Nvidia (NASDAQ:NVDA) is taking the market by storm, and it’s not just the stock that is benefiting. Three ETFs with big positions in Nvidia, the VanEck Semiconductor ETF (NASDAQ:SMH), the iShares U.S. Technology ETF (NYSEARCA:IYW), and the Invesco S&P Momentum ETF (NYSEARCA:SPMO) are reaping the rewards of Nvidia’s historic run and look poised to capture more upside if shares continues to rise.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To find these ETFs featuring significant Nvidia exposure, I went to Nvidia’s page on TipRanks and used the ETF Exposure tab on the side of the page, a useful tool that enables investors to sort through ETFs by a stock’s percentage weight within the ETF.

Let’s take a more in-depth look at these three ETFs, which all have different strategies and different reasons for owning Nvidia. All have large positions in the surging stock, which is up 235.5% over the past year and closing in on a $2 trillion market cap.

1. VanEck Semiconductor ETF (NYSEARCA:SMH)

SMH is a $16 billion ETF from VanEck that, according to the fund, seeks to give investors “exposure to the top 25 most liquid U.S.-listed semiconductor companies, spanning the entire industry value chain from chip design and fabrication to manufacturing machinery.”

SMH has a massive Nvidia position. In fact it makes up over one-quarter of this semiconductor-focused fund’s assets, with a weighting of 25.7%.

Below, you’ll find an overview of SMH’s top 10 holdings using TipRanks’ holdings tool.

In addition to Nvidia, SMH owns Nvidia’s competitors like Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC), and it also owns companies that are vital to the semiconductor manufacturing process like foundry Taiwan Semiconductor (NYSE:TSM) and semiconductor equipment manufacturers Applied Materials (NASDAQ:AMAT), Lam Research (NASDAQ:LRCX), and ASML Holding (NASDAQ:ASML).

SMH’s top holdings are viewed favorably by TipRanks’ Smart Score system, as eight out of SMH’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or above. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

This ETF has crushed the market in recent years, thanks in no small part to its outsized position in Nvidia. As of January 31, SMH has returned an impressive 18.8% over the past three years, a phenomenal 32.1% over the past five years, and an incredible 26.1% over the past 10 years, easily beating the broader market S&P 500 (SPX) and tech-oriented Nasdaq (NDX) indices over each time frame.

Of note, SMH has an expense ratio of 0.35%, meaning that an investor in the fund will pay $35 in fees on a $10,000 investment annually.

I’m bullish on SMH, given its large position in Nvidia, its track record of market-beating performance, and its portfolio of highly-rated stocks (according to Smart Score ratings). For investors looking to gain exposure to Nvidia in ETF form, SMH is a great way to do so due to its massive 25.7% Nvidia position and the fact that it gives you exposure to additional stocks that are swimming in the same lane as Nvidia.

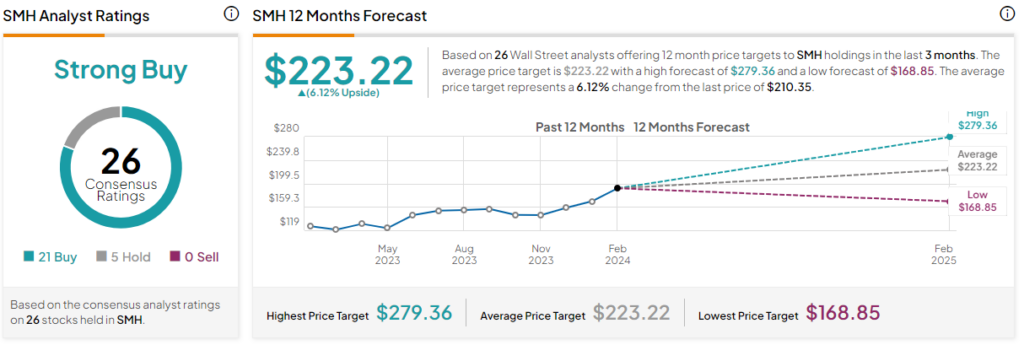

Is SMH Stock a Buy, According to Analysts?

Sell-side analysts view SMH favorably, giving it a Strong Buy consensus rating based on 21 Buys, five Holds, and zero Sell ratings assigned in the past three months. The average SMH stock price target of $223.22 implies 6.1% upside potential from current levels.

2. iShares U.S. Technology ETF (IYW)

Meanwhile, the iShares U.S. Technology ETF owns Nvidia as part of its strategy to “track the investment results of an index composed of U.S. equities in the technology sector.” IYW invests in U.S.-based electronics companies, computer hardware and software companies, and IT companies.

Nvidia makes up 6.8% of IYW’s assets under management. This is a relatively large position, but it pales in comparison to SMH’s massive 25.7% position. Altogether, IYW owns 135 stocks, and its top 10 holdings make up 63.9% of the fund.

Below is an overview of IYW’s top 10 holdings using TipRanks’ Holdings tool.

As you can see, IYW has a broader focus than SMH, so while it has top-10 positions in semiconductor stocks like Advanced Micro Devices and Broadcom (NASDAQ:AVGO), it also owns stocks from beyond the semiconductor space like Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), and Meta Platforms (NASDAQ:META).

Like SMH, IYW’s portfolio is viewed favorably by TipRanks’ Smart Score, and even more so, an impressive nine out of SMH’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or above.

While this ETF’s focus is different than SMH’s, one thing that the two funds have in common is that they’ve both generated excellent returns over time. As of January 31, IYW has put up annualized returns of 14.2% over the past three years, 24.5% over the past five years, and 20.2% over the past 10 years.

