The cross-border payments segment is a huge industry offering both consumers and businesses ways to transfer money across the globe in a cheaper and faster manner than traditional banking allows.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It also offers plenty of opportunities for investors. Writing from Needham, and covering the international payment niche as a whole, 5-star analyst Mayank Tandon sees a bright future for investments in this sector, writing, “We expect there to be robust growth in the cross-border payments market over the next several years on both the B2B and C2C side, and our view is that firms that prioritize compliance, geographic diversification, and bank partnerships will emerge as LT winners.”

With that background, let’s use the TipRanks platform to take a deep dive into three international payment transfer companies projected to boast strong growth in the year ahead to find out what makes them compelling buys for investors today.

International Money Express, Inc. (IMXI)

First up, International Money Express, is a long-time inhabitant of the cross-border remittance business. IMXI is based in Miami, Florida, and has offices in both Mexico and Guatemala – which makes sense, as the company is a leader in the remittance business from the US and Canada to Latin America. In addition to 17 Latin countries in its orbit, the company offers remittance and transfer services to 7 countries and Africa and 2 in Asia. International Money Express also offers financial processing and payment services to its customers.

The company’s most recent quarterly financial release, for 1Q21, shows the strength of its business model. At the top line, total revenues of $94.6 million were up more than 22% from the prior year, and the EPS grew 35% to 28 cents. The strong results were driven by a 13.8% yoy increase in the active customer base, a 19.3% increase in the number of money transfer transactions, and 30.2% increase in the principal sent per transaction.

In another point of interest for investors, IMXI announced last month that it had shored up its liquidity situation, through a combination of refinancing debt and increasing credit access. On the debt side, the company refinanced an $87.5 million term loan, while on the credit side, it entered a new revolving credit facility, up to $150 million.

BTIG analyst Mark Palmer, rated 5-stars at TipRanks, described recent share price weakness as a buying opportunity, and writes, “IMXI in 1Q21 posted double-digit growth in transactions, revenues, net income and adjusted EBITDA; the money-transfer firm has now delivered adjusted EBITDA beats in all 11 quarters since it became a public company… We believe IMXI shares are inexpensive as their valuation does not reflect the strong top- and bottom-line growth demonstrated by the resilient business model that has enabled its outperformance in the money transfer space since the COVID-19 pandemic began.”

Palmer rates the stock as a Buy, with a $22 price target to indicate a 41% one-year upside. (To watch Palmer’s track record, click here.)

IMXI shares hold a Moderate Buy consensus rating, based on 3 recent reviews that include 2 to Buy and 1 to Hold. The shares are priced at $15.56 and their $20 average price target implies an upside of 28% in the next 12 months. (See IMXI’s stock analysis at TipRanks.)

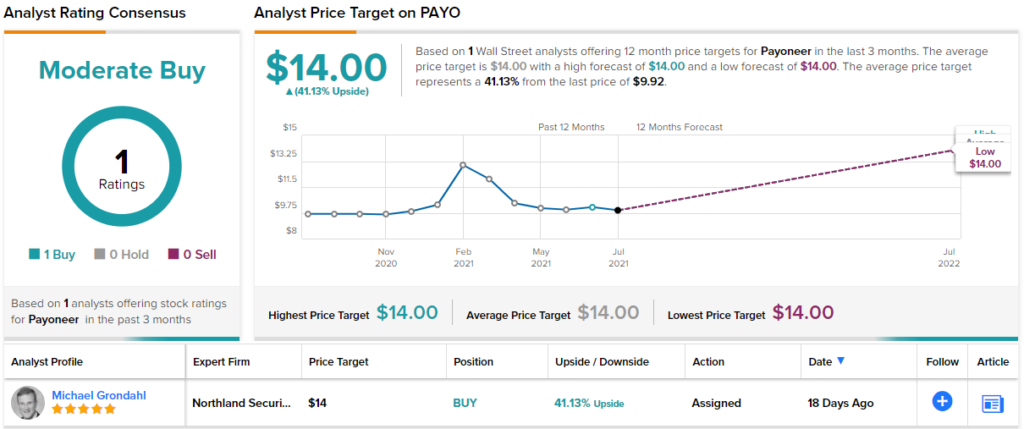

Payoneer (PAYO)

