It’s been a great year for tech with AI driving the narrative, but not all tech stocks’ gains can be attributed to the game-changing technology. Case in point: Uber Technologies (NYSE:UBER).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The shares of the ride-hailing company have delivered year-to-date returns of 126%, as investors have warmed to Uber’s improving margins and notable increase in free cash flow. At the same time, Uber has seen a rise in monthly active users, resulting in strong growth in bookings.

The good news, according to BTIG analyst Jake Fuller, is that the positives keep rolling in with the analyst noting several reasons for investors to keep a bullish stance.

For one, Fuller notes US consumer panel data from Bloomberg Second Measure that shows quarter-to-date bookings growth “running stable” in rideshare and delivery. In both instances, November data looks stronger than October with Fuller seeing bookings “trending up” quarter-over-quarter. Particularly notable is the fact that even in the face of a “challenging consumer backdrop,” order frequency across both categories is on the up.

Secondly, the competition in both US rideshare and delivery “remains relatively benign.” While the data shows that since slashing fares earlier in the year, Lyft has been reclaiming share, from Q3 to Q4, Fuller sees that “trending down slightly.” Meanwhile, Uber share in the delivery category appears to be holding steady around the the mid-20s, with segment leader Doordash at ~65%.

Due to the ongoing strength witnessed in these trends, Fuller sees reason to nudge the 2024 bookings forecast from $159 billion to $160 billion.

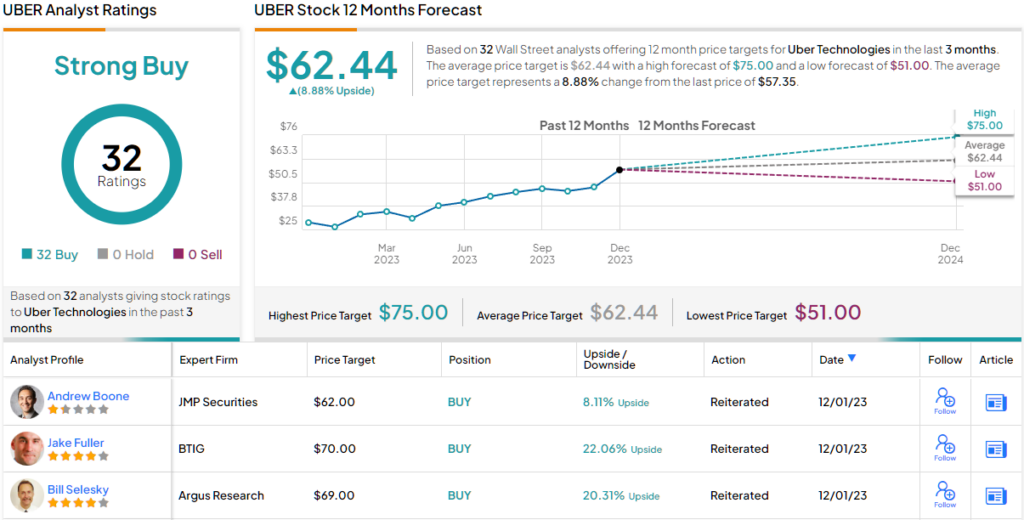

More importantly for investors, Fuller thinks a new price target is merited. He raises the figure from $60 to $70, suggesting gains of 22% lie in store for the coming year. Fuller’s rating stays a Buy. (To watch Fuller’s track record, click here)

Explaining his stance, Fuller notes three reasons for the raised price target: “1) Confidence in topline growth is rising given the durability we continue to see in our checks; 2) Out-year estimates are moving higher, and we now pencil out to ~$10B in EBITDA and ~$6B in GAAP net income in 2026; 3) Driver status is far from settled, but a recent deal with the NY Attorney General settles the matter (remain contractors) in the state and is encouraging as a potential template.”

Uber is that rare beast – a stock with plenty of coverage where everyone is in agreement. It has garnered 32 analyst reviews over the past 3 months – all Buys – naturally making the consensus view here a Strong Buy. The forecast calls for one-year returns of ~9%, considering the average target clocks in at $62.44. (See Uber stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.