Technology stocks surged after the Reserve Bank of Australia (RBA) delivered a softer than expected rate rise yesterday afternoon. The S&P/ASX 200 Information Technology (XIJ) index jumped more than 4.9%, with stocks Wisetech Global Ltd. (ASX:WTC), Xero Limited (ASX:XRO), Megaport Ltd. (ASX:MP1) leading the charge.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Why did ASX tech shares rise on RBA’s 0.25% rate hike?

The RBA increased its benchmark interest rate by 0.25%, lower than the 0.50% increase many within the market expected.

The softer than expected rate rises were welcomed by tech investors, as higher interest rates can pose various challenges to technology companies. Aside from increasing borrowing costs and hindering access to capital, rapidly rising rates can also diminish demand for tech products.

Let’s take a look at three ASX tech stocks that jumped after the RBA rate decision.

Wisetech Global share price target implies 8% upside

Wisetech is a software provider to the logistics industry. Its shares popped up about 7% after the RBA rate announcement, bringing their gains to more than 42% in the past three months. However, the stock still trades about 8% below where it began the year.

According to TipRanks’ analyst rating consensus, Wisetech stock is a Moderate Buy based on five Buys, three Holds, and one Sell. The stock’s AU$59.31 average Wisetech price target implies about 8% upside potential.

Xero Limited share price forecast indicates 33% upside

Xero provides digital solutions to small businesses. Its shares rose about 6% yesterday, but are still down nearly 50% since the beginning of the year. According to TipRanks’ analyst rating consensus, Xero stock is a Strong Buy based on four Buys versus one Hold. The stock’s AU$100.53 average Wisetech price forecast suggests about 33% upside potential.

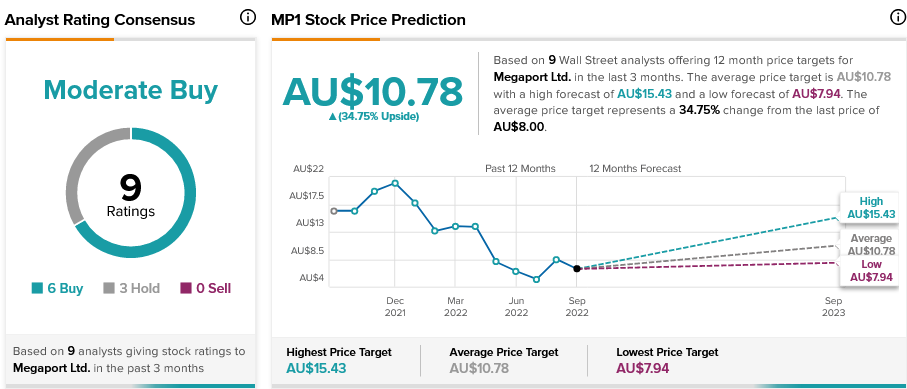

Megaport stock price prediction shows 35% upside potential

Megaport provides software-based network interconnection solutions. Its shares popped up about 5% on the back of the softer rate rise, lifting their gains in the past three months to over 50%. However, the stock still trades nearly 60% below where it started the year.

According to TipRanks’ analyst rating consensus, Xero stock is a Moderate Buy based on six Buys versus three Holds. The stock’s AU$10.78 average Wisetech price prediction implies about 35% upside potential.

Concluding remarks

While rate increases are usually adverse to the technology sector, gradual RBA rate hikes should ease the pressure on the sector. If the central bank succeeds in bringing down inflation, tech companies could benefit from lower operating costs offsetting higher borrowing costs.