Investing in dividend-paying stocks can be rewarding even in a challenging macro environment. For instance, investors can earn a steady income through stocks that consistently pay and grow their payments regardless of market conditions. Leveraging TipRanks’ data, let’s take a look at three dividend stocks – Enterprise Products Partners (NYSE:EPD), Agree Realty (NYSE:ADC), and Star Bulk Carriers (NASDAQ:SBLK) – that have received Strong Buy recommendations from the top Wall Street analysts.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Enterprise Products Partners

EPD is a midstream energy services company that provides the gathering, processing, transportation, and storage of crude oil, natural gas, and natural gas liquids. The solid demand for its services and geographically diversified assets enable to company to consistently grow its EBITDA and cash flows to support its dividend payouts.

For instance, its adjusted EBITDA has increased at a CAGR of 10.6% since 2017. Meanwhile, its adjusted free cash flow per unit had a CAGR of 32% during the same period.

Enterprise Products Partners increased its dividends for 24 consecutive years. Further, its dividends grew at a CAGR of 7% during the same period. The stock offers an attractive and reliable dividend yield of 7.3%.

Is EPD Worth Buying?

Wall Street is bullish about EPD stock. It has received 10 Buy and one Hold recommendations for a Strong Buy consensus rating. These analysts’ average price target of $31.73 implies 20.97% upside potential.

While analysts are optimistic, hedge funds sold 22.5M shares of EPD last quarter. Nonetheless, EPD has an Outperform Smart Score of nine on TipRanks.

Agree Realty

Agree Realty is a Real Estate Investment Trust (REIT) that focuses on top retailers. Thanks to its high-quality tenant base of recession-resilient businesses, ADC benefits from a high occupancy rate and long-term leases that drive its cash flows and dividend payments.

At the end of Q4, ADC had an occupancy rate of 99.7%, which is incredible. Moreover, it had a WALE (weighted average lease term) of 8.8, which adds visibility over future earnings potential. Its solid asset base, high occupancy, and long WALE bode well for future growth. Notably, ADC has increased its dividend at a CAGR of 6.1% in the past decade and is offering a yield of about 4%.

What’s the Prediction for ADC Stock?

ADC stock has received six Buys and one Hold for a Strong Buy consensus rating. Analysts’ average price target of $77.64 implies 10.11% upside potential.

Besides for analysts, ADC has a positive signal from insiders. Overall, it carries an Outperform Smart Score of eight.

Star Bulk Carriers

Star Bulk Carriers provides transportation solutions in the dry bulk sector. SBLK offers an attractive forward dividend yield of over 10%. SBLK’s high yield reflects its generous and variable dividend policy.

It’s worth highlighting that after retaining the minimum cash (cash balance per vessel multiplied by the number of vessels), SBLK distributes the excess cash to its shareholders. This means that its payouts are well covered and work well for the shareholders, especially in a time of high demand.

Even though demand and pricing have weakened for shipping companies, their significant FCF (free cash flow) generation capabilities ensure that the payouts are well covered.

Is SBLK a Buy?

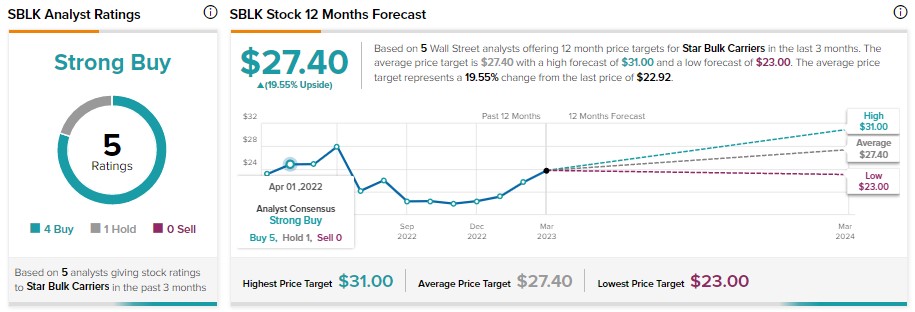

SBLK stock has a Strong Buy rating consensus based on four Buy and one Hold recommendations. Meanwhile, analysts’ average price target of $27.40 implies 19.55% upside potential.

While analysts are bullish, Star Bulk Carriers stock has a negative signal from hedge fund managers who sold 286.4K shares of SBLK last quarter. Nevertheless, SBLK sports an Outperform Smart Score of eight on 10 on TipRanks.

Bottom Line

The strong business models of these companies, solid dividend payouts, Strong Buy consensus rating, and Outperform Smart Score make them attractive investments to earn a steady income.