Investors looking for regular income can consider investing in dividend stocks. Using TipRanks’ Stock Screener tool, we zeroed in on companies offering a dividend yield higher than 2.5% and have received Buy recommendations from the top Wall Street analysts. Let’s take a closer look at three such high-yielding dividend stocks – Johnson & Johnson (NYSE:JNJ), Verizon(NYSE:VZ), and Bank of America (NYSE:BAC).

Johnson & Johnson

Johnson & Johnson provides healthcare products across its Consumer, Pharmaceutical, and Medical Devices segments. Last year, the company raised its quarterly dividend by 6.6%, marking the 60th consecutive dividend increase, which is encouraging. JNJ stock currently has a dividend yield of about 3%.

The consistent dividend growth and upbeat 2023 guidance provided by the management help instill confidence in the stock. The company’s free cash flow also indicates room for further growth in the near future. Furthermore, JNJ stock declined to a new 52-week low recently, making it an attractive buying opportunity.

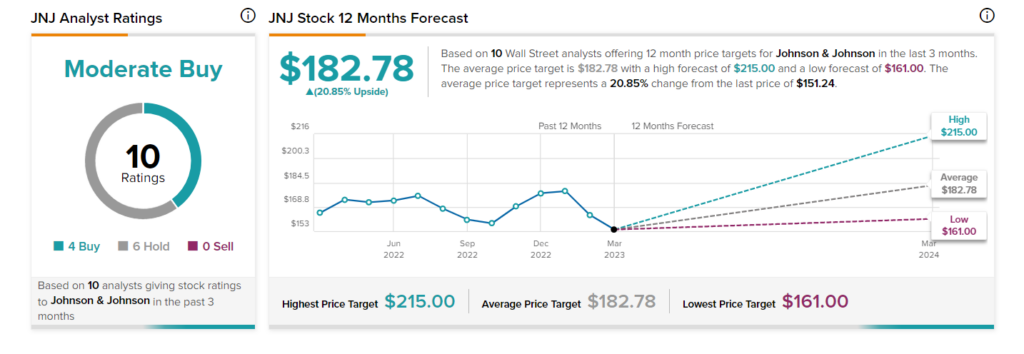

Is JNJ a Good Buy Right Now?

JNJ stock has a Moderate Buy consensus rating on TipRanks. This is based on four Buy and six Hold recommendations. The average stock price target of $182.78 implies 20.9% upside potential. Shares have tanked 14.5% so far in 2023.

Bank of America Corporation

BAC is a multinational investment bank and financial services holding company. The bank’s strong capital position supports its dividend hike strategy. Apart from the pandemic year 2020, BofA has increased dividends every year since 2014. Also, it has a share repurchase plan of $25 billion in place. Currently, BAC stock has a dividend yield of 2.84%.

The company continues to benefit from a higher interest rate environment and cost-saving efforts. Also, its management remains cautious but optimistic about its ability to weather a storm.

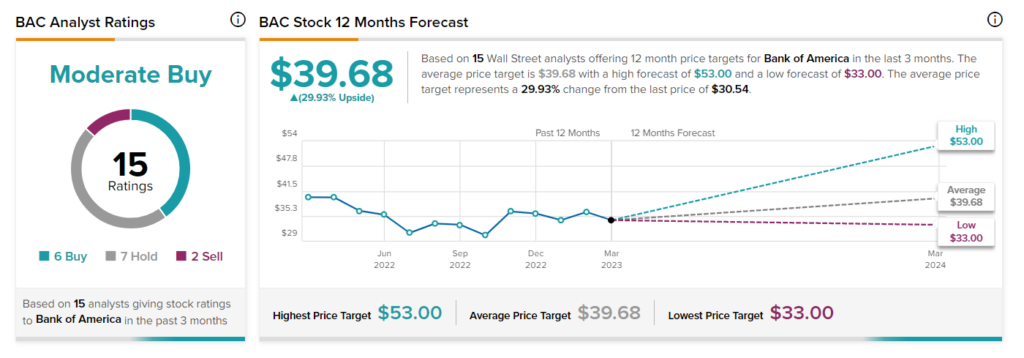

Is BAC a Buy or Sell?

Wall Street is cautiously optimistic about BofA, giving it a Moderate Buy consensus rating. The average BAC stock price target of $39.68 implies 29.9% upside potential from here. Shares are down 8.3% year-to-date.

Verizon Communications

Verizon provides wireless and wireline communications services and products. The company has raised its payout for 16 consecutive years. Furthermore, the stock has a rock-solid dividend yield of 7.1%.

The company is steadily expanding the reach of its 5G ultra-wideband service, which is expected to support its top-line growth. Also, Verizon’s diverse portfolio and focus on operational improvement are other key factors supporting its long-term growth.

Is VZ a Good Buy Right Now?

VZ stock has received five Buys and seven Holds for a Moderate Buy consensus rating. Analysts’ average price target of $46.50 implies 27.2% upside potential. The stock has dropped 7.5% in 2023 so far.

Ending Thoughts

High dividend yields, strong growth prospects, and a Buy consensus rating make these stocks attractive. Investors might want to consider adding these stocks to their portfolios to generate steady passive income.