Such has been the force of the cumulative headwinds in 2022 that trying to make headway in this year’s downtrending market has been a struggle for most. A slowing economy, decades-high inflation and the accompanying rate hikes in the attempt to tame it, not to mention Russia’s invasion of Ukraine and the impact on energy prices have all played their part in souring sentiment.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The result has been widespread share losses. The good news is that those with a strong stomach could use the opportunity to scoop up shares of good companies at depressed and rather enticing levels. The question of course is, which stocks are the most promising?

There are plenty of routes to follow in the pursuit of a winner and one way is to track the movements of insiders – those with in-depth knowledge of their company’s inner workings and responsibility for said company’s performance. When an insider makes a move to buy, it signals they believe the shares offer good value. To keep the playing field level, they are required to make any purchases public.

Using the TipRanks platform we’ve homed in on two names which the insiders have been loading up on, but they are not the only ones making bullish noises. The Street’s analysts currently rate both as Strong Buys. Let’s see what all the fuss is about.

Clarivate Plc (CLVT)

We’ll start with Clarivate, an analytics company, or more specifically, a supplier of intellectual property (IP), scientific data, analytical tools, and services. It makes use of this information for the discovery, protection, and commercialization of concepts and products. By offering up actionable information and insights that shorten the period between a new idea and potentially life-changing inventions, the company’s goal is to assist customers in solving some of the world’s most complicated issues. Areas of focus include Academia & Government, Life Sciences & Healthcare, Manufacturing & Technology and Professional Services and Consumer Goods.

Formed in 2016 following Onex Corporation and Baring Private Equity Asia’s acquisition of Thomson Reuters’ Intellectual Property and Science Business, since then Clarivate has acquired more than a dozen businesses in the information services sector, contributing to its rapid growth.

The latest set of earnings results had growth on tap again. Revenue increased by 54% year-over-year to $686.6 million, although that figure came in short of expectations by $4.3 million. Non-GAAP EPS of $0.22, however, beat the $0.20 consensus estimate.

Following in the footsteps of countless others in 2022, the company also lowered its outlook for the rest of 2022. Revenue is now expected in the range between $2.70 billion-$2.76 billion compared to $2.80 billion-$2.88 billion beforehand, while adj. EBITDA was lowered from the prior $1.16 billion-$1.22 billion to between $1.12 billion-$1.16 billion.

The disappointing guidance and top-line miss have exacerbated the stock’s 2022 losses. The shares have been on a downtrend since the results’ announcement and year-to-date are down by 60%.

Evidently, a C-suite member thought it’s the right time to pounce. Recently, Vice Chairman Andrew M. Snyder picked up 259,396 shares worth just over $3 million.

Snyder’s confidence is echoed by analyst Seth Weber, who covers this stock for Wells Fargo.

“We have a positive view of Clarivate’s life science/ healthcare and patent/IP info assets – an estimated $100B+ TAM, where we expect solid long-term growth; meanwhile, embedded solutions support 90%+ customer retention. Following three large acquisitions (ProQuest sounds to be trending better than we expected) and considerable investment to improve the business, we believe the model is ready to be scaled, including better pricing and recent cross-selling traction, capable of supporting mid/upper-SD growth, mid-40% adj EBITDA margin and generate significant free cash flow over time,” Weber opined.

To this end, Weber rates CLVT an Overweight (i.e., Buy) along with a $19 price target. Investors stand to score a 100% gain, should Weber’s thesis go according to plan in the year ahead. (To watch Weber’s track record, click here)

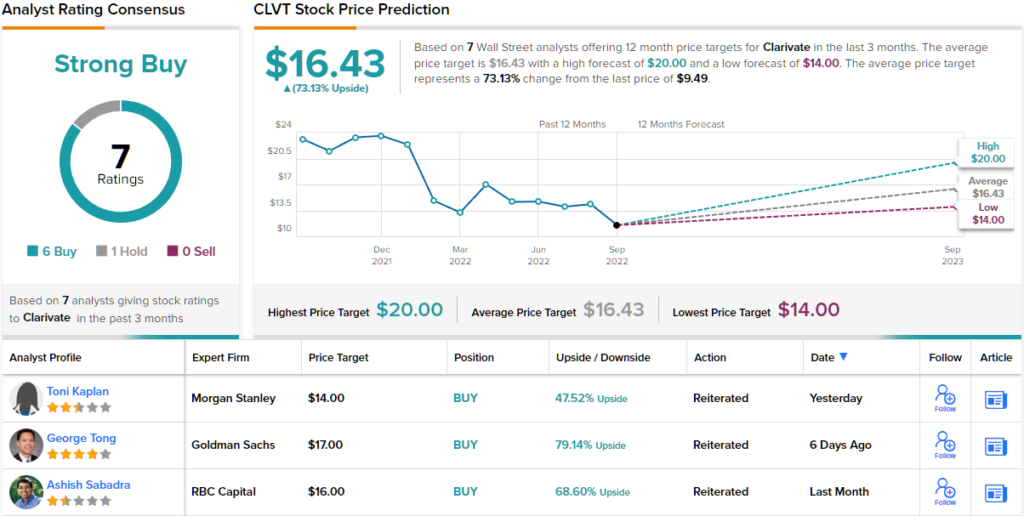

All in all, CLVT has picked up 7 analyst reviews in recent months, with 6 Buys and 1 Hold making for a Strong Buy consensus rating. The stock’s $16.43 average price target suggests it has a robust 73% upside from the current trading price of $9.49. (See CLVT stock forecast on TipRanks)

Sarepta Therapeutics, Inc. (SRPT)

Let’s now pivot to an entirely different proposition. Sarepta is a biotech company focused on the development of RNA-based medicines and gene therapies for rare diseases.

