If any market segment epitomized the concept of Wall Street giving and later taking away, it would be real estate. Once one of the hottest arenas, the housing market cooled substantially from its earlier bonanza phase. Fundamentally, the Federal Reserve’s commitment to a hawkish monetary policy imposes significant headwinds. Not only that, two tech stocks highly dependent on housing sentiment – OPEN and MTTR – may incur continued volatility.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

To understand the current situation of real estate, investors must go back to the early days of the COVID-19 crisis. In an effort to save the U.S. economy from a shock implosion, Washington approved various monetary and fiscal stimulus packages. While the measures ultimately kept the economic machinery above water, the result was an unprecedented expansion of the money supply.

By late 2021/early 2022, consumers conspicuously felt the pain of dramatically higher prices. Essentially, to save the economy from lasting, perhaps permanent damage, the Fed decided to tighten the money stock. In doing so, fewer dollars will be chasing after more goods, which theoretically should reduce inflation. Recently, the central bank raised the benchmark interest rate by 0.75%, the third consecutive time it did so.

Supporting the broader initiatives to control inflation stands the International Monetary Fund (IMF). Per TipRanks reporter Robert Waugh, the IMF urged global policymakers to reduce inflation. Certainly, the Fed and other central banks have been happy to oblige.

However, the IMF also warned about the risks of global recession rising. To be sure, attacking inflation will be necessary for broader economic stability. After all, inflation disproportionately impacted working-class Americans. Still, aggressive monetary tightening will likely reduce economic activity (due to higher borrowing costs), which then exacerbates the recession risks the IMF is so concerned about.

It’s a tough situation for any market sector. However, real estate will likely feel the heat the most because of the underlying products’ pricing scope. Moreover, certain tech stocks dependent on the housing segment present significant risks.

Opendoor Technologies (NASDAQ: OPEN)

An online enterprise, Opendoor Technologies deploys the innovative iBuyer business model to help clients navigate the complexities of real estate transactions. Essentially, Opendoor utilizes artificial intelligence to assess the value of a home. From there, it spits out an offer. Should the seller accept the terms, Opendoor fully accepts the burden of owning, marketing, and reselling the home.

Another nifty feature is that the platform allows people to sell on their own time. In this way, Opendoor introduces predictability to the home transaction process. One key benefit is that sellers can avoid paying a double mortgage – the first on the home they own now but are trying to sell and the second on the home they recently purchased.

Unfortunately, this framework hasn’t been successful thus far because Opendoor necessarily must spit out an uncompetitive offer. Unless someone is in an absolute hurry, it’s likelier that a seller will receive significantly more money through a traditional brokerage.

Really, the evidence is in the financials. Although Opendoor features an impressive three-year revenue growth rate of 58.9% — ranking better than 94% of the real estate industry – it features poor profitability metrics.

According to the company’s latest Q2-2022 earnings report, Opendoor’s retained earnings line item came out to a loss of $1.73 billion. That’s despite generating a staggering $4.2 billion in revenue for the quarter. Frankly, OPEN represents one of the tech stocks to avoid.

Is OPEN Stock a Buy, According to Analysts?

Turning to Wall Street, OPEN stock has a Moderate Buy consensus rating based on eight Buys, three Holds, and one Sell rating. The average OPEN price target is $8.55, implying 245.45% upside potential.

Matterport (NASDAQ: MTTR)

While tech stocks presented problematic investments this year, Matterport seems especially vulnerable. The tale of the tape provides a quick and pointed reason why investors must be cautious. Since the start of this year, MTTR stock has fallen nearly 82%. For comparison, OPEN dropped a little more than 81%.

At its core, Matterport represents a spatial imaging specialist. The company manufactures 3D cameras that enable operators to present an accurate visualization of indoor spaces across a 2D platform (i.e., your computer monitor). In this way, Matterport enabled real estate agents to sell homes to interested buyers without visiting from a physical perspective.

However, Matterport’s peak relevance coincided with unprecedented housing demand amid a pandemic. Since late 2021, MTTR has only looked like a shell of its former glory, and it’s difficult to imagine that Matterport would make a comeback given the deterioration of housing sentiment.

As with Opendoor, Matterport’s financials say everything. Although the company enjoys tremendous long-term growth, its profitability metrics present significant vulnerabilities. For instance, in Q2 2022, its net loss amounted to $64.6 million, an unfavorable expansion from a loss of $6.2 million one year ago.

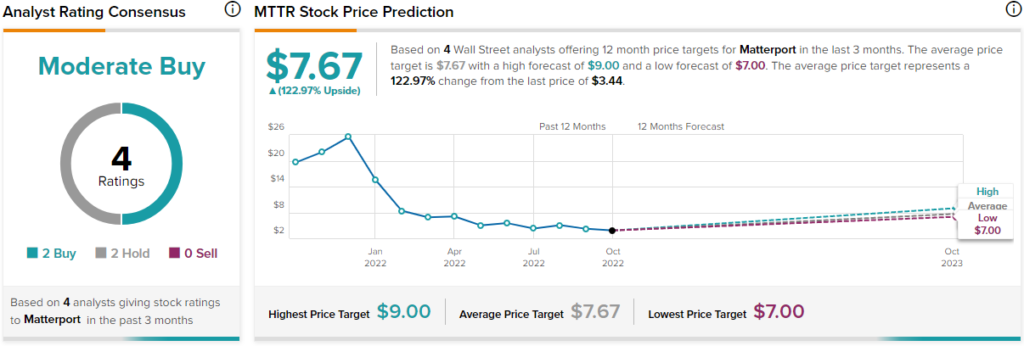

Is MTTR Stock a Buy, According to Analysts?

Turning to Wall Street, MTTR stock has a Moderate Buy consensus rating based on two Buys, two Holds, and zero Sell ratings. The average MTTR price target is $7.67, implying 123% upside potential.

Conclusion: These Tech Stocks Face Trouble

Although some beaten-up tech stocks offer a compelling profile for contrarians, regarding OPEN and MTTR, most investors should stay away. Fundamentally, it comes down to relevance. With the Fed committed to raising rates to control inflation, affordability becomes a major problem. Thus, housing prices must come down if sellers want to sell their homes. Under this deflationary ecosystem, not much room exists for companies trying to improve the transactional process.