Canada is renowned for its dividend equities, with numerous names featuring outstanding dividend-growth track records. At the top spots stand Canadian Utilities (TSE: CU) (OTC: CDUAF) and Fortis (TSE: FTS) (NYSE: FTS), which boast 50 and 49 years of consecutive dividend increases, respectively.

Both companies own regulated utility assets that transmit electricity, gas, and water in Canada and the United States. The utilities sector is generally preferred by investors during economic downturns due to companies in the space generating relatively robust cash flows.

Combined with both companies’ prolonged dividend-growth track records, high dividend yields, and reasonable valuations, Canadian Utilities and Fortis could be ideal buys for income-oriented investors these days.

That said, both companies feature limited growth prospects. Thus, I am neutral on both stocks.

Which is the Better Dividend Stock?

Since both companies share a similar dividend growth track record, let’s consider which stock makes for the better dividend pick and explore each stock’s dividend metrics.

Canadian Utilities’ Dividend Prospects

Canadian Utilities currently features an annualized dividend rate of C$1.7768. At the current CAD/USD rate, it converts close to US$1.30. With shares now hovering close to US$24.80, the stock yields around 5.4%. This is significantly higher than the stock’s historical average after its recent correction.

The company’s 10-year and five-year dividend-per-share CAGRs stand at around 8.1% and 6.2% in their original CAD declaration. These numbers definitely imply a slowdown lately, but they are still great dividend growth rates for a utility.

That said, I would be prepared for dividend growth to slow down further, going forward. The company’s latest hike was by just 1%. Basically, over the years, dividend growth has outpaced earnings-per-share growth, which has remained mostly stable over the past decade.

This has led to a growing payout ratio. Based on consensus Fiscal 2022 earnings-per-share estimates of C$2.39, its payout ratio stands just under 75%. Thus, future dividend hikes will likely remain in the low single digits before the company’s new investments start bearing fruit.

Fortis’ Dividend Prospects

Fortis has enjoyed better growth prospects over the years due to its increased exposure to international investments and equities. For example, the company has a controlling stake in publicly-traded Caribbean Utilities (TSE: CUP), which operates as a monopoly in several islands of the Caribbean. The company’s 10-year EPS CAGR stands at 4.4% – not spectacular, but better than Canadian Utilities’.

The company’s 10-year and five-year dividend-per-share CAGRs stand at around 5.9% and 6.1% in their original CAD declaration, not showing any signs of slowing down as well – there is a slight acceleration, in fact. The company is expected to earn C$2.39 this year, implying a payout ratio of around 87%. Despite the high payout ratio, last month, the company increased its dividend for its 49th consecutive time by 5.6%, which is in line with its historical average.

In my view, Fortis’ dividend will eventually have to slow down as well toward the lower single digits. Considering the various similarities between Canadian Utilities and Fortis, including their business model, identical dividend growth track records, and humble dividend-growth prospects, there isn’t a clear winner. Canadian Utilities features a juicier yield of 5.0% over Fortis’ 4.5%, but that’s not a tremendous difference.

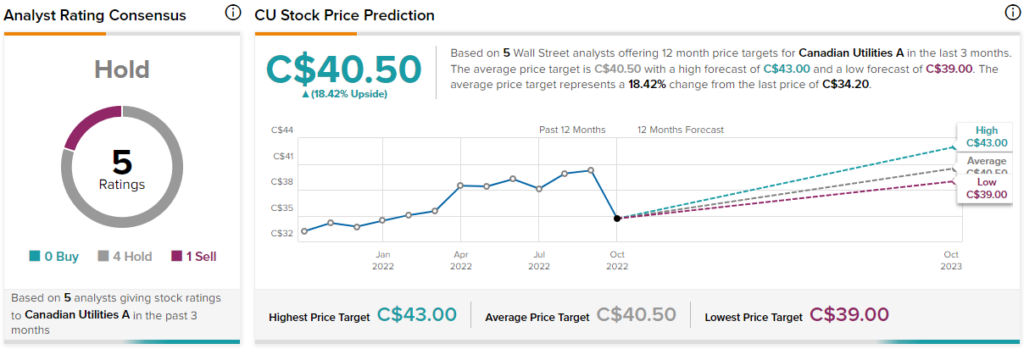

What is the Target Price for CU Stock?

As far as Wall Street’s sentiment goes, Canadian Utilities’ has a Hold consensus rating based on four Holds and One Sell assigned in the past three months. At C$40.50, the average Canadian Utilities’ stock forecast implies 18.4% upside potential.

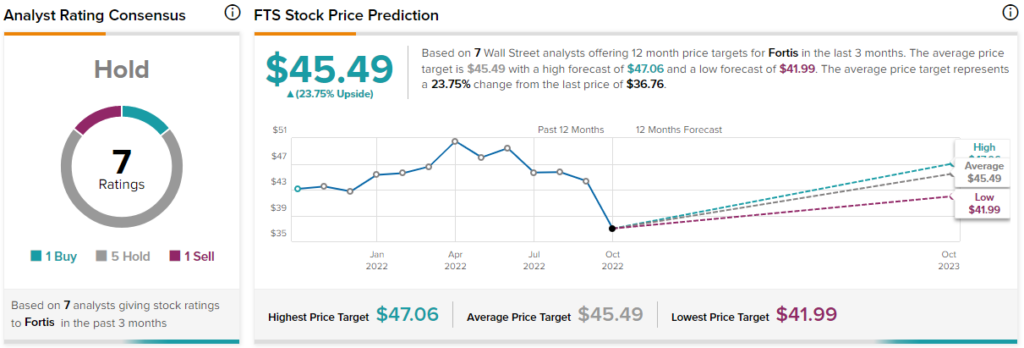

What is the Target Price for FTS Stock?

Fortis has also attracted a rather mixed sentiment, with a Hold consensus rating based on one Buy, five Holds, and one Sell assigned in the past three months. At $45.74, the average Fortis stock forecast implies 23.75% upside potential.

Are the Two Companies Reasonably Valued?

I believe Canadian Utilities and Fortis are reasonably valued. The two stocks trade at forward P/E ratios of 14.7x and 15.7x, respectively (using 2023 estimates). These are not dead cheap multiples in a rising interest environment considering the two companies enjoy humble growth prospects.

However, based on their incredible moats, unparalleled track records of growing dividends, and robust cash flows, I don’t think any of the two will ever trade at a substantial discount. The modest premium of Fortis likely reflects the company’s significantly more diversified operations and slightly better historical earnings-per-share growth.

Conclusion: CU and FTS Should Provide Stable Income

Canadian Utilities and Fortis are not supposed to make you rich overnight, but their shares will likely do a pretty good job in terms of providing stable income that should grow slowly over time. Conservative income-oriented investors are likely to find the two stocks fitting in their portfolios.

However, U.S.-based investors should consider the FX risks that come with investing in Canadian Equities. While the CAD/USD rate has generally been stable over the years, small annual changes in the conversion rate can really impact one’s total returns. For instance, during the past three years, U.S.-based investors didn’t really experience growth in Canadian Utilities’ dividend rate due to the CAD/USD depreciation.