Artificial intelligence (AI) is generating a lot of hype, but early signs are beginning to emerge that this is no mere stock market bubble but a sea change that will produce tangible economic results. Goldman Sachs (NYSE:GS) believes that AI could increase productivity by 1.5% per year for the next decade and boost the S&P 500’s (SPX) profits by 30% over the same time frame.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Earlier, the renowned investment bank predicted that generative AI (more on this shortly) could help to lift global GDP by 7%, or $7 trillion, over the next decade. A great way to invest in this emerging megatrend is through ETFs. Here are two under-the-radar AI ETFs that take interesting approaches to the space. Both are fairly new and are relatively small in terms of assets under management, and both could be hidden gems for investor portfolios.

1. Roundhill Generative AI & Technology ETF (NYSEARCA:CHAT)

CHAT is the world’s-first ETF focused specifically on generative AI, the technology that Goldman Sachs hailed as having the capability to increase GDP. Roundhill explains that generative AI is AI that can create new and unique content, such as images or text, by “learning patterns and structures from existing data.”

Generative AI differs from generalized, traditional AI “in its ability to create new, unique content, rather than just analyzing or processing existing information.” Examples of generative AI you may have seen or experienced would be asking ChatGPT to write a poem or story for you or creating an image seemingly out of thin air with Dall-E. Adobe (NASDAQ:ADBE) is now incorporating AI into its core Photoshop and Illustrator products with Firefly, its creative generative AI engine that allows users to describe the images they want to generate using text.

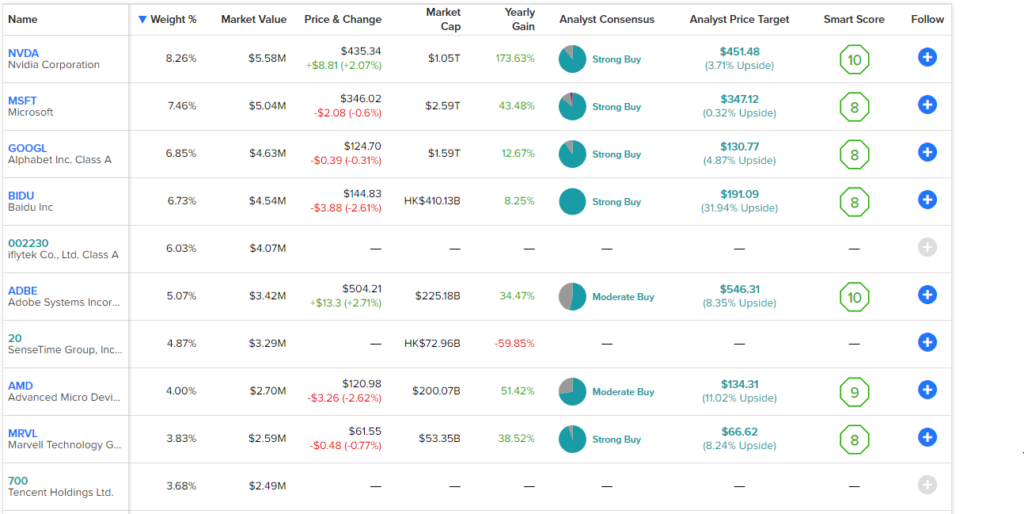

As such, it’s no surprise that Adobe makes up a 5.2% weighting in the CHAT ETF. Overall, CHAT has 35 holdings, and its top 10 positions account for 56.1% of the fund. Below, you can take a look at CHAT’s top 10 holdings using TipRanks’ Holdings Tool.

Nvidia (NASDAQ:NVDA) is CHAT’s top holding, which makes sense as Nvidia’s semiconductors are powering today’s generative AI applications. Beyond these names and other mega-cap tech names like Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL), CHAT casts a wide net in looking for generative AI names.

It owns quite a few Chinese companies that are making advances in AI, from stocks that are well-known to Western investors like Baidu (NASDAQ:BIDU) and Tencent (OTC:TCEHY), to more under-the-radar names like iFlytek Co. and SenseTime Group. These types of stocks are stocks can be difficult for retail investors to access, so it’s nice to have the option to be able to gain exposure to them through CHAT.

We first covered CHAT last month when it launched and had under $2 million in assets under management (AUM). Now, just a few weeks later, CHAT has grown to over $66 million in AUM. While this is still relatively small in the world of ETFs, it shows that CHAT is garnering momentum. The only downsides to point out about CHAT is that it is a new, small ETF without a proven track record, and it has a relatively high expense ratio of 0.75%.

