One way for savvy retail investors to identify companies with potential for solid earnings is by monitoring their web traffic. Exciting companies with strong earnings potential tend to attract attention through web searches, and following their website traffic can complement traditional metrics.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

And this is where TipRanks’ Website Traffic Screener comes in. By using the tool, investors can analyze a company’s website performance and potentially forecast its upcoming earnings report.

With this in mind, we’ve used the screener to identify three e-commerce stocks that experienced sequential growth in website traffic during the recent quarter and have received Strong Buy ratings from Wall Street analysts. Let’s take a closer look.

Pinduoduo, Inc. (PDD)

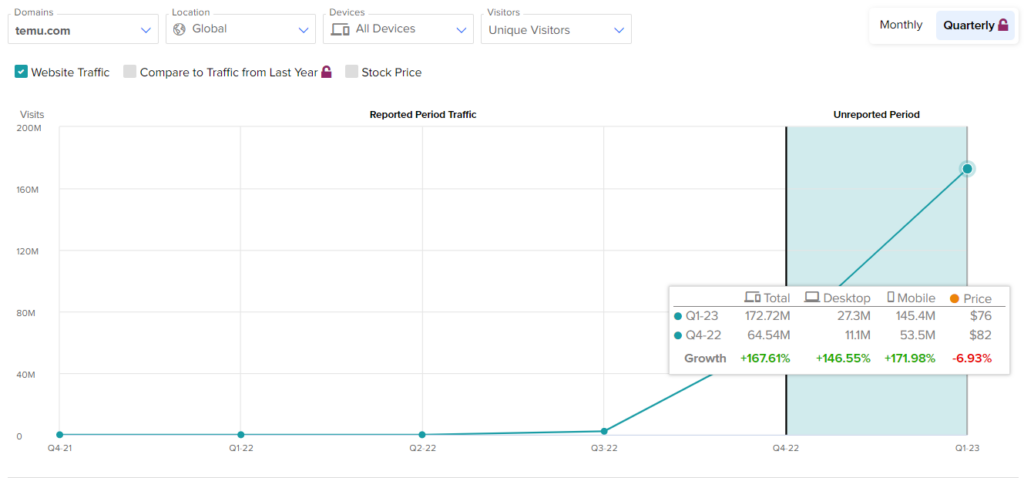

In the January-March quarter, the Chinese e-commerce company Pinduoduo has likely benefited from the reopening of China’s borders and efforts to enhance e-commerce offerings. In September 2022, the company launched its deep discount online platform Temu in the United States, which has become the most downloaded app in the United States.

It is worth mentioning that the TipRanks website traffic tool points to a solid top-line performance in the first quarter (ended March 2023). Global visits to temu.com and pinduoduo.com climbed by 167.6% sequentially in the quarter.

The increase in website visits can be attributed to the platform’s vast addressable market and high demand for low-priced products due to persistently high inflation.

The company is expected to announce its first-quarter results on May 26, 2023.

Overall, Wall Street is bullish about PDD stock. It has received 10 Buy and one Hold recommendations for a Strong Buy consensus rating. Further, analysts’ 12-month average price target of $110.36 implies 53.2% upside potential from current levels.

MercadoLibre, Inc. (MELI)