IYW has an expense ratio of 0.40%, meaning that investors in the fund will pay $40 in fees annually on a $10,000 investment.

I’m bullish on IYW overall, given its strong track record of performance and its highly-rated portfolio of top tech stocks, although it should be noted that SMH gives investors considerably more exposure to Nvidia.

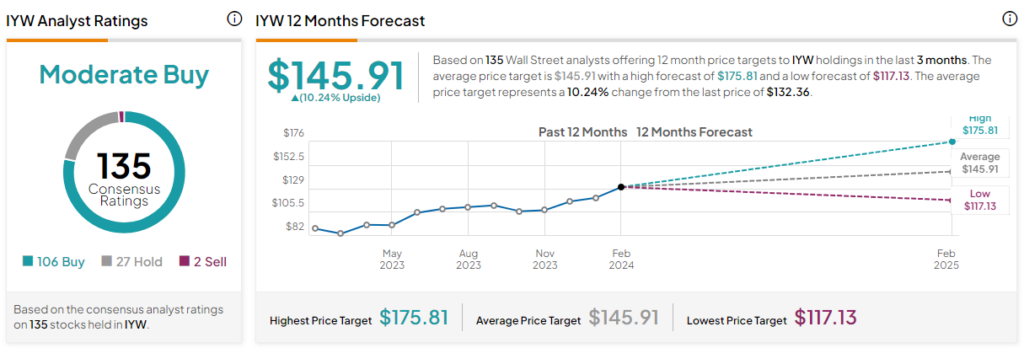

Is IYW Stock a Buy, According to Analysts?

Turning to Wall Street, analysts assign IYW a Moderate Buy consensus rating based on 106 Buys, 27 Holds, and two Sell ratings assigned in the past three months. The average IYW stock price target of $145.91 implies 10.2% upside potential from current levels.

3. Invesco S&P 500 Momentum ETF (SPMO)

Lastly, the Invesco S&P 500 ETF is another large Nvidia holder with an entirely different approach. SPMO is “based on the S&P 500 Momentum Index,” which “tracks the performance of stocks in the S&P 500 Index that have a high ‘momentum score.’” The fund and index are reconstituted and rebalanced twice a year, and components of the index are weighted by their market caps and their momentum scores.

Nvidia makes up 11.4% of SPMO’s holdings, which is less than SMH’s exposure but more than IYW’s. In total, SPMO owns 100 stocks, and its top 10 holdings make up 56.1% of the fund.

Below is an overview of SPMO’s top 10 holdings using TipRanks’ holdings tool.

SPMO isn’t specifically focused on semiconductor or technology stocks like SMH or IYW, but some of these stocks, like Nvidia and Broadcom, appear in SPMO’s top holdings, as these stocks have been leading the market higher. Beyond semiconductors, Meta Platforms is SPMO’s largest holding, and the fund also owns plenty of names from outside of the tech sector that are performing well, like Eli Lilly (NYSE:LLY), General Electric (NYSE:GE), and Walmart (NYSE:WMT).

An impressive nine out of SPMO’s top 10 holdings feature Outperform-equivalent Smart Scores of 9 or higher. Like SMH and IYW, SPMO has also generated good returns over time, although it doesn’t have a track record as long as that of the other two funds, as it only launched in 2015. Still, as of January 31, SPMO had posted a solid three-year annualized return of 10.9% and an even better five-year annualized return of 15.1%.

SPMO is reasonably priced, with an expense ratio of just 0.13%, making it the cheapest of the three funds profiled here. An investor in SPMO will pay just $13 annually in fees on a $10,000 investment. I’m bullish on SPMO based on its decent performance, highly-rated portfolio, and substantial Nvidia position.

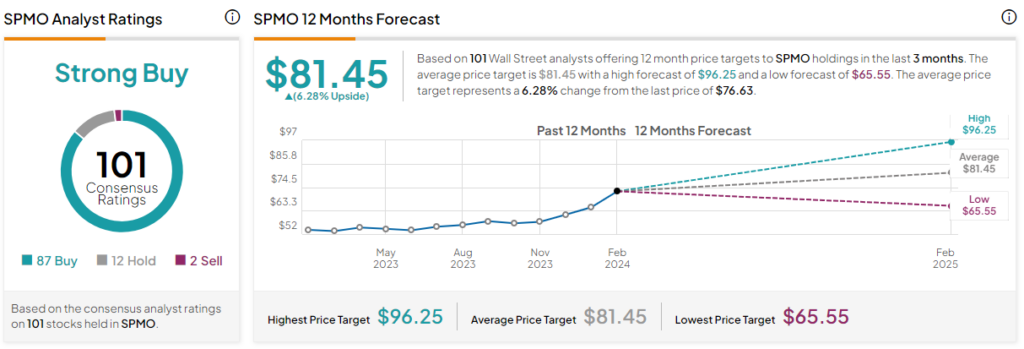

Is SPMO Stock a Buy, According to Analysts?

Analysts view the fund favorably, as SPMO earns a Strong Buy consensus rating based on 87 Buys, 12 Holds, and two Sell ratings assigned in the past three months. The average SPMO stock price target of $81.45 implies 6.3% upside potential from current levels.

No Shortage of Ways to Invest in Nvidia

All three of these ETFs are good options for investors, as they have strong portfolios and have generated solid returns over time. Any of the three is a worthy investment, but my pick of the three is SMH, as it offers by far the highest exposure to Nvidia, plus the best performance track record.