Inflation? What inflation? Shoppers across the nation defied expectations and beat the CPI blues in 2022, buying like there’s no tomorrow in a post-Thanksgiving frenzy. Online spending increased 2.3% year-over-year to a record $9.12 billion on Black Friday this year. Cyber Monday is expected to be even bigger, with $11.2 billion in anticipated online spending, up 5.1% year-over-year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s a sign of strength for the American consumer, no doubt, but there’s more to the story than shopping bags and holiday deals. If you’re really looking for a deal, check out these three retail-segment stocks, AMZN, WMT, and TGT, with holiday-season momentum.

Amazon (NASDAQ:AMZN)

Amazon is known as the king of U.S. e-commerce platforms. If Amazon is doing well, that’s a pretty good gauge of the American economy as a whole.

Some financial traders may have felt anxious as Amazon workers in multiple regions of the world organized a Black Friday strike. However, Amazon survived Black Friday and Cyber Monday as well, and plenty of shoppers received their packages as expected.

As mentioned earlier, online sales were robust on the Friday following Thanksgiving. All in all, Morningstar (NASDAQ:MORN) analyst Dave Sekera expects the company to thrive in the coming years – not only because of Amazon’s e-commerce platform but also with the help of the Amazon Web Services (AWS) cloud-technology division and Amazon’s advertising sales. These business units will, Sekera predicts, “lead to a compound annual growth rate of 10% over the next five years.”

Furthermore, AMZN stock is finally coming down to a reasonable valuation (1.9x price/sales) after a furious COVID-19 pandemic-driven rally.

What is the Price Target for AMZN Stock?

AMZN has a Strong Buy consensus rating based on 33 Buys and two Hold ratings assigned in the past three months. The average Amazon stock price target of $139.88 implies 48.9% upside potential.

Walmart (NYSE:WMT)

Walmart is a well-established retailer with many brick-and-mortar stores as well as an online presence. During a time of high inflation, many cost-conscious shoppers turned to Walmart for deals on a variety of goods.

Tragically, there was a fatal shooting at a Walmart location not long ago. Still, the retailer kept its stores open on Black Friday and Cyber Monday as shoppers poured in for post-Thanksgiving deals.

They also shopped online, and not always at Amazon. Believe it or not, searches for Walmart’s Black Friday discounts jumped 386% year-over-year, outpacing the almighty Amazon.

Meanwhile, analysts at Cowen specifically pinpointed WMT stock as a top Black Friday holiday pick. Analyst Oliver Chen expects Walmart to “benefit from product diversification, trend right execution, gifting assortments at competitive prices, and value positioning.” Perhaps, then, it’s time for you to do some “value positioning” in your portfolio and consider Walmart stock.

What is the Price Target for WMT Stock?

WMT has a Strong Buy consensus rating based on 20 Buys and four Hold ratings assigned in the past three months. The average Walmart stock price target of $162.83 implies 6.1% upside potential.

Target (NYSE:TGT)

Target a retail big-box store chain like Walmart, albeit not quite as gigantic. Some folks consider Target to be slightly higher-end in terms of product quality than Walmart. Also, Target stores are sometimes less crowded than Walmart stores, and that’s appealing to shoppers who aren’t fond of huge crowds.

Like Walmart, Target beat Amazon this year in terms of online searches for Black Friday discounts. Could TGT stock be the better bet, then, even though Target is a smaller and less powerful company than Amazon?

Sometimes, the stock that gets less attention can be the one that outperforms the market darlings. In-store customer traffic reportedly rose 7% year-over-year on Black Friday, and some of that traffic walked down the aisles of Target’s not-too-crowded stores.

Right now, there’s a sale happening, but you don’t have to drive to any store to participate; Target has a reasonable trailing 12-month P/E ratio of 22.4x and pays a 2.64% forward annual dividend yield.

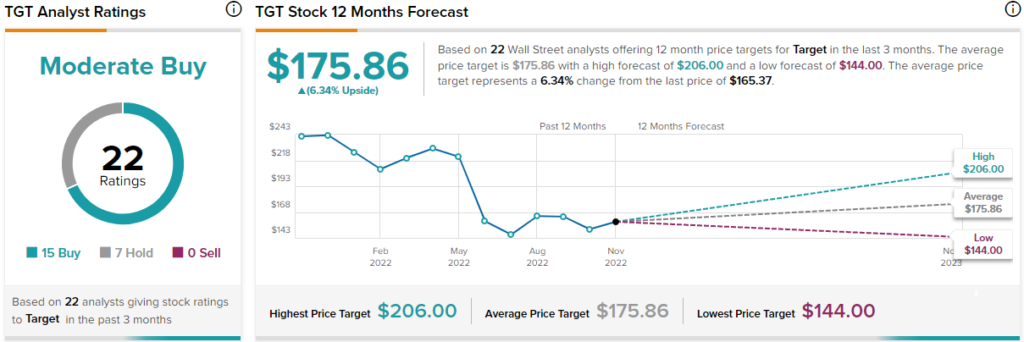

What is the Price Target for TGT Stock?

TGT has a Moderate Buy consensus rating based on 15 Buys and seven Hold ratings assigned in the past three months. The average Target stock price target of $175.86 implies 6.3% upside potential.

Conclusion: These Retail Giants are Worth Your Attention

Amazon, Walmart, and Target are three retail giants with different business models. Yet, they’re all raking in the revenue this holiday season as shoppers hunt for sales in stores and online. This year’s Black Friday and Cyber Monday sales are showing that U.S. consumers are strong despite inflationary pressures. If you’re feeling bullish and are ready to shop for great deals in the financial market, consider positions in AMZN, WMT, and TGT shares.