Looking at the news, tension is everywhere. Headlines such as “Market risks are increasing as US and China tensions intensify” and “Global COVID-19 cases top 15 million as US approaches 4 million” are almost a daily event. Despite all of this, one sector in particular has been gaining traction.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Even though the space is often overlooked, industrial stocks have outpaced the broader market over the last three months, with the Industrial Select Sector SPDR Fund (XLI) posting a 17% gain compared to the S&P 500’s 13% increase. That being said, analysts remind investors these names still face trade risks, so due diligence is essential.

That’s where TipRanks comes in. We used TipRanks’ database to find three industrial stocks that have earned a “Strong Buy” consensus rating from the analyst community, while also providing double-digit upside potential. Let’s take a closer look.

Workhorse Group (WKHS)

Our first stock is Loveland, Ohio-based Workhorse Group (formerly AMP Holding), which manufactures battery-electric vehicles and aircrafts. The company’s products include electric cargo vans and pickup trucks, as well as drone delivery systems.

Workhorse’s stock has soared since the middle of June, with explosive gains totaling 398% year-to-date. The rise was prompted by the US government’s approval of the company’s C-Series trucks, which are electric vehicles for last-mile delivery (deliveries to their final address).

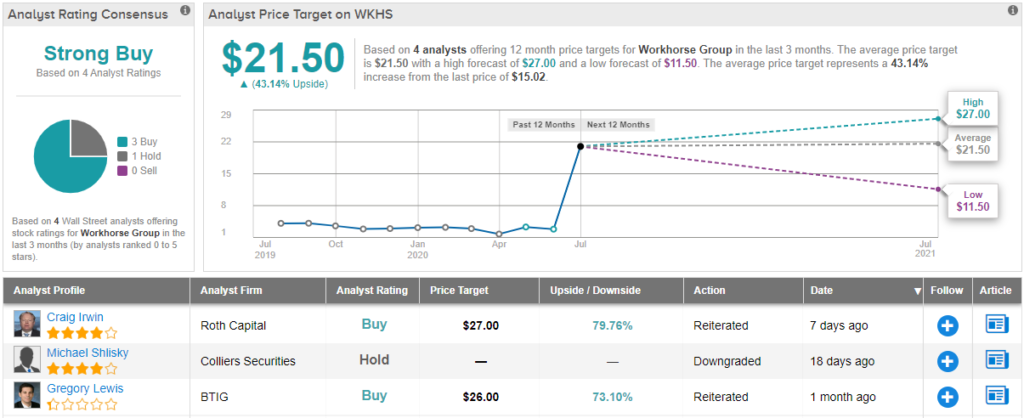

Writing for BTIG, analyst Gregory Lewis provided some insight regarding the excitement surrounding Workhorse: “…WKHS has a first-mover advantage which was solidified last week when the Series C received final safety approvals which give Workhorse roughly a 1-2-year head-start on other electric vehicle last-mile delivery competitors.”

On top of this, a bid for the United States Postal Service contract for zero-emission mail delivery vehicles is a potential catalyst that could propel the stock even higher. Lewis commented, “In thinking about the United States Postal Service contract we expect the initial contract award(s) to be a scaled-down version of the potential $8 billion contract and probably split between two suppliers (we expect WKHS to be one of the winners).”

Based on all of the above, Lewis rates WKHS a Buy along with a $26 price target. This figure implies a hefty one-year upside potential of 73% from current levels (To watch Lewis’ track record, click here)

In general, the analyst community agrees with Lewis. Workhorse gets a Strong Buy consensus rating, based on 3 Buys and 1 Hold. The average price target is $21.50, which adds up to substantial upside potential of 43%. (See Workhorse stock analysis on TipRanks)

Limoneira Company (LMNR)

Next up is Limoneira Company, which operates an agribusiness and develops real estate. Limoneira operates six segments: Fresh Lemons, Lemon Packing, Avocados, Other Agribusiness, Rental Operations, and Real Estate Development.

