When it comes to investing in REITs, different types of real estate investors will have different likings in each of the sector’s sub-industries. Some, for instance, may prefer residential REITs due to their relatively more attractive rent-growth prospects, while others may find cell tower REITs more attractive due to their resilient and highly-secured cash flows.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

One thing is for certain, however: hardly anybody likes retail properties. In particular, people don’t like REITs whose exposure is concentrated in malls because they suffer from several lasting challenges. While I would also not touch most mall REITS, I believe three, in particular, are actually worthy of buying. Specifically, Simon Property Group (NYSE: SPG), Regency Centers Corporation (NYSE: REG), and Saul Centers (NYSE: BFS) have been delivering robust numbers lately, paying growing dividends. Yet, they are trading at attractive valuations.

Why Do Investors Hate Mall Stocks Right Now?

Many investors have hated mall stocks for years, as the mall industry as a whole has faced challenges in recent years, resulting in impaired financials. The most significant challenge many traditional malls face is the fact that they have struggled to attract and retain tenants and shoppers. The primary driver for this trend is the rise of online shopping and shifting consumer preferences that have led to declining foot traffic and sales at malls. The COVID-19 pandemic, in particular, solidified the long-term trend of declining interest in malls as it made consumers increasingly used to purchasing the majority of their goods online.

These challenges have led to mall REITs struggling to produce stable profits, let alone grow, resulting in unpleasant events in the space, such as dividend cuts. Take Tanger Factory Outlet Centers (NYSE: SKT), for instance. Up until 2020, SKT was a Dividend Aristocrat, numbering 28 years of consecutive annual dividend increases.

Investors had started to price in a dividend cut since the stock’s extended decline began in 2016. After years of struggling financials, the pandemic stroke the final blow to SKT’s dividend coverage, resulting in an inevitable cut. SKT was considered one of the highest-quality mall REITs, and even its dividend didn’t survive. There have been many sad stories surrounding mall stocks, which justifies why many investors avoid them with passion.

Why are SPG, REG, and BFS Shares Worth Considering?

1. Resilient Financials

Despite the numerous challenges the mall industry is facing, SPG, REG, and BFS have managed to perform relatively well, with their financials remaining resilient over the years. Their most recent results were also strong.

SPG posted total revenues of $1.32 billion in Q3, a 1.5% increase compared to last year. Occupancy stood at a very satisfactory 94.5% compared with 92.8% in Q3 2021, while comparable FFO per share rose by 1.7% to $2.97. Simon’s prime real estate locations have clearly been able to attract strong foot traffic against all odds. Management also lifted its prior full-year outlook, expecting FFO/share to be in the range of $11.83 to $11.88. At the midpoint, this figure is just 4.1% away from SPG’s pre-pandemic FFO/share of $12.37 in Fiscal 2019. This illustrates how resilient the company’s properties are.

REG’s Q3 results were also robust, with its quarter-end leased occupancy standing at 94.3%, 40 basis points higher sequentially. REG’s same-property portfolio was also 94.7% leased, 20 basis points higher compared to the previous quarter. REG’s management even boosted their outlook, with FFO/share expected to land between $4.00 and $4.03. This means that REG will hit a new FFO/share record while the industry is suffering.

Finally, BFS also posted a solid Q3, as revenues reached $61.1 million, up 1.3% compared to last year, while its malls achieved an occupancy rate of 93%, up 50 bps compared to Q3 2021.

2. Growing Dividends

In the meantime, all three companies have been growing their dividends, which should inspire investor confidence in management’s future expectations. In the case of SPG, with its Q3 results, the company increased its dividend for a seventh successive quarter by 2.9% sequentially or by 9.1% year-over-year. REG also grew its dividend by 4%, now numbering 10 years of successive annual increases. Finally, BFS has increased its dividend for two consecutive years, with the latest hike being this past June by 3.5%. The three companies now yield 6.1%, 4.2%, and 6%, respectively.

What are the Price Targets for SPG, REG, and BFS?

Turning to Wall Street’s view on Simon Property Group, the stock has been assigned a Moderate Buy consensus rating based on three Buys and seven Holds assigned in the past three months. At $126.40, the average SPG stock price target implies 3.5% upside potential.

Moving on to Regency Centers, the stock has attained a Moderate Buy consensus rating based on five Buys and four Holds assigned in the past three months. At $67.11, the average REG stock price target implies 7.7% upside potential.

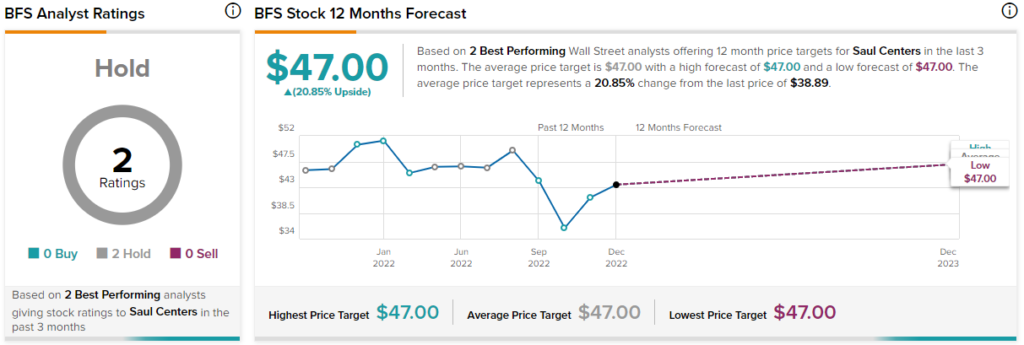

Finally, Saul Centers has a Hold rating based on two Holds assigned in the past three months. At $47.00, the average BFS stock price target implies 20.85% upside potential.

Takeaway – Durable Mall REITs

Mall REITs, in general, are likely to remain under pressure as the long-term trends that have contributed to their downfall are still in place. Nevertheless, I believe that SPG, REG, and BFS are quite durable and are likely to continue to perform relatively well.

The success of their properties, which are occupied by high-quality tenants and managed by skilled teams, is expected to continue as they produce industry-leading results. Along with their dividends growing and shares trading at reasonable levels, SPG, REG, and BFS could be strong performers for 2023.