It’s been a strong year for tech stocks, even with the recession and rate-hike chatter. Though the future is clouded by uncertainty, Wall Street favors many underrated tech names as they look to operate in challenging times.

Therefore, let’s check in with TipRanks’ Comparison Tool to see where analysts stand on three relatively-affordable tech firms with bright paths forward.

Uber (NASDAQ:UBER)

Uber is the ride-hailing leader that’s quickly driving into profitability. Even as a recession introduces new road bumps, I still think it’s tough to stop CEO Dara Khosrowshahi and his team as they shift gears (sorry for the puns!) to improve margins. Though Uber is more of a slow and steady tech play, I remain bullish like many Wall Street analysts.

Mr. Khosrowshahi is a great manager that could help transform Uber into a profitable growth heavyweight. Last September, he literally got in the driver’s seat, spending some time as an Uber driver to get a better feel for the business.

Undoubtedly, the “hands-on” approach is nothing new for CEOs. However, I do find it intriguing that Khosrowshahi decided to give it a try. When hunting for margin enhancement, it’s always a good idea to go on the hunt for potential inefficiencies so they can be alleviated.

Looking ahead, I expect Uber won’t be too heavily impacted by a “soft-landing” type of recession. Though Uber Eats orders could pull the brakes, I do find Uber’s mobility business relatively defensive.

If Uber can survive pandemic lockdowns, it can surely sail through a downturn without experiencing a crash landing. If anything, Uber may be in a spot to not only hit pre-pandemic ridership levels but also exceed them.

As Uber stock continues fluctuating wildly, I’d look to hail a ride into the name on any dips. The stock trades at around 2x price/sales (P/S), well below the 5-7x P/S range it spent most of 2020 and 2021.

What is the Price Target for UBER Stock?

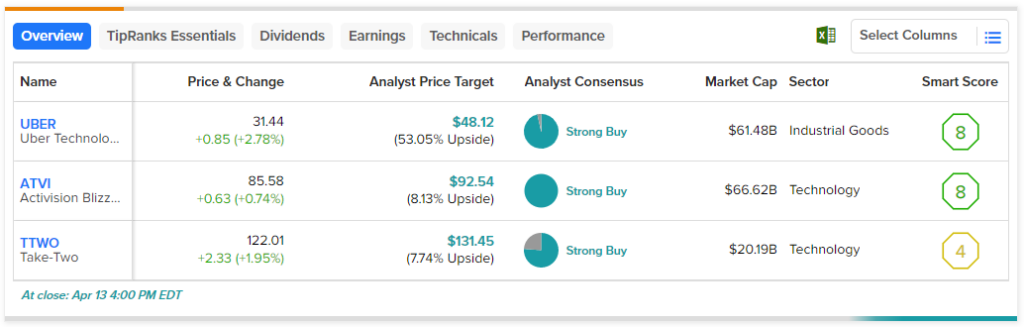

According to analysts, Uber comes in as a Strong Buy, with 26 Buys and one Hold. The average UBER stock price target of $48.12 implies 53.05% upside potential.

Activision Blizzard (NASDAQ:ATVI)

Optimism over Microsoft’s (NASDAQ:MSFT) acquisition of Activision Blizzard hasn’t been higher. The stock is actually quite a bit higher than where it settled (in the $78-81 range) shortly after Microsoft made the announcement more than a year ago! Undoubtedly, Microsoft has needed to get in the good books of regulators to surpass the hurdles set before it. Acquisition or not, I remain bullish right here, with shares at $85.58 per share, which is about $10 below Microsoft’s expected acquisition price.

Indeed, it’s not usually a good idea to reach too far for a smaller gain when pursuing merger arbitrage opportunities. Nonetheless, while the odds of a successful deal — around 50-70%, according to Citigroup (NYSE:C) — are now higher, I still think that ATVI stock remains a great bet if such a deal falls through.

For now, investors are looking to score an 11% gain from ATVI stock as Microsoft looks to close the deal. Currently, Microsoft is looking to July 2023 as a closure date target. It’s noteworthy that any such gains are uncorrelated to the broader market.

Activision Blizzard isn’t just a prize in Microsoft’s eye. It’s a rare breed in that it’s one of the very few publicly-traded video game stocks, and many big-tech companies are eager to bolster their services businesses through gaming.

If Microsoft can’t appease regulators, perhaps a smaller firm in the industry will be able to. Though I expect Activision stock to take a hit if the deal doesn’t go through, you’re still getting quality merchandise in a losing scenario. Activision’s Call of Duty franchise remains a top seller. Its latest title has shown it’s still capable of clawing share in the first-person shooter (FPS) market. Indeed, there is a moat surrounding the firm’s hottest franchises.

What is the Price Target for ATVI Stock?

Activision Blizzard comes in at a Strong Buy, with 14 unanimous Buy ratings. Further, the average ATVI stock price target of $92.54 entails an 8.1% gain from here.

Take-Two Interactive (NASDAQ:TTWO)

Take-Two Interactive is another video-gaming firm that’s been acquisitive itself in recent years, punching its ticket to the mobile-gaming market with the acquisition of Zynga for $12.7 billion. The deal closed nearly a year ago, but Take-Two has yet to bring out the best in the mobile-gaming gem.

As Take-Two looks to invest in mobile while simultaneously working on its triple-A blockbuster title, Grand Theft Auto (GTA) VI, look for TTWO stock to be a sleeper pick that could suddenly pop like a coiled spring at some unknown date down the road. I am bullish on the stock.

Indeed, Take-Two may get flack for being too reliant on just a handful of games like GTA. However, with Zynga in hand, Take-Two is no longer just a firm with one or two heavyweight products that dictate the trajectory of the share price.

Still, investors must be patient with the firm. Integrating new companies takes time. Further, the stock is much lower today than it was two years ago despite being two years closer to a GTA launch. I don’t think the action makes a lot of sense. I think investors are too impatient with a name that needs a multi-year time horizon to pay off.

Down around 43% from its peak, I view Take-Two as a video game stock worth that second look.

What is the Price Target for TTWO Stock?

Take-Two Interactive boasts a Strong Buy consensus rating based on 16 Buys and five Holds. The average TTWO stock price target of $131.45 implies a modest 7.7% gain from here.

Conclusion

The following tech firms are still great bets, according to analysts. Of the three, though, Uber has the most upside potential from here — and by a large margin.