The stock market could remain choppy amid persistently high inflation, volatile energy prices, and increasing interest rates. Using TipRanks’ Stock Screener, we zeroed in on large-cap companies like Enterprise Products Partners (NYSE:EPD), Energy Transfer (NYSE:ET), and NextEra Energy (NYSE:NEE), which appear attractive for earning a steady income amid volatility. What stands out is that these stocks sport Buy recommendations from analysts and carry an Outperform Smart Score on TipRanks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

How Often Does EPD Stock Pay Dividends?

Enterprise Products Partners is a midstream energy company that transports crude oil, natural gas, natural gas liquids, and petrochemicals. It pays a quarterly dividend of $0.49 a share, translating into a high yield of over 7.3%.

Its diversified assets and customer base enable it to generate strong cash flows and pay higher dividends. EPD has raised its dividend at a CAGR of 7% in the past 24 consecutive years. Furthermore, its multi-billion-dollar capital projects, low leverage, and energy transition opportunities will likely drive its future financials and payouts.

Analysts are bullish about EPD stock. It has a Strong Buy consensus rating, reflecting 10 Buy and one Hold recommendations. These analysts’ average price target of $31.91 implies 20.96% upside potential. In addition, EPD stock carries an Outperform Smart of nine on TipRanks.

What is the Future of Energy Transfer Stock?

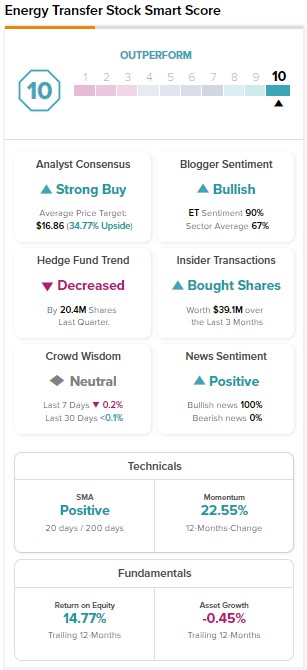

Energy Transfer transports and stores crude oil and natural gas liquids. ET stock has received seven unanimous Buys for a Strong Buy consensus rating. Further, analysts’ average price forecast of $16.86 implies 34.77% upside potential from current levels.

Its high-quality, fee-based assets remain resilient to volatility in commodity prices and generate strong earnings. Furthermore, its diversified portfolio and strong geographic footprint augur well for dividend growth.

It pays a quarterly dividend of $0.305 a share, reflecting a stellar yield of over 9.7%. At the same time, it has a maximum Smart Score of “Perfect 10” on TipRanks.

Is NEE a Good Long-Term Investment?

NextEra Energy is an electric utility company offering stability and income. The clean energy company will likely benefit from the Inflation Reduction Act (IRA). Moreover, an increase in average regulatory capital employed and new assets placed into service will drive its earnings growth and dividend payments.

NextEra pays a quarterly dividend of $0.47 a share, reflecting a dividend yield of 2.37%.

NEE stock has received 12 unanimous Buys for a Strong Buy consensus rating. These analysts’ average price forecast of $94.18 implies 19.26% upside potential. NEE stock also sports a maximum Smart Score of “Perfect 10” on TipRanks.

Bottom Line

The strong earnings base, positive indications from analysts, and an Outperform Smart Score make these large-cap stocks attractive investments to generate steady dividend income.