Let’s talk about IPOs, the most common route for companies to enter the public trading markets. Last year, and the year before, saw record-breaking and record-setting numbers, in total number of public offerings, and in capital raised, but that blistering pace has slowed down this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The first half of 2022 saw a mere 92 IPOs raise some $9 billion, and analysts are projecting that this year will see a total of 184 companies go public through initial offerings. For comparison, just the first quarter of 2021 saw 395 IPOs raise a total of $140 billion. The drop-off is clear.

The slowing IPO activity can be traced back to the 6 month bear market we went through in 1H22, to the increased market uncertainty and the overall economic downturn. In such an environment, start-up firms are more reluctant to enter the public markets, and investors are more cautious about where they put their money. From both sides, we’re more likely to find a ‘wait and see’ attitude, as companies and investors watch to see how the markets will shake out.

From the investor’s perspective, what all of this really means is that the homework is now more important than ever. Learning the details of the IPO before the event and finding the firms with strong underwriting for the offering are good first steps. They can be followed by checking in with the Street’s analysts – these are the objective professionals who publish regular research notes on the stock markets, and their research can point the way toward hidden gems.

We’ve opened up the TipRanks database to find 3 recent IPO stocks that the analysts say are looking up. These are all companies that went public in May of this year, but have since picked up some Street love. Here are the details, along with the analysts’ commentary.

PepGen, Inc. (PEPG)

We’ll start in the biotechnology sector, where PepGen is a clinical-stage firm working on oligonucleotide therapeutics, a new generation of drug candidates that promise to transform the way we treat severe neuromuscular and neurological diseases. The company uses a proprietary development platform, based on Enhanced Delivery Oligonucleotides (EDOs), to create a line of drug candidates; these are now entering clinical trials.

The leading candidate, PGN-EDO51, is under investigation as a treatment for Duchenne muscular dystrophy (DMD), and the company started dosing patients in a Phase 1 study this past April. The current trial is focused on healthy normal volunteers, testing safety, tolerability, and pharmacokinetics. The company expects to release data by the end of this year.

The company’s second leading drug candidate is PGN-EDODM1, a potential treatment for myotonic dystrophy type 1 (DM1). It showed promise in preclinical testing, and the company is planning an IND submission during 1H23, in advance of initiating a Phase 1/2 clinical trial.

PepGen has another three drug candidates in the discovery and preclinical phases – but the shift to human clinical trials is expensive. To raise the capital for that, the company held its IPO in May of this year. The event saw the PEPG ticker start trading on May 6, with initial pricing at $12 per share and first-day’s close at $12.89. The IPO successfully raised the $108 million expected, although the shares have fallen by 24% since then.

SVB analyst Joseph Schwartz covers this relatively new stock, and he sees the leading drug candidates as superior to competitors’ assets, writing, “We view PEPG’s lead candidate — PGNEDO51 for Duchenne muscular dystrophy (DMD) patients with Exon 51 mutations — as de-risked based on clinical data from SRPT’s SRP-5051…. PGN-EDO51’s Ph.1 healthy volunteer readout is guided to occur by year-end and will include safety, PK and exon 51 skipping data. We view this as an underappreciated catalyst that will establish baseline expectations for patients and also has potential to demonstrate PGN-EDO51’s best-in-class capabilities when compared to SRP-5051’s HV study results…. We note that DM1 represents a large market opportunity — we currently model peak (2035E) gross WW sales of ~$730M for PGN-EDO51 and ~$2.5bn for PGN-EDODM1.”

