More data is almost always a good thing to have, especially when making high-stakes decisions. But it is possible to have too much data, or at least, to have more than is easily parsed. There are almost 7,600 professional stock analysts working on Wall Street, working for dozens of investment firms and reviewing the performance of nearly ten thousand stocks. The resulting pool of data, while a true treasure trove for investors, is also a challenge.

Fortunately, investors can turn to the Street’s top analysts, to find the stock pros who stand head and shoulders above the rest. These are the analysts who have made the most calls, achieved the best success rates, and brought in the highest returns. In short, they’re the analysts with extensive, proven track records of success.

Scott Berg, covering the markets for Needham, stands in the top ten out of all of Wall Street’s analyst corps – in fact, he is rated #7 overall. This rating is based on his total of 427 stock ratings, with a success rate of 77% and an average return better than 33%.

We’ve used the TipRanks platform to look up the details on two software companies under his coverage for which Berg has high hopes. These are both Strong Buy stocks, with solid upside potential; let’s see what he has to say about them.

Upland Software, Inc. (UPLD)

The first of Berg’s picks that we’re looking at is a company in the business software niche. Upland’s products, a range of 29 cloud software applications, bring capabilities such as document automation and security, project management, contact center admin, and customer experience management to more than 10,000 business customers, and more than 1 million users globally. Even better, the company boasts 94% net renewal rate.

For the first quarter of 2021, Upland reported $73.9 million in top line revenue, up from $68 million in the year-ago quarter, a gain of 9%. Upland, like many other tech companies, runs a net loss each quarter – but the Q1 loss of 69 cents per share was a 14% improvement from the 81-cent loss in 1Q20. Upland saw free cash flow of $12.2 million, a strong increase from the year-ago quarter’s $5.6 million. In the balance sheet, the company ended 1Q21 with $186.7 million in net cash.

At the end of June, Upland announced the acquisition of the cloud software company Panviva, an enterprise knowledge management solution. The acquisition gives Upland a step into a new product for its customers. The acquisition came with a purchase price of $19.8 million in cash (with another $3.5 million in cash to be paid within a year), and Upland expects recurring annual revenue of $7.5 million from Panviva’s business. Upland has a history of expansion through acquisition.

Berg notes the strength of the Panviva move, writing, “Panviva fits into the Enterprise Knowledge Management suite for Upland, making the acquisition consistent with recent management commentary of expanding suites beyond CXM (customer experience management). We believe the heavy acquisition activity for CXM over the last few years leads to a period of expanding functionality in UPLD’s three other product suites. We also like the Panviva acquisition because we expect its revenues can grow faster than Upland’s current corporate average given strong software adoption trends in the Contact Center space.”

A $60 price target, suggesting a 49% 12-month upside, goes along with Berg’s Buy rating on UPLD shares. (To watch Berg’s track record, click here.)

Berg is bullish here, but so is Wall Street generally. This stock has a unanimous Strong Buy consensus rating, based on 4 reviews. The $55.50 average price target implies an upside of 37% for the year ahead. Shares in UPLD are currently selling for $40.47. (See Upland’s stock analysis at TipRanks.)

Thryv Holdings (THRY)

Next up on our list is Thryv, which got its start as an amalgamation of Yellow Page companies, and still has hints of its origin as a deep resource. Nowadays, Thryv is a software company in the SaaS niche, offering a range of services to small businesses – services that are amalgamated into a single platform, accessed through a single login, so that users don’t need to bounce from app to app. Thryv’s products include apps for marketing automation, document storage and sharing, sales and payments, customer service management – the list is nearly as long as the needs of a small business.

With Thryv’s software, small business managers can reach out to customers, manage their accounts, bill for work done, and track and receive payments in a timely fashion. The company’s customers come from a variety of niches, animal services, auