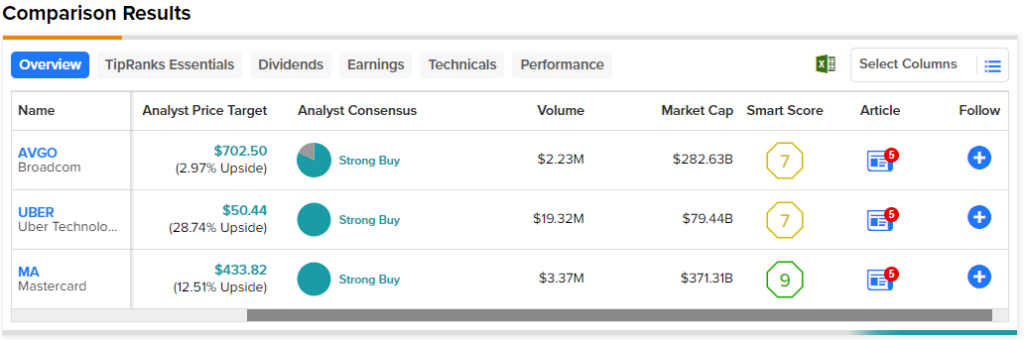

In this piece, we’ll check TipRanks’ Comparison Tool to weigh in on three profitable (or nearly-profitable) tech stocks still viewed favorably by Wall Street analysts.

Broadcom (NASDAQ:AVGO)

Broadcom is a semiconductor behemoth that’s been increasing its software exposure over the years. The company’s semiconductor business is robust, but it’s the software segment that could be a more meaningful driver of margins, moving forward. It’s not just Broadcom’s software push that’s impressive; it’s the ability of management to spot value in the large-cap software space that’s most impressive. I’m bullish on AVGO.

Unlike most other deep-pocketed companies, Broadcom doesn’t chase momentum. Instead, it’s likelier to take advantage of dips to best put its liquidity to work. Broadcom went after cloud and virtualization software firm VMWare (NYSE:VMW) on the dip, as it’s looking to acquire the company. For now, Broadcom is providing remedies to appease EU regulators. If all goes well, the $61 billion deal should go through, giving Broadcom yet another edge in the arena of enterprise software.

The company is also getting into the AI game, with a new chip revealed last month tailored for AI networks. Indeed, AI hardware is in high demand these days. As Broadcom expands its AI product lineup, it may be challenging for Mr. Market to slow down the stock’s impressive run.

Shares are now at all-time highs. At 23 times trailing price-to-earnings (well below the semiconductor industry average multiple of about 35 times), with a 2.7% dividend yield, AVGO stock still stands out as an intriguing value play with potentially underrated growth prospects.

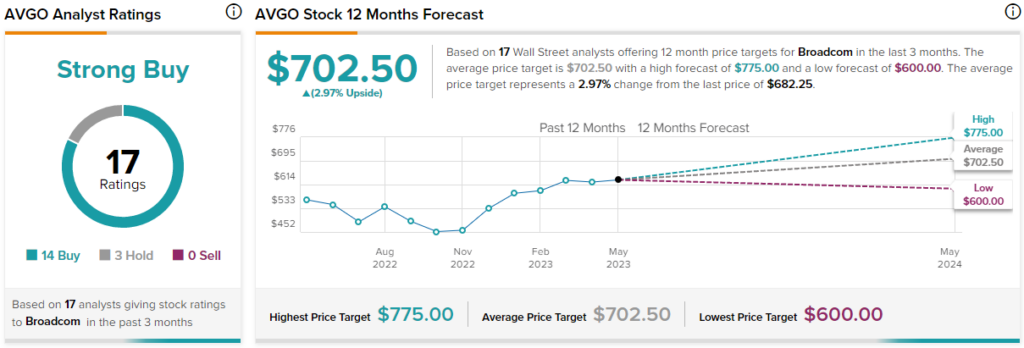

What is the Price Target for AVGO Stock?

Broadcom stands at a Strong Buy, with 14 Buys and three Holds. The average AVGO stock price target of $702.50 implies a 3% gain from here.

Uber (NASDAQ:UBER)

Uber is the famous ride-hailing giant on the cusp of a GAAP profitability push. As the firm continues to drive operating margins higher, shares are bound to be rewarded by investors. Further, with such a strong network of drivers and users, the firm can easily “upsell” new features and drive sales. With sales and margins heading in the right direction, it’s hard not to be bullish on the firm, like the many analysts that stand by their Buy ratings, even in the face of last year’s vicious sell-off.

After a 74% surge off last year’s lows, a lot of margin expansion potential is likely baked in. However, new products and features may not have been considered yet by a majority of investors. At the firm’s annual product showcase, the firm unveiled group rides and the ability for teens to hail without a parent. Indeed, the Uber experience is getting richer with time.

At around 2.2 times price-to-sales (well below the software industry average), Uber still seems to be a “show-me” story for many. Still, after a solid first-quarter revenue beat that saw sales surge 29% year-over-year, Uber may have done enough to win over the confidence of big-name analysts.

What is the Price Target for UBER Stock?

Uber remains at a Strong Buy among the analyst community, with all 27 analysts covering the stock giving it a Buy rating. Currently, the average UBER stock price target of $49.04 entails a 25.2% gain from here.

Mastercard (NYSE:MA)

Mastercard is a credit card behemoth that may be viewed as more of a fintech innovator. The stock is up over 36% from its 2022 lows and is just shy of its 2021 all-time high. Although crypto hype has died down of late, Mastercard still sees value in innovating on the front of blockchain. The company plans to expand its crypto-tied card roster.

Even if “crypto winter” lasts a while longer, I view the initiative as quite wise. Even if crypto winter turns into more of an ice age, there’s not much to lose for the payments behemoth. Therefore, I’m staying bullish on MA stock as it looks to push to a new high.

Despite recent macro headwinds, Mastercard improved upon its EBIT margins in its latest quarter (up 0.4%). With a lengthy streak of earnings beats behind it, I’d be shocked if Mastercard doesn’t pole-vault over second-quarter expectations (estimates currently looking for $3.00 EPS).

Though the stock trades at a hefty premium (38.7 times trailing price-to-earnings) over its credit card rivals, analysts still think the price of admission is worth paying.

What is the Price Target for MA Stock?

Mastercard stands at a Strong Buy, with 18 unanimous Buy ratings assigned in the past three months. At writing, the average MA stock price target of $433.82 implies 12.5% upside potential from current levels.

Conclusion

The following three tech plays could be in for a strong finish to the year. Analysts expect the most from UBER stock, with expectations of a 25.2% gain.