If you’re on a quest to find this year’s potential stock-market winners, just look to the sky for red-hot solar stocks for 2023. Solar energy may be the answer to nations’ clean-energy ambitions, and it looks like a good time to scoop up shares of solar stocks representing fast-growing companies in the space.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Some folks claim that smart money is delving into the solar sector right now, and they might be right about that. In a recent example, South Korean conglomerate Hanwha Group reportedly plans to spend a whopping $2.5 billion to build solar panel manufacturing infrastructure in the U.S. state of Georgia.

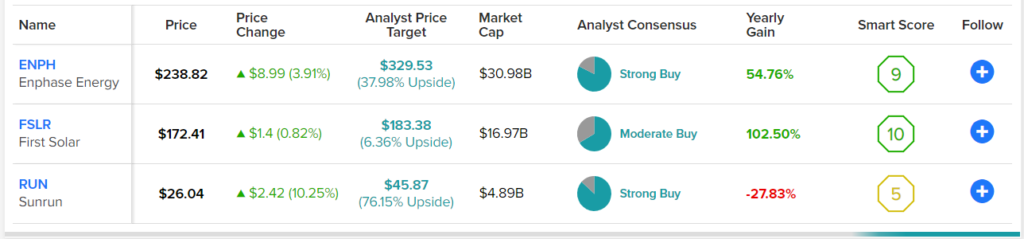

Could tax incentives spur more high-dollar investments into the American solar energy industry? The sector certainly appears to be heating up, so let’s delve into a sampling of three prime picks – ENPH, FSLR, and RUN – for prospective solar stock stakeholders.

Enphase Energy (NASDAQ:ENPH)

We’ll start off with a favorite among analysts: Enphase Energy. Shares of this solar micro-inverter and home energy solutions specialist dropped from $330 to ~$240 in the past month, so there’s definitely a potential buy-the-dip opportunity here.

Enphase Energy comes up first on the list of Best Solar Energy Stocks if you screen for the biggest market caps in that sector. Truly, Enphase Energy is an industry giant, as its market cap is over $32 billion. Furthermore, the company has consistently grown its financials, including its revenue and balance of cash and cash equivalents over the past year.

You just never know where Enphase Energy might deploy its industry-leading IQ8 micro-inverters next: Arizona, New Hampshire, and wherever else solar equipment is in demand. Goldman Sachs (NYSE: GS) analyst Brian Lee envisions ENPH stock heading to $379 in the next 12 months, so this could be your chance to get exposure to an undisputed market leader.

What is the Price Target for ENPH Stock?

ENPH has a Strong Buy consensus rating based on 14 Buys and three Hold ratings assigned in the past three months. The average Enphase Energy stock price target of $329.53 implies 38% upside potential.

First Solar (NASDAQ:FSLR)

Like Enphase Energy, First Solar has plenty of Buy ratings on Wall Street as well as Brian Lee’s seal of approval. The Goldman Sachs analyst assigned a lofty $231 price target on FSLR stock, observing that First Solar “has ~3GW US capacity, positing the company as an immediate beneficiary of the IRA [Inflation Reduction Act] manufacturing tax credits.” It’s certainly helpful to have government funding.

Notably, First Solar is a go-to solar equipment provider for clients like Minnesota-based National Grid Renewables, and its $1.2 billion plan to scale up its U.S.-based photovoltaic panel production capacity could create shareholder value.

What is the Price Target for FSLR Stock?

FSLR has a Moderate Buy consensus rating based on 12 Buys and six Hold ratings assigned in the past three months. The average First Solar stock price target of $183.38 implies 6.4% upside potential.

Sunrun (NASDAQ:RUN)

Again, we have an analyst favorite with plenty of Buy ratings and no Sell ratings: residential solar energy system supplier Sunrun. RUN stock was very choppy in 2022, but it seems to be bouncing off of the low $20s like it has done before. So, that’s likely a prime entry point if you don’t already have a position in Sunrun or would like to add to an existing stake.

The Best Solar Energy Stocks screener shows that Sunrun isn’t nearly as big a company as Enphase Energy and First Solar. Yet, smaller businesses can grow faster, and Enphase’s 21% year-over-year customer growth in Q3 2022 demonstrates this point. Also, during that period, Enphase Energy grew its total revenue from $438.77 million to $631.91 million – not too shabby.

Furthermore, Deutsche Bank (NYSE: DB) analyst Corinne Blanchard assigned RUN stock a Buy rating and a $36 price target back in November, saying Sunrun is “well positioned to benefit from the accelerating U.S. Residential solar demand, supported by favorable government policy support.” Sunrun should also benefit from the $835 million worth of financings the company recently secured. So now, let’s see how the analyst community collectively rates RUN stock.

What is the Price Target for RUN Stock?

RUN has a Strong Buy consensus rating based on 13 Buys and two Hold ratings assigned in the past three months. The average Sunrun stock price target of $45.87 implies 94.2% upside potential.

Conclusion: It’s a Great Time to Consider Solar Stocks

Wall Street has spoken, and enterprising investors are listening. The American solar industry has government support, and the sector’s leaders have demonstrated firm financials and robust growth potential.

You’re invited, therefore, to consider ENPH, FSLR, and RUN shares as worthy additions to your solar-friendly portfolio. Future returns aren’t guaranteed, but the evidence suggests that these three solar companies will soon have their day in the sun.