The recent rally in AI stocks has been the talk of the town these days. OpenAI’s impressive large language model (LLM) ChatGPT opened the floodgates of enthusiasm. Indeed, many of us have now had time to get comfortable with generative AI. Through our numerous prompts, we’ve seen what LLMs are truly capable of, even with sometimes restrictive guardrails in place. As AI tech continues powering forward, there’s a chance that LLMs like ChatGPT will take up more time in our daily lives. Further, the advent of new AI-tied plug-ins could change how we accomplish everyday tasks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As exciting as LLMs are, investors must never lose sight of valuations. Further, ChatGPT may be the hot technology today, but it’s still unclear if it will be the best LLM in the near and distant future. Sometimes, it’s hard to tell which companies will take the lion’s share of the pie. At this juncture, it seems like OpenAI has what it takes to be player number one now and well into the coming years.

So, what’s the best way to bet on AI? Keep a watch on new AI technologies and be ready to pounce if the market doesn’t yet realize its potential. In this article, I’ll use TipRanks’ Comparison Tool to track three AI stocks I’d keep tabs on.

Alphabet (NASDAQ:GOOGL)

Even before the ChatGPT frenzy, Alphabet is a FAANG behemoth that has long been considered to be a powerful force in the field of AI. Undoubtedly, LLMs have the hearts of investors, but ChatGPT may very well be the first of many profoundly-powerful technologies we’ll need to learn the ropes with.

Alphabet’s consumer-facing LLM Bard is an intriguing response to ChatGPT. Though it’s hard to tell which technology is superior at this point in time (the two LLMs have their own unique strengths and weaknesses), I do think the odds that Alphabet creates an LLM better than ChatGPT are quite high. For this reason, I remain bullish on GOOGL stock.

Shares of Alphabet have participated in the so-called AI rally, spiking after an upbeat I/O event that unleashed a wave of AI potential. That said, I’d argue the AI innovator still looks relatively cheap compared to other tech companies with comparable (or even inferior) AI capabilities.

At writing, GOOGL stock trades at 28.7 times trailing price-to-earnings (P/E) or 22.8 times its forward P/E. I believe a P/E multiple in the 20s is not indicative of a bubble. In that regard, I continue to view Alphabet as relatively undervalued in the AI universe.

Sure, Alphabet is a behemoth we’re all familiar with, but it should not be viewed as a market leader that only stands to get disrupted from here. If any firm stands to disrupt the current state of Google Search, it’s Google with AI.

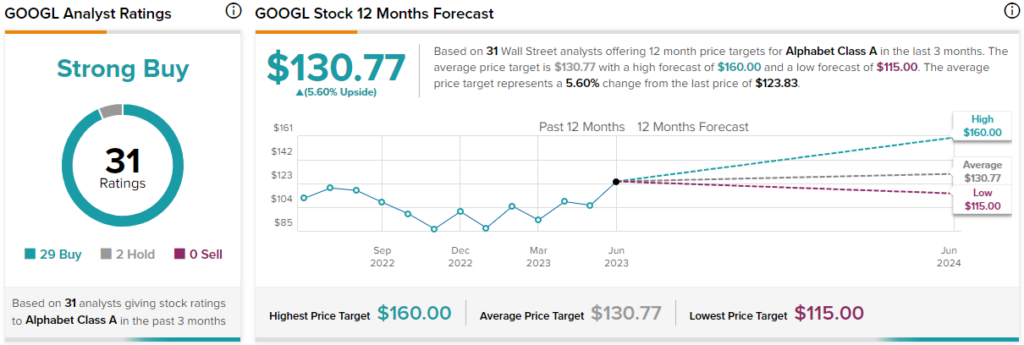

What is the Price Target for GOOGL Stock?

Analysts have a Strong Buy rating on shares, with 29 Buys and two Holds. The average GOOGL stock price target of $130.77 implies 5.6% upside potential from here.

Nvidia (NASDAQ:NVDA)

Nvidia is the GPU (graphics processing unit) kingpin that’s enjoyed explosive demand for its products amid the so-called “AI gold rush.” It seems like there aren’t enough GPUs to go around to meet the needs of firms that know they need the hardware power to get up to speed with the latest and greatest AI technologies.