A biotech’s holy grail is to bring a product to market, a feat already achieved by Sarepta. In fact, the company has 3 FDA-approved drugs, EXONDYS 51 (eteplirsen), VYONDYS 53 (golodirsen) and AMONDYS 45 (casimersen) all indicated to Duchenne Muscular Dystrophy (DMD), a rare, life threatening neuromuscular genetic condition that causes progressive weakness and loss (atrophy) of skeletal and heart muscles. These RNA-based PMO drugs generated revenue of $211.2 million in Q2, amounting to a 50% increase from the same period last year.

With over 40 programs in various stages of development, Sarepta has an extremely active pipeline, but the drug of most interest right now is another DMD therapy which could be entering the market soon.

The company is pursuing accelerated approval of its gene therapy SRP-9001 for the treatment of patients with DMD and is expected file a BLA (biological license application) this fall, and if all goes well, there’s the prospect of approval by mid-2023.

Standing out from the crowd, Sarepta shares have easily outperformed the broader markets this year and are up 20% year-to-date. Nevertheless, Director Michael Andrew Chambers thinks now is the time to load up. Having bought 46,170 shares for a total value of $5 million last month, on September 14, Chambers added 57,100 shares to his holdings – on which the Director splashed out a total of $5.96 million.

That’s certainly a display of confidence, but not the only one. Oppenheimer analyst Hartaj Singh notes the noises made by some of the top brass regarding SRP-9001’s prospects when the company reported Q2 financials last month.

“Perhaps the single greatest insight gained from the 2Q22 earnings call was the enthusiasm the entire management team demonstrated for the feedback from the FDA regarding SRP-9001,” Singh writes. “While the SRPT CEO has generally been a vocal supporter of SRP-9001’s potential for patients and the DMD community, we feel that strong commentary by the CSO and CFO now seems to match in intensity… In addition, the company reported another quarter of strong sales for its suite of approved exon-skipping agents for various DMD mutations, upgraded sales expectations for FY22, and reviewed various pipeline projects. We stay bullish.”

Based on all of the above, it’s no wonder Singh reiterated his Outperform (i.e., Buy) rating on SRPT shares. With a price tag of $150, the analyst believes shares could surge 38% in the next twelve months. (To watch Singh’s track record, click here)

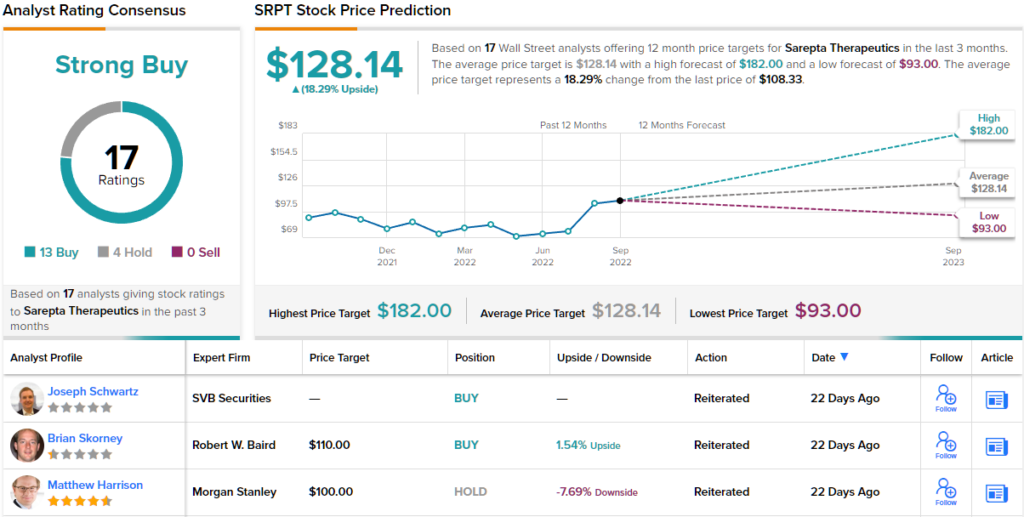

Wall Street, generally, seems upbeat about SRPT’s prospects. The stock has 17 recent analyst reviews, which break down to 13 Buys and 4 Holds, for a Strong Buy consensus rating. The shares are trading for $108.33 and their $128.14 average price target implies a 12-month upside of 18%. (See SRPT stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.