Despite the global iron ore price dropping around 20% in the last 12 months, the raw material remains a critical component of the global economy. Iron ore is used to make steel, the world’s most important engineering and construction material.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Australia is the world’s largest iron ore producing country. The raw mineral is a major contributor to the Aussie economy. Australia’s regulatory environment is generally favourable to the iron ore mining industry. As a result, ASX iron ore mining companies are usually driven by strong fundamentals, are mostly profitable and provide solid dividends.

For the best exposure to the iron ore mining industry, investors may want to consider ASX stocks that offer above-average dividend yields and substantial share price upside potential. Rio Tinto Limited (ASX:RIO), BHP Group Ltd (ASX:BHP), and Mineral Resources Limited (ASX:MIN) are some of analysts’ favourites in this space, according to TipRanks insights.

Rio Tinto shares offer modest upside but strong dividend yield

Multinational mining conglomerate Rio Tinto is one of the world’s largest iron ore producers. The company yesterday entered into a AU$3 billion iron ore production joint venture project in Western Australia, with China’s biggest state-owned steelmaker, Baowu. Rio Tinto holds the majority stake in the project, which will have a maximum annual capacity of 25 million tonnes.

Rio Tinto stock offers a dividend yield of nearly 11%, well above the sector average of less than 2%. The mining giant’s shares have gained about 5% over the past week.

According to TipRanks’ analyst rating consensus, Rio Tinto stock is a Moderate Buy. The average Rio Tinto share price target of AU$108.95 implies almost 15% upside potential.

Rio Tinto scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

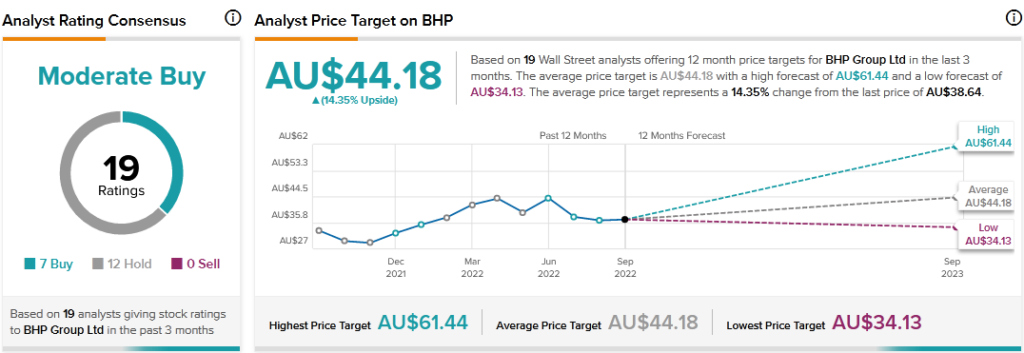

BHP Group shares price prediction

Melbourne-headquartered BHP Group has been in the mining business since 1885. The stock offers a dividend yield of more than 13%, versus the sector average of less than 2%. BHP shares have gained more than 6.6% over the past week and seem to have more room to run. According to TipRanks’ analyst rating consensus, BHP stock is a Moderate Buy. The average BHP share price prediction of AU$44.18 implies over 14% upside potential.

BHP Group stock is seeing favourable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 88% Bullish on BHP, compared to a sector average of 75%.

Mineral Resources share price forecast

Perth-headquartered Mineral Resources, also called MinRes, is a mining services company. Its work includes operating mine sites for its clients. The company handles mining of iron ore, lithium, and other metals. MinRes stock offers a dividend yield of 2.68%, a modest one compared to Rio Tinto and BHP yields but still better than the sector average of less than 2%.

Mineral Resources shares have gained more than 19% over the past week and have the potential to move higher. According to TipRanks’ analyst rating consensus, MinRes stock is a Strong Buy. The average Mineral Resources price forecast of AU$77.61 implies nearly 8% upside potential.

MinRes stock scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Moreover, Mineral Resources stock is receiving favourable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 90% Bullish on MIN, compared to a sector average of 75%.

Final thoughts

For investors with long-term perspectives, ASX iron ore stocks, Rio Tinto, BHP Group, and Mineral Resources, may be worth considering now. Apart their solid share price upside potential, the stocks are also attractive for income portfolio given their strong dividend yields.