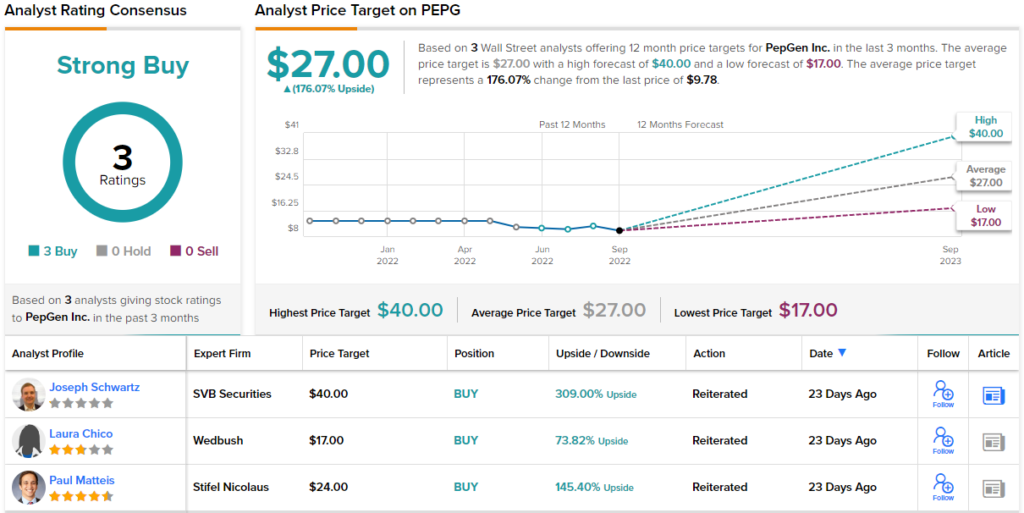

Schwartz gives PEPG shares an Outperform (Buy) rating, along with a $40 price target that implies a one-year upside potential of a huge 3o9%. (To watch Schwartz’s track record, click here.)

Over the past 3 months, 3 analysts have weighed in on this stock, and they are all positive, giving it a unanimous Strong Buy consensus rating. The shares are selling for $9.78 and their $27 average target indicates a strong 176% upside for the coming year. (See PepGen’s stock forecast at TipRanks.)

ProFrac Holding Corporation (PFHC)

Next on our list, ProFrac, is a holding company whose subsidiaries offer a range of services and solutions to the North American hydrocarbon industry. ProFrac’s offerings include services and products to enable hydraulic fracturing and well completion services in both the oil and gas exploration and production sectors.

Back in May, the PFHC ticker hit the markets through an IPO that opened on the 13th of the month. The stock closed that day at $18.11, a shade above the $18 opening price. The company successfully raised $441.6 million through the IPO, and since the first day’s close, the shares are up 9%.

Last month, ProFrac released its second quarterly financial report as a public entity – and the first one to show results achieved since the firm went public. The 2Q22 report showed a top line quarter-over-quarter gain of 40%, with revenues coming in at $589.8 million. Net income was reported at $70.1 million, and the company reported a cash position of $73.7 million as of June 30. Overall, the company reported $88 million in total liquidity at the end of Q2.

Stephen Gengaro, 5-star analyst with Stifel, was duly impressed by this company’s performance ‘out of the gate,’ and notes the quarterly results as key points in his review of the stock: “Bolstered by strong pressure pumping fundamentals, solid execution, and the positive benefits of its vertical integration, ProFrac delivered its second consecutive upside surprise since its IPO…. We continue to expect strong pressure pumping fundamentals to drive rising profitability at least through 2023, and likely longer.”

Gengaro rates these shares as a Buy and gives a target price of $29, implying a potential upside of 46% on the one-year horizon. (To watch Gengaro’s track record, click here.)

This energy/industrial stock has gotten attention from 7 Wall Street analysts, and their reviews include 6 to Buy and 1 to Hold, for a Strong Buy consensus rating. The current trading price of $19.79 and the average price target of $26.93 combine to give a 36% upside in the next 12 months. (See ProFrac’s stock forecast at TipRanks.)

Hanover Bancorp, Inc. (HNVR)

For our last stock, we’ll shift focus again – this time, to the financial world. Hanover Bancorp was established recently, in 2009, as a one-bank holding company; that is, it’s sole subsidiary is Hanover Community Bank, a small bank with some $1.6 billion in assets and operations in New York/New Jersey. Hanover Bank has 8 physical branches, in metropolitan NYC, on Long Island, and in Freehold, New Jersey.

