The growing demand for renewable energy sources, supported by government incentives, is driving the growth for green hydrogen. Interestingly, green hydrogen, also called “fuel of the future” is generated through the electrolysis of water using renewable energy sources like solar and wind power. Using the TipRanks Essentials tab on the TipRanks’ Stock Comparison Tool, let’s have a look at three green hydrogen stocks that top analysts with strong track records recommend.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

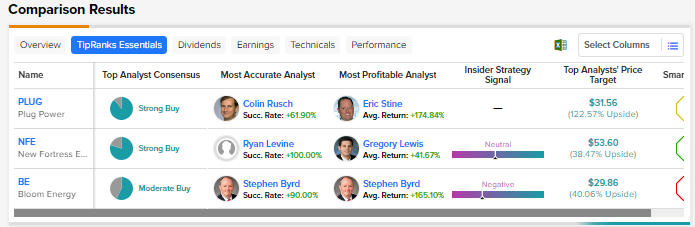

The TipRanks Essentials feature helps us identify the Most Accurate Analyst and the Most Profitable Analyst for a particular stock. Such information could help investors make informed decisions about the stock and achieve better returns.

Plug Power (NASDAQ:PLUG)

Plug Power (NASDAQ:PLUG) delivers clean hydrogen and zero-emission fuel cell solutions for various applications, including supply chain and logistics, electric vehicles, and the stationary power market. The company claims that it has deployed over 60,000 fuel cell systems for e-mobility, more than anyone else in the world.

Recently, Plug Power disappointed investors when it slashed its 2022 revenue growth guidance to the range of 45% to 50%, significantly lower than the initial growth outlook of over 80%. The company lowered the guidance as some larger projects are expected to be completed in 2023 instead of 2022 due to “customer timing and broader supply chain issues.”

Further, Q4 revenue was hit by new product launch delays. However, the company expects to deliver revenue of $5 billion by 2026 and $20 billion by 2030.

Despite near-term pressures, Wall Street remains optimistic about Plug Power’s long-term prospects in the green hydrogen space.

Is Plug Stock a Buy or Sell?

As per TipRanks Essentials feature, the most accurate analyst covering Plug Power is Oppenheimer’s Colin Rusch, with a success rate of nearly 62% on the stock. His average return per rating on Plug Power is 168.5%.

Meanwhile, the most profitable analyst is Eric Stine of Craig-Hallum, whose average return per rating on Plug Power is about 175%. Overall, the consensus rating of top analysts for Plug Power is a Strong Buy based on eight Buys and one Hold. The average price target of top analysts for Plug Stock is $31.56, implying upside potential of 122.6%.

New Fortress Energy (NASDAQ:NFE)

New Fortress Energy (NASDAQ:NFE) operates natural gas and liquefied natural gas (LNG) infrastructure and an integrated fleet of ships and logistics assets to deliver turnkey energy solutions worldwide.

Last year, New Fortress Energy announced an agreement with Plug Power to build a 120-megawatt green hydrogen facility in Beaumont, Texas. The facility will leverage Plug Power’s proton exchange membrane (PEM) electrolysis technology to produce over 50 tons per day of green hydrogen. The facility is expected to be operational in 2024 and will be scalable to nearly 500 megawatts.

Is New Fortress Energy a Good Stock to Buy?

The most accurate analyst in case of New Fortress is Ryan Levine of Citigroup, who has a remarkable 100% success rate on the stock, with an average return of 41.6%. The most profitable analyst for NFE is BTIG’s Gregory Lewis, whose ratings have generated an average return of 41.7%, almost same as Levine’s average return.

Overall, New Fortress Energy scores a Strong Buy consensus rating from top analysts, based on four Buys and one Hold. The average NFE stock price target of $53.60 suggests 38.5% upside.

Bloom Energy (NYSE:BE)

Bloom Energy (NYSE:BE) boasts of creating the first large-scale, commercially viable solid oxide fuel-cell based power generation platform. The company’s solid oxide technology converts natural gas, biogas, or hydrogen into electricity without combustion, resulting in low or no carbondioxide emission.

Last year, Bloom collaborated with LSB Industries to install a 10 megawatt solid oxide electrolyzer at LSB’s Pryor, Oklahoma facility. The project is expected to generate green hydrogen that will help in synthesis of nearly 13,000 metric tons of zero-carbon ammonia per year. Overall, Bloom is focused on developing sustainable energy solutions. It ended 2022 with a strong $10 billion backlog.

Is Bloom Stock a Good Buy?

Morgan Stanley’s Stephen Byrd is the most successful analyst for Bloom Energy. With a 90% success rate, Byrd’s ratings on Bloom have generated an average return of 165.1%, making him the most profitable analyst as well for the stock.

Overall, top analysts have a Moderate Buy consensus rating for Bloom Energy based on four Buys and three Holds. At $29.86, the average price target of top analysts indicates 40% upside potential from current level.

Conclusion

The clean hydrogen production tax credit of up to $3 per kilogram under the Inflation Reduction Act is expected to boost the prospects of green hydrogen companies. Tracking the ratings and performance of top analysts could be very useful in selecting the right green hydrogen stocks, or for that matter, other stocks as well, based on the goals of individual investors.