Growth stocks were on fire in the wake of the pandemic, but many of the top names fizzled in 2022. Now in 2023, however, it’s time to revisit several high-potential stocks – SOFI, NIO, and NKLA – as they deserve another look while they’re at attractive price points.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sure, value investing was in vogue last year, and it’s fine to check commonly used metrics, like P/E ratios. Today, however, you’re invited to look past current earnings and consider several companies’ potential to disrupt industries and deliver surprisingly strong results. So, follow me as we explore three growth stocks that investors can consider holding until the end of 2023 and perhaps much longer than that.

SoFi Technologies (NASDAQ: SOFI)

SoFi Technologies operates a neo-banking platform that’s poised to disrupt the American personal finance market. Big banks should be threatened, as SoFi Technologies’ app appeals to millennials and Gen Z consumers. It’s basically a one-stop shop for practically every finance-related service a young user would need, from keeping track of expenses to basic investing services to refinancing a loan.

Yet, in 2022, financial traders had a panic-fueled flight to safety, so they abandoned former growth names like SoFi Technologies. As a result, SOFI stock got clobbered last year. Yet, SoFi Technologies exceeded consensus EPS forecasts for the past five quarterly earnings releases.

Furthermore, SoFi Technologies would undoubtedly benefit if the federal government ended its moratorium on required student loan repayments. That’s because the company generates revenue from refinancing student loans.

Also, SoFi Technologies has struggled while the Federal Reserve raised interest rates, but the central bank might enact a more accommodative monetary policy later this year. If that happens, then borrowing and lending activity should pick up, and that would likely give a nice boost to SoFi Technologies and to SOFI stock in 2023.

What is the Price Target for SOFI Stock?

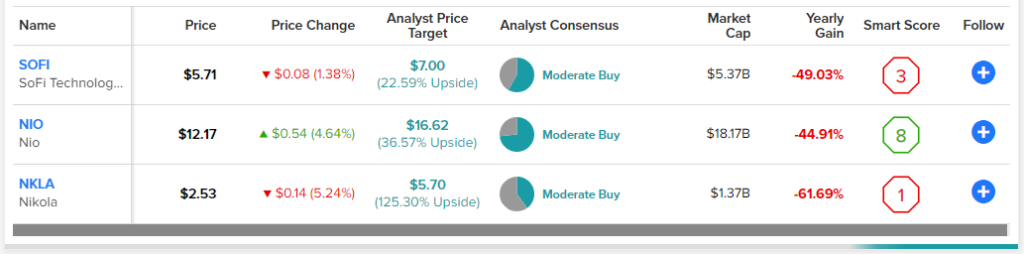

SOFI has a Moderate Buy consensus rating based on seven Buys and five Hold ratings assigned in the past three months. The average SoFi Technologies stock price target of $7.00 implies 22.6% upside potential.

NIO (NYSE: NIO)

Ready to hit the highway and ride out an electric vehicle market recovery in 2023? If you’re not afraid to try out an international investment, NIO stock deserves your attention as it’s trading at less than half of its 52-week high of $26.41.

China’s government is known to support clean energy, and lately, it seems that Beijing might be ready to ease up on COVID-19 lockdowns and other restrictions. Plus, if China is willing to stop cracking down on the nation’s technology-focused businesses, NIO stock could gain back some of its lost ground from 2022.

Besides, the sharp drawdown in NIO stock appears to be overdone, as Nio’s December 2022 vehicle deliveries increased by a whopping 50.8% year-over-year. In addition, for all of 2022, Nio’s vehicle deliveries grew 34% year-over-year. If the automaker can continue on this growth trajectory in 2023, NIO stock has a good chance of heading much higher within 12 months.

What is the Price Target for NIO Stock?

NIO has a Moderate Buy consensus rating based on 11 Buys and four Hold ratings assigned in the past three months. The average NIO stock price target of $16.62 implies 36.6% upside potential.

Nikola (NASDAQ: NKLA)

NIO stock could benefit from the Chinese government’s investment in clean energy initiatives, but what about the U.S.? With the passage of the Inflation Reduction Act, America’s government established its commitment to supporting vehicle electrification. Yet, Nikola stock continues to trade near its 52-week lows as financial traders seemingly dismiss the company’s growth potential.

That’s a mistake, I believe, as Nikola is among the most ambitious clean energy automotive companies in the country. In a partnership with E.ON Hydrogen, Nikola plans to achieve annual carbon dioxide savings of around 560,000 metric tons by 2027. Plus, Nikola just introduced a hydrogen fuel cell fueler for electric trucks and other compatible vehicles.

Additionally, Nikola recently received an order for 100 heavy-duty fuel cell electric vehicles from a German company called GP JOULE. This suggests that Nikola has international ambitions and won’t only generate revenue from U.S. clients. Don’t be too surprised, then, if NKLA stock is much higher before year-end.

What is the Price Target for NKLA Stock?

NKLA has a Moderate Buy consensus rating based on two Buys and three Hold ratings assigned in the past three months. The average Nikola stock price target of $5.70 implies 125.3% upside potential.

Conclusion: Should You Consider These 3 Growth Stocks?

If you’re only looking for value stocks with positive earnings and little volatility, these picks aren’t for you. As the old saying goes, “You’ve got to be in it to win it.” If you can handle a potentially volatile 2023, then these three top growth stocks could prove to be highly rewarding.

You never know – 2023 could be the year when growth stocks outperform and, ironically enough, deliver more value than so-called value stocks. Just be sure to have an exit strategy ready, or just accept the risks and hold on if you dare. With all of that in mind, feel free to take a chance on SOFI, NIO, and NKLA if you’re ready to try them out with small but confidently held positions.