Like many local banks, Hanover provides full services to smaller customers, including retail and small business clients. Services include checking and saving accounts, debit cards, money markets and CDs, banking advisory services, personal and business loans, mortgages, and online and mobile banking.

Hanover Bancorp held its IPO from May 11 to May 13, with the stock opening on May 11 at $21; since then, the shares have dropped a little – by ~5%.

On June 30, the company ended its 3Q of fiscal year 2022, with net income of $5.3 million, or 80 cents per diluted share. This compares to a year-ago result of just $221,000 and 5 cents per diluted share; the y/y jump is substantial. Revenue also increased substantially, by 50% from the same period last year to $16.65 million. The company’s $1.6 billion in assets are up from $1.54 billion at the end of the year-ago quarter. These assets included $133 million in cash.

Banks and bank holding companies typically pay out regular dividends, and Hanover Bancorp has paid out three common share divs, in February, June, and August of this year. The payments, of 10 cents per common share, annualize to 40 cents and give a yield of 2%, almost exactly the average dividend found among peer companies.

Covering this stock for Piper Sandler, analyst Mark Fitzgibbon sees this bank’s loan performance as the differentiator. Following the FQ3 print, he wrote, “Total loan balances grew 10% Q/Q, while total balance sheet footings rose 9% from the linked quarter. Loan growth from the linked quarter was seen across each of their three major loan buckets: Multifamily (+23% Q/Q), commercial real estate (+11% Q/Q), and residential mortgages (+2% Q/Q). Each of these loan categories represent >25% of their calendar 2Q22 loan portfolio composition. Our conversations with management lead us to believe Hanover will benefit from a strong pipeline in 3Q22. We think residential mortgage could see better growth than other loan categories as they look to further diversify the balance sheet.”

In Fitzgibbon’s view, this justifies an Overweight (Buy) rating, and his price target, set at $26, suggests room for 30% share appreciation in the year ahead. (To watch Fitzgibbon’s track record, click here.)

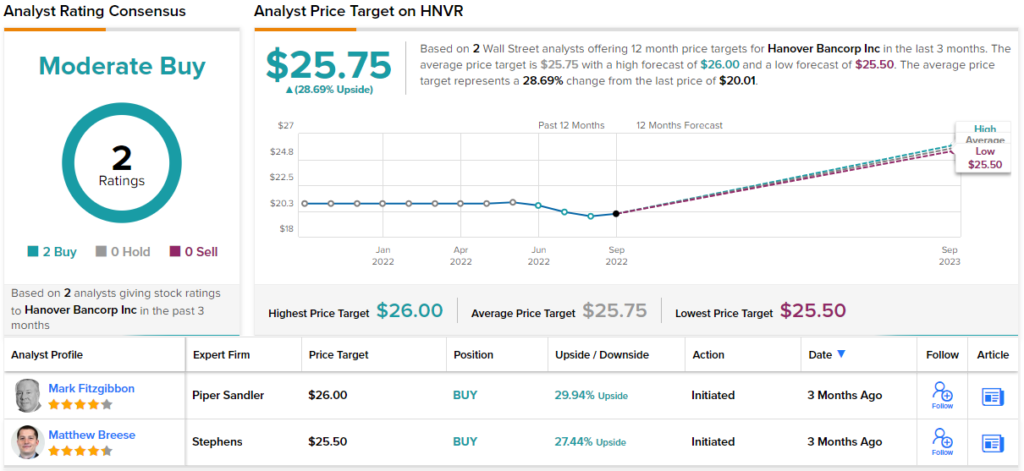

While there are only 2 recent reviews of this new bank holding company, they both agree that it’s a Buy, making the Moderate Buy rating unanimous. Shares in HNVR are priced at $20.01 while the $25.75 average price target is almost identical to Fitzgibbon’s objective. (See Hanover Bancorp’s stock forecast at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.