Everyone knows the benefits of investing in mutual funds – safer and diversified returns. Interestingly, these investments can earn higher returns if we are willing to take a little bit of risk. Yes, we are talking about mutual funds focusing on small market capitalization companies. That means companies with a market cap ranging between $300 million and $2 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Today, we will look at three mutual funds that boast high returns and could offer a potential upside of over 20% in the next twelve months.

Vanguard Small-Cap Growth Index Fd Admiral (VSGAX)

The VSGAX fund invests in small-cap U.S. growth stocks that have the potential to grow faster than the broader market. It is a passively managed fund but is considered more volatile due to the nature of the stocks.

As of today’s date, VSGAX has 656 holdings with total assets of $31.28 billion. The fund mainly focuses on the Technology sector, followed by Healthcare. VSGAX pays a thrice-yearly dividend amounting to $0.11 per share, with a current yield of 0.70%.

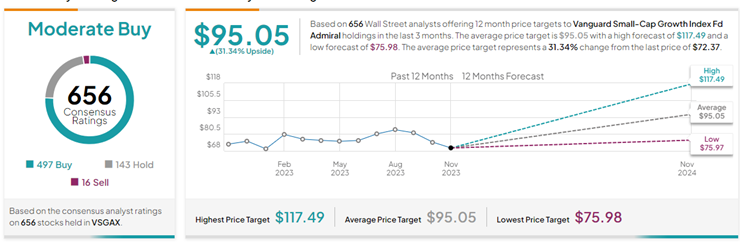

On TipRanks, VSGAX has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 656 stocks held, 497 have Buys, 143 have Holds, and 16 stocks have a Sell rating. The average Vanguard Small-Cap Growth Index Fd Admiral price target of $95.05 implies 31.3% upside potential from the current levels.

Year-to-date, VSGAX has gained 4.1%. Its top five major holdings include Fair Isaac Corporation (FICO), Targa Resources (TRGP), Exact Sciences (EXAS), Entegris (ENTG), and PTC Inc. (PTC). The top 10 holdings account for 7.53% of the portfolio.

Schwab Fundamental US Small Company Index Fd (SFSNX)

The SFSNX fund replicates the Russell RAFI US Small Company Index. Its total returns aim to correspond to those of the RAFI index. SFSNX also pays annual dividends of $0.98 per share, representing an impressive current yield of 1.31%.

The mutual fund has 997 holdings, focused mainly on the Industrials and Financial sectors. The fund has $1.79 billion in assets, with the top ten holdings accounting for 4.18% of the portfolio.

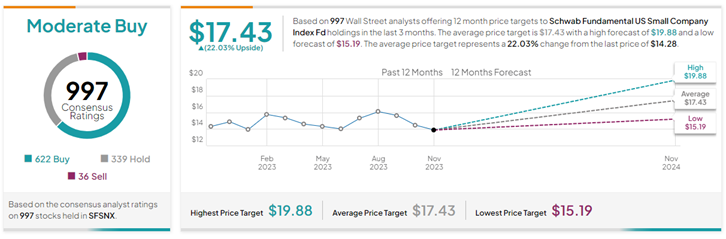

On TipRanks, SFSNX has a Moderate Buy consensus rating. This is based on 622 stocks with a Buy rating, 339 stocks with a Hold rating, and 36 stocks with a Sell rating. The average Schwab Fundamental US Small Company Index Fd price target of $17.43 implies 22% upside potential from current levels.

SFSNX has gained 2.4% so far this year. Its top five holdings include Super Micro Computers (SMCI), Diversified Healthcare (DHC), Prog Holdings (PRG), Xpo, Inc. (XPO), and

Spectrum Brands (SPB).

Vanguard Tax-Managed Small Cap Fund Admiral CI (VTMSX)

As the name suggests, VTMSX seeks to help investors from the higher tax bracket and an investment horizon of five years or more. Although, it is possible that the fund may not always be tax-efficient while trying to keep taxable gains to a minimum. Remarkably, VTMSX pays a quarterly dividend of $0.26 per share, with a current dividend yield of 1.45%.

The fund has 603 holdings with total assets of $8.33 billion. A major focus of VTMSX remains on the Industrials and Financial sectors. Its top 10 holdings account for 6.01% of the portfolio.

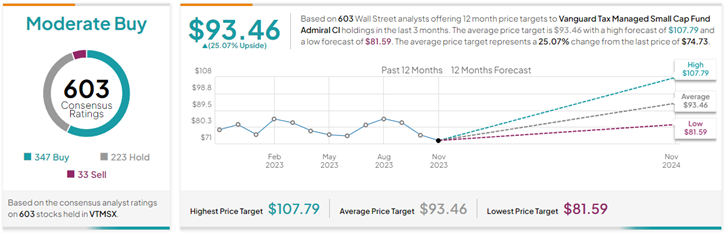

On TipRanks, VTMSX has a Moderate Buy consensus rating. This is based on 347 stocks with a Buy rating, 223 stocks with a Hold rating, and 33 stocks with a Sell rating. The average Vanguard Tax-Managed Small Cap Fund Admiral Cl price target of $93.46 implies 25.1% upside potential from current levels. Year to date, VTMSX has lost 1.8%. Its top five major holdings include SPS Commerce (SPSC), Rambus (RMBS), Axcelis (ACLS), Comfort Systems USA (FIX), and Onto Innovation (ONTO).

Key Takeaways

Every investor seeking marginally higher returns with moderate risk can turn to small-cap-focused mutual funds. The above three MFs can help generate attractive returns for your portfolio. If you have not tried investing in mutual funds yet, start your journey today with the help of TipRanks’ mutual fund tools, which will help you make the right choices.