Nonetheless, CHAT looks like an interesting option for investors thanks to its unique, undiluted focus on generative AI and its portfolio that goes off the beaten path to find these generative AI companies.

Also, it has an ETF Smart Score of 8 out of 10. The Smart Score is TipRanks’ proprietary quantitative stock scoring system. It gives stocks a score from 1 to 10 based on eight market key factors. The score is data-driven and does not involve any human intervention.

Is CHAT Stock a Buy, According to Analysts?

Analysts view CHAT as a Moderate Buy. Over 75% of the ratings on CHAT are Buys, 21.8% are Holds, and just 2.8% are Sells. It should be noted that the average CHAT stock price target of $31.55 represents only 4.9% upside potential, reflecting the fact that the price of CHAT has run up over 15% since its launch just a month ago.

2. WisdomTree Artificial Intelligence & Innovation Fund (BATS:WTAI)

Like CHAT, the WisdomTree Artificial Intelligence & Innovation Fund is a relative newcomer to the world of ETFs, launching in December 2021. It’s larger than CHAT, with nearly $100 million in AUM, and it has a comparatively lower expense ratio of 0.45%.

While WTAI isn’t exclusively focused on generative AI like CHAT, it takes a comprehensive approach toward investing across the space as a whole, including AI software, semiconductors, hardware (which includes things like drones, autonomous vehicles, and industrial automation), and innovation, which WisdomTree describes as any application of AI technology disrupting existing industries.

WTAI is more diversified than CHAT, with 79 holdings, and its top 10 holdings make up just 20.9% of the fund. Below, you can get an overview of WTAI’s top 10 holdings.

Like CHAT, WTAI’s top position is Nvidia, although with a smaller 2.55% weighting. Nvidia competitor Advanced Micro Devices (NASDAQ:AMD) is the fund’s second-largest holding, and the semiconductor space is well-represented throughout the top 10 with these names plus Taiwan Semiconductor (NYSE:TSM), Synopsys (NASDAQ:SNPS) and Cadence Design Systems (NASDAQ:CDNS).

Like CHAT, WTAI isn’t afraid to go off the beaten path and go international in its search for AI leaders, with top 10 positions in Taiwan’s Alchip Technologies and Switzerland’s STMicroelectronics NV (NYSE:STM). WTAI also has positions in the mega-cap tech names that are pushing advances in AI, like Microsoft, Alphabet, and Meta Platforms (NASDAQ:META).

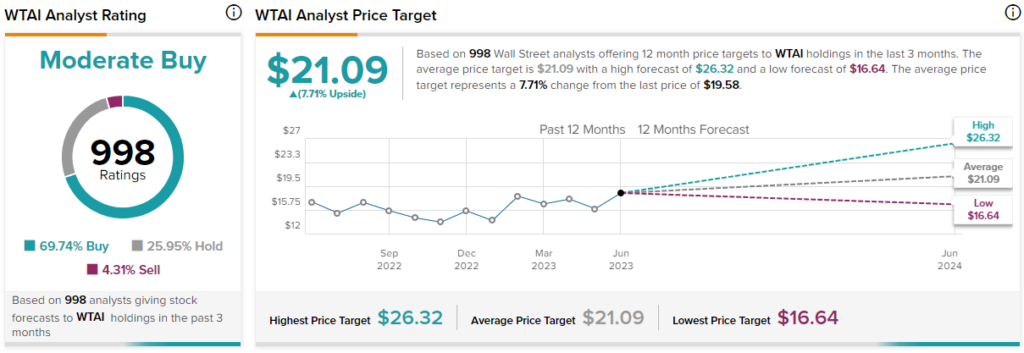

WTAI has a Neutral ETF Smart Score of 7, one point lower than CHAT.

Is WTAI Stock a Buy, According to Analysts?

WTAI is viewed as a Moderate Buy by analysts, and nearly 70% of analyst ratings on the ETF are Buys. The average WTAI stock price target of $21.09 is just 7.7% above the ETF’s current price, reflecting the fact that the ETF has gained nearly 40% year-to-date.

Investor Takeaway

AI and generative AI will have a long-term impact for years to come, and this is the type of secular trend that I personally want to invest in. I like CHAT because of its unique, laser-like focus on generative AI, as well as the fact that it leaves no stone unturned in its hunt for AI stocks. I like WTAI for its comprehensive, all-encompassing approach to AI innovation. Therefore, both ETFs look like intriguing options for investors who want to add exposure to their portfolios.