As firms continue to stock up on Nvidia GPUs, it’s easy for demand to rocket above estimates. As the tides turn, though, there’s a good chance that demand could go bust after the latest boom. For Nvidia shareholders, that could mean a sudden surrender of recent gains. Now up a staggering 187% year-to-date, I’m neutral on the stock, entirely due to the price of admission, which is above and beyond what I’d be willing to pay.

Nvidia is likely to remain the heavyweight champion in the AI race, though, and it’s a worthy newcomer to the $1 trillion market cap club. As the company launches new chips tailored for AI, one has to think that firms will be quick to submit their bulk orders again.

Though I view AI’s ascent as sustainable, I’m not so sure when the next bust cycle will hit. Big-ticket hardware products can be quite cyclical. In that regard, I’d much rather wait for the stock to come down instead of “chasing” it near the $400 level.

Of late, Nvidia seems to be teaming up with capable firms while placing bets on other AI contenders in the space (think Cohere). As the company adds to its AI exposure, it’s tempting to be bullish on the company. However, the stock is just too hot to handle for most value hunters.

What is the Price Target for NVDA Stock?

I’m not comfortable with Nvidia’s valuation, but many analysts think the good times will keep coming. The stock has a Strong Buy rating, with 32 Buys and four Holds. The average NVDA stock price target of $449.92 implies 9.7% upside potential from here. Perhaps it’s not too late to get in on the GPU leader, according to analysts, at least.

Broadcom (NASDAQ:AVGO)

Broadcom has enjoyed a massive AI-driven spike of its own, bringing shares up a whopping 54.9% year-to-date. Undoubtedly, the opportunity to buy the stock with a 4% yield and P/E in the teens is over, but that doesn’t mean Broadcom’s glory days are over.

The stock added another 6.3% on Monday, bringing shares above the $850 mark, thanks to EU regulatory approval to acquire software company VMWare (NYSE:VMW) for $61 billion. As the deal moves closer to the finish mark, it’s hard not to be excited about Broadcom as a catch-up play to win the AI race on the fronts of hardware and software (the VMWare deal gives Broadcom a nice “moat” in the visualization software space).

At 26.5 times trailing price-to-earnings, Broadcom looks like a bargain-basement stock compared to Nvidia. As a reasonably-priced chip name with a relatively high dividend yield (2.3%), AVGO stock strikes me as one of the high-momentum stocks that I’d not be afraid to “chase.” Therefore, I’m staying bullish on Broadcom, as the $1,000 mark seems in sight.

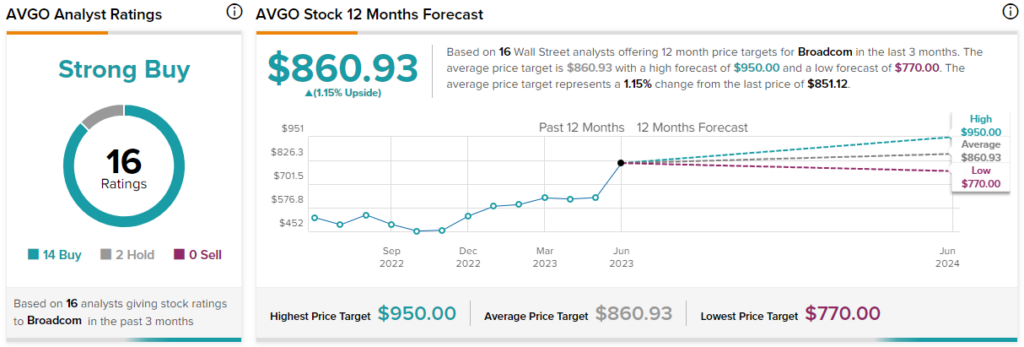

What is the Price Target for AVGO Stock?

Broadcom’s a Strong Buy on Wall Street, with 14 Buys and two Holds assigned in the past three months. Nonetheless, the average AVGO stock price target of $860.93 implies just 1.2% upside potential.

Conclusion for AI Investors

Perhaps a technology we’ve yet to hear of, or a competing offering (think Bard or Bing), could be the LLM that tops ChatGPT. In any case, investors should grow comfortable with the thought of diversifying one’s AI bets. There will be a few huge winners, but I don’t believe it’s that easy to tell at this juncture.