The next company on our list, Payoneer, is new to the public markets. It got its start as a startup in the fintech industry in 2005 – offering customers online money transfers and digital payment services, with a special focus on international B2B money transactions. Payoneer’s service is available in over 200 countries and 150 currencies, and the company is a favorite in the online freelance marketplace.

The company jumped on the SPAC bandwagon for its move to the public markets, accepting a merger with FTAC Olympus Acquisition in a transaction worth at least $300 million. PAYO shares started trading on the NASDAQ on June 28, closing at $10.60 that day, and the company boasts a market cap of $783 million.

A month before the SPAC transaction completed, Payoneer released its 1Q21 quarterly results, showing a 61% yoy increase in business volume since 1Q20, to reach $13.3 billion. The company’s revenue, of $100.6 million, was up 23% from the prior year. The solid results were helped along by a decrease in transaction costs, from 30% of revenue to 20%.

This newly public company’s reach and diverse customer base attracted the eye of Mike Grondahl, writing form Northland Securities. Grondahl notes that Payoneer works with 9 of the top 20 most valuable companies in the world by market cap. Payoneer also serves SMBs, ranging in size from a single freelance worker all the way to small manufacturers with $100M+ in annual revenues.”

Looking deeper, the analyst sees a clear path forward for Payoneer as the corona conditions continue to recede, writing, “The post-pandemic environment is expected to provide significant world-wide momentum as Payoneer’s mission is to democratize access to global commerce via enablement of access to sophisticated financial services, platform, and software. Payoneer allows all businesses, not just major corporations, to participate in global commerce by localizing redundancy and settlement capabilities.” (To watch Grondahl’s track record, click here.)

In light of these comments, Grondahl rates the stock as Outperform (i.e., a Buy), and his $14 price target implies room for 41% growth this year. His is the only review on record for Payoneer so far. The stock is currently trading for $9.92 per share. (See Payoneer’s stock analysis at TipRanks.)

Euronet Worldwide, Inc. (EEFT)

The third company on our list got started in Hungary with a single ATM machine in 1994. Today, Euronet Worldwide operates a network of 36,000 ATMs and over 300,000 point-of-sale services in 170 countries, along with credit and debit cards, currency transfers, and online financial transactions. The company’s headquarters are in Kansas, and it has 66 offices around the world.

In the first quarter of this year, EEFT reported total revenues of $652 million, up 12% from the year-ago quarter. At the same time, EPS was down, dropping from a 4-cent profit per share last year to a 16-cent loss in the current report. The company has a total cash position of $1.48 billion, $339 million in ATM cash, as of the end of March.

Shares have been volatile since these mixed results were published, but the stock remains up 40% for the past 12 months and Needham’s Mayank Tandon thinks the company is well poised to benefit from the economic reopening.

“We believe EEFT operates a well-diversified set of payments businesses with a global footprint that should be able to generate mid to high-teens EPS growth over the LT,” the 5-star analyst said. “While FY20 and the early parts of FY21 has been challenging due to sharp reductions in global travel, we believe EEFT has weathered the storm well and is poised for a return to consistent low double-digit revenue growth with sustained EBITDA margin expansion as business conditions improve and global leisure travel normalizes.”

Tandon rates the stock a Buy, and his $180 price target suggests a solid 29% one-year upside potential. (To watch Tandon’s track record, click here.)

There are only two recent reviews on file for EEFT – but both are positive, making the Moderate Buy consensus unanimous. This stock is trading for $139.32 and has an average price target of $172.50, making the upside potential 23% over the next 12 months. (See Euronet Worldwide’s stock analysis at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.