So far, 2023 has been kind to SoFi Technologies (NASDAQ:SOFI), to say the least. Since the year kicked off, shares have surged ~40%, and investors are wondering if there’s still more fuel left in the tank.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Singapore investment bank DBS is among those saying there’s more room for the stock to grow. Laying out the bullish case, DBS analyst Manyi Lu lists three main reasons why investors should consider adding SOFI shares to the portfolio.

For one, the company is positioned well to compete with traditional banks. The analyst explains, “SoFi focuses on serving tech-savvy millennials, which has helped the company attract a group of well-educated and high-credit score customers. With its low fees, competitive rate, and user-friendly apps, SoFi is well positioned to attract customers from traditional banks and generate revenue by providing full banking services.”

Secondly, future growth will be fueled by product offerings and customer monetization. SoFi’s banking license has made it possible for it to offer comprehensive financial services to both current and potential customers, increase the size of its deposit base, and keep loans on its books and increase interest income. SoFi’s revenue climbed by 60% year-over-year to $1.6 billion in FY22 as a result of a larger client base, a wide range of products, and well managed funding expenses.

Lastly, SoFi is protected from rate increases by a variety of hedging strategies. To keep up with rising rates, “hedge its interest rates,” and maintain low loan losses and default rates in FY22, SoFi has been successful in increasing its weighted average coupon for personal loans. “We believe SoFi’s resilient business model and strong execution will help the company to further grow its market share and keep healthy credit cost,” Lu summed up.

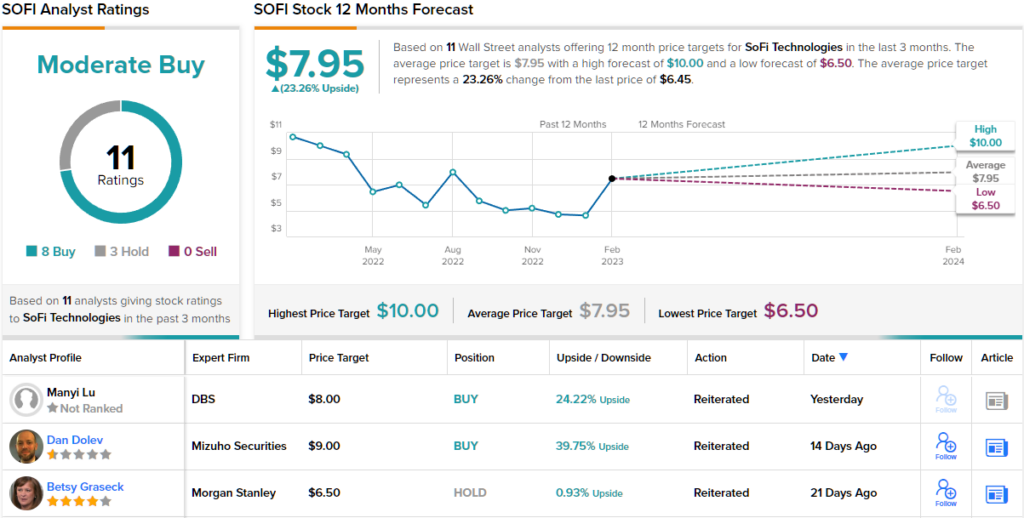

Against this backdrop, it’s no wonder that Lu rates SOFI a Buy, and her price target of $8 implies it has a one-year upside potential of 24%

So, that’s DBS’ view, what does the rest of the Street have in mind for SOFI? Currently, the analyst consensus rates the stock a Moderate Buy, based on 8 Buys vs. 3 Holds. The average price target stands at $7.95, which is practically the same as Lu’s. (See SOFI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.