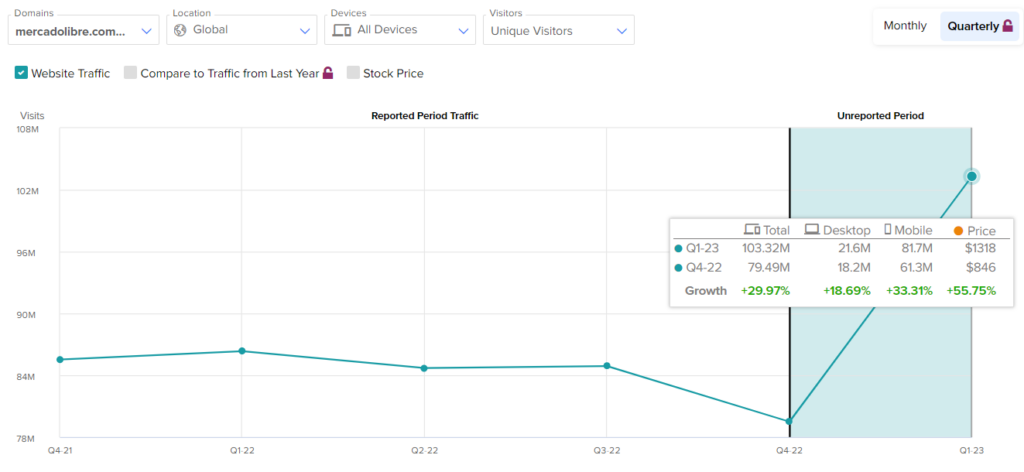

MercadoLibre is an e-commerce company that operates in Latin America. It also offers payments and lending solutions, along with a robust ad business and a logistics division. The company is benefitting from rapid e-commerce and fintech adoption in Latin America.

As per the tool, total global visits to mercadolibre.com.ar and mercadolibre.com climbed 30% sequentially in the quarter that ended March 2023. The increase in visits could indicate that demand for its products remained strong.

MercadoLibre is expected to release first-quarter results on May 4, 2023.

Wall Street has given MercadoLibre a Strong Buy rating based on nine Buys and one Hold. The average MELI stock price target of $1,524 entails a 22.4% gain from here.

Alibaba Group (BABA)

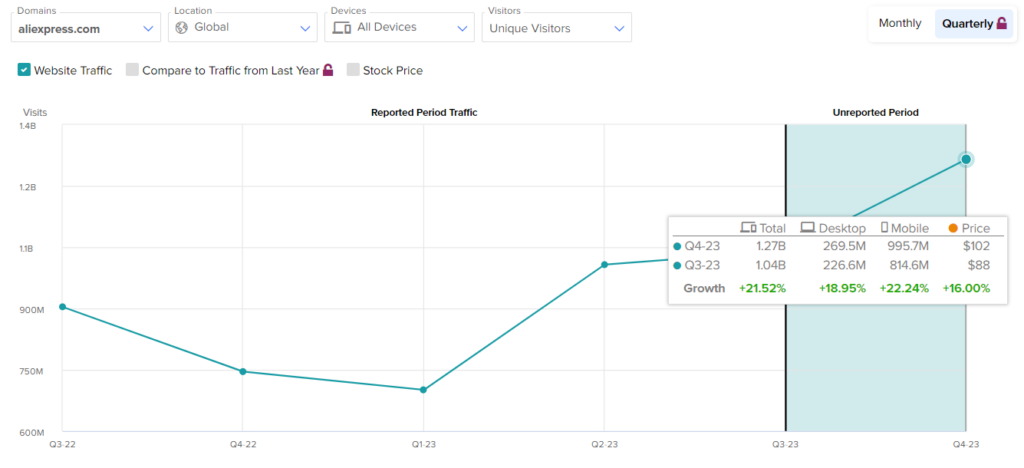

Chinese e-commerce giant Alibaba Group is benefitting from a strong presence in China’s consumer-to-consumer and business-to-consumer markets. Moreover, China’s reopening might have enhanced the efficiency of its cross-border platform AliExpress.

Furthermore, the company is expected to launch its own artificial intelligence chatbot, similar in nature to OpenAI’s ChatGPT, this year. This is expected to bolster Alibaba’s long-term growth prospects.

The website traffic tool shows that the number of visits to Alibaba’s websites — aliexpress.com, alibaba.com, and taobao.com increased by 21.5% sequentially for the March quarter.

BABA is expected to announce results for the first quarter of 2023 on May 18, 2023.

Analysts have a Strong Buy rating on Alibaba based on 19 unanimous Buys assigned in the past three months. The average BABA stock price target of $149.74 implies 45.8% upside potential from current levels.

Final Thoughts

PDD, MELI, and BABA have witnessed solid website traffic growth despite lingering macro headwinds. Interestingly, investors can enhance their stock research with the website traffic tool, as it enables one to analyze changes in consumer behavior and predict how this may affect the upcoming earnings report and stock price.