Investors looking for stocks with the potential to beat market averages can consider the ones on TipRanks’ Top Smart Score Stocks list. It is worth mentioning that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The tool considers eight different factors, including analyst ratings, technical analysis, and insider activity, among others, and assigns a score to stocks between 1 and 10, with 10 being the best.

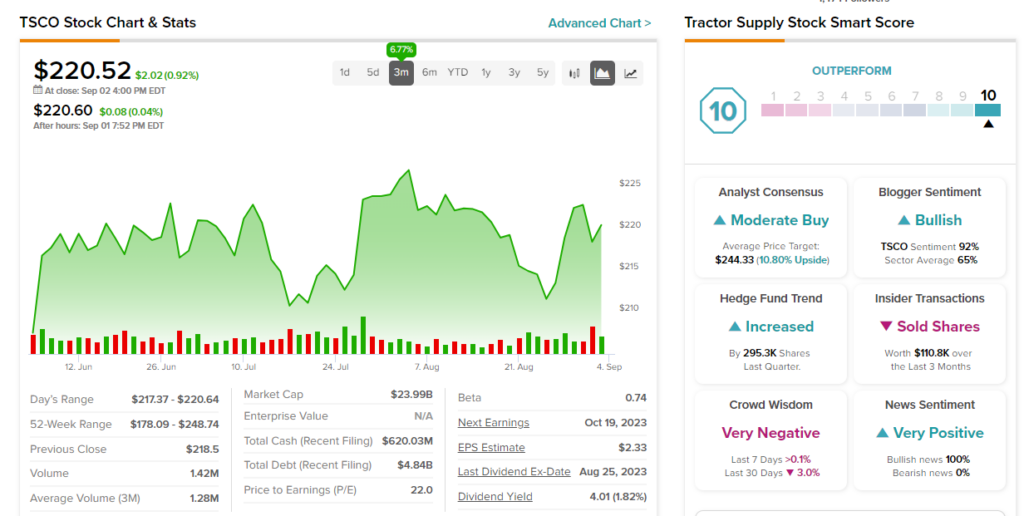

Using this tool, we’ve chosen two stocks that are currently displaying the “Perfect 10” score: Tractor Supply (NASDAQ:TSCO) and CNH Industrial (NYSE:CNHI). Let’s take a closer look at these two companies.

Tractor Supply Co.

Tractor Supply is a rural lifestyle retailer. TSCO was included in the Perfect 10 list yesterday. The stock has a Very Positive signal from hedge funds. Our data shows that hedge funds bought 295,300 TSCO shares in the last quarter. The stock also enjoys Bullish blogger sentiment and Very Positive news sentiment on TipRanks. Furthermore, the efficiency of Tractor Supply is further demonstrated by its return on equity (ROE) of 55.45%.

The company’s revenue growth has been supported by expansion efforts, including new store openings. Moreover, the company recently increased its long-term store count target in the U.S. by 200 to 3,000 stores. Finally, its Neighbor’s Club loyalty program continues to attract more customers and has reached 31 million members as of June’s end.

Is TSCO Stock a Buy?

Tractor Supply has a Moderate Buy consensus rating on TipRanks. This is based on 11 Buy and eight Hold recommendations. The average price target of $244.33 implies 10.8% upside potential from current levels. TSCO stock is up 6.7% in the past three months.

CNH Industrial N.V.

CNH Industrial provides equipment and services for agriculture and construction work. CNHI stock was added to the Perfect 10 list yesterday. Our data shows that hedge funds are currently bullish on the stock, as they bought 3.8 million shares of the company last quarter. Also, blogger sentiment is bullish, while news sentiment is Neutral in comparison to other stocks in the consumer cyclical sector. The company has generated a 35.16% ROE over the trailing 12 months.

CNH Industrial has been benefitting from strong momentum in the agricultural technology space. Additionally, CNHI is consistently launching new and improved products, which points to its long-term growth potential.

Is CNHI a Good Stock to Buy?

CNHI stock has a Moderate Buy consensus rating on TipRanks. This is based on four Buys and four Hold recommendations assigned in the past three months. The average CNHI stock price target of $16.64 implies 20.3% upside potential. The stock is up 51.5% year-to-date.

Concluding Thoughts

Investors seeking stocks with considerable growth potential might want to consider TSCO and CNHI. Their high Smart Scores on TipRanks, positive sentiments from hedge funds, and strong fundamentals indicate the possibility of outperformance compared to the broader market. It’s worth noting that investors can use TipRanks’ Experts Center tool to discover top stock picks as well.