Calls for a stock market pullback or correction seem to be growing by the week. The market rally started off the year strong, but a potential recession is still in play, causing some pundits to lower their expectations on U.S. stocks, specifically U.S. growth stocks. Nevertheless, even if tech, the year’s leader, ends up giving back some of the gains in the second half, there are still other sectors out there that could be spared.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

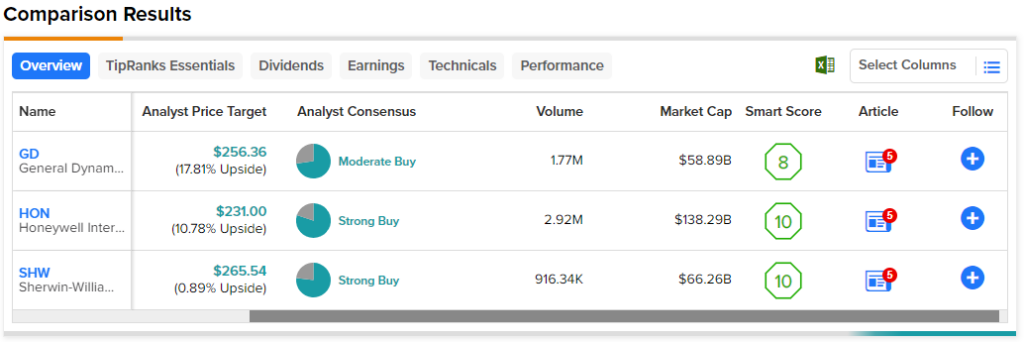

The underappreciated industrial sector stands out as an area that may be spared from the next sell-off in broader markets. There are a bunch of large-cap names that trade at modest valuations, with Strong or Moderate Buy ratings from the analyst community. Therefore, in this piece, we’ll use TipRanks’ Comparison Tool to check in with three highly-touted names on the Street right now.

General Dynamics (NYSE:GD)

General Dynamics is a $60 billion aerospace and defense contractor that may very well be one of the cheapest of the batch right now, with shares going for just 17.55 times trailing price-to-earnings, well below the 30.35 times aerospace and defense industry average. Undoubtedly, General Dynamics has some overlap with some of its larger defense peers (think the aviation division). Still, the company’s biggest strength lies in its Marine Systems business and, with that, contracts from the U.S. Navy.

Undoubtedly, nuclear-powered submarines (one of the faster-growing business lines) and massive combat-ready ships are incredibly difficult and expensive to build. In that regard, General Dynamics has an impressive moat that’s tough to break. Due to the modest multiple and the wide moat, I am bullish on GD stock.

General Dynamics stock has been weighed down of late, now off around 16% from its all-time high hit late last year, thanks in part to supply-chain issues. Despite the ongoing supply-side hiccups, management is sticking with its full-year forecast, calling for revenues to fall in the $41.2-$41.3 billion range (lower than the $42 billion consensus).

Indeed, the original guidance seems to have already accounted for supply and labor constraints. On the supply side, things could be looking up for the supply chain in the second half as management looks to tackle the issue head-on.

Sure, General Dynamics faces a unique slate of issues, but as an acyclical firm, I view GD stock as a potential name that could buck the trend, even as a recession comes to the U.S.

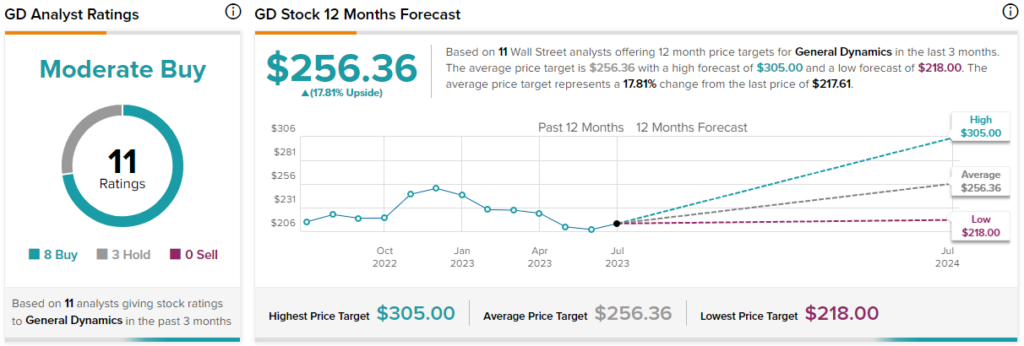

What is the Price Target for GD Stock?

General Dynamics boasts a Moderate Buy, with eight Buys and three Holds. The average GD stock price target of $256.36 implies 17.8% upside potential from here.

Honeywell (NYSE:HON)

Honeywell is a behemoth-sized ($140 billion market cap), diversified industrial company that’s started to trend higher again. The stock is now off just north of 11% from its 2021 all-time high and could be in a spot to realistically break out to new heights by year’s end. With strong first-quarter results (and a guidance raise) in the books, I find it hard to be anything but bullish on the stock.

For the first quarter, Honeywell clocked in a nice $2.07 in EPS, beating the analyst consensus of $1.93. Revenue also climbed 8% year over year to $8.9 billion. That’s not bad growth for such a large industrial giant.

Looking ahead, I’d expect more single-digit growth to be fueled in part by prudent M&A. Undoubtedly, Honeywell’s growth-by-acquisition strategy could help power growth from here. Recently, the company bought turbomachinery control service provider Compressor Controls in a deal worth $670 million.

At writing, shares of HON trade at 22.4 times forward price-to-earnings, in line with the five-year historical average of 21.9 times. With a 2% dividend yield and a new CEO, Vimal Kapur, who brings forth a wealth of experience, I’d not want to bet against the name as it inches closer to all-time highs.

What is the Price Target for HON Stock?

Honeywell stock is a Strong Buy on TipRanks, with eight Buys and two Holds assigned in the past three months. The average HON stock price target of $231.00 implies 10.8% upside potential.

Sherwin Williams (NYSE:SHW)

Finally, we have paint play Sherwin Williams, which is starting to pick up traction after enduring a painful plunge of over 40% from peak to trough. The stock is now currently down just 27% from its peak, thanks in part to a solid first quarter ($2.04 EPS vs. $1.79 consensus estimate) and two notable upgrades coming in over the past two months. As the housing recovery looks to pan out following an economic slowdown, I have to stay bullish on SHW stock.

Investment banking company Jefferies likes the risk/reward in the name, given its belief that the “housing market is turning.” Undoubtedly, a recession hasn’t even landed yet. Still, I believe Jefferies is right to look beyond the negatives that the market has already had ample time to contemplate.

With a strong brand name and potential upside in a post-recession cyclical upswing, I’d not be afraid to pay 32.2 times trailing price-to-earnings for the name. Such a multiple makes SHW stock in line with the industry average.

What is the Price Target for SHW Stock?

Sherwin Williams is a Strong Buy, with 10 Buys and three Holds. Nonetheless, the average SHW stock price target of $265.54 implies 0.9% upside potential from current levels.

Conclusion

Industrial stocks look to offer good value at these levels, say analysts. Currently, General Dynamics stock boasts the most upside potential (17.8%) of the trio mentioned in this piece.