LMNR’s second quarter results were negatively impacted by the COVID-19 pandemic. The price of lemons dropped due to an oversupply as restaurants and bars were closed. As a result, revenue fell to $39.6 million, compared to $42 million in the prior-year quarter.

Meanwhile, National Securities analyst Ben Klieve defends the stock, noting: “While the current environment is weak, we believe demand is improving and see a long runway ahead for pricing. We remain buyers of LMNR as we believe depressed share values do not consider the substantial upside potential from increased acreage, improved pricing and an improved balance sheet from non-core cashflows.”

To this end, Klieve has a Buy rating on the stock with a $20 price target. This means significant upside potential of 47% could be in store. (To watch Klieve’s track record, click here)

Overall, Limoneira has a Strong Buy consensus rating from other analysts as well, with 3 Buys and no Holds or Sells. The stock’s average price target of $18.67 indicates 37% upside potential from the current share price. (See Limoneira stock-price forecast on TipRanks)

Gentherm (THRM)

Last but not least is Gentherm, which manufactures thermal management technologies such as climate comfort systems for cars. The company operates two segments: automotive and industrial.

Gentherm performed relatively well in the first quarter of 2020, despite the challenging economic environment. Sales for the company’s automotive segment declined only 9.4%, compared to a decline of 24% for overall vehicle production in Gentherm’s markets. In total, revenue fell by 11%, while adjusted EPS was down 7.3%.

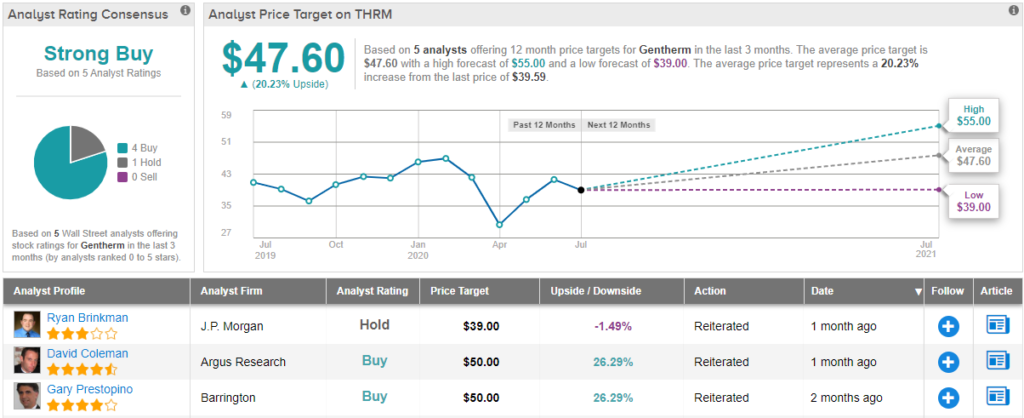

Although a recovery for the auto industry may take some time, Roth Capital analyst Matt Koranda is taking a longer-term view of the stock: “We expect the next several quarters to be challenging for Gentherm and auto industry peers. However, we view the company as better-positioned than most to weather a COVID-induced downturn. We view THRM shares as increasingly attractive,” he commented.

The Roth Capital analyst based his opinion on Gentherm’s “long-term growth potential given a leadership position in climate-controlled seating and the under-penetration of the category, stronger-than-peer median margin profile, healthy balance sheet, and exposure to a troughing automotive industry across most global markets.”

In light of this, Koranda rates Gentherm a Buy. He has a $44 price target on the stock, which translates to upside potential of 11%. (To watch Koranda’s track record, click here)

Turning to the rest of the Street, most of the analysts are on the same page. 4 Buys and 1 Hold suggest a Strong Buy consensus rating. The rest of the Street is more aggressive than Koranda, with the average price target of $47.60 implying upside potential of 20%. (See Gentherm stock analysis on TipRanks)

To find good ideas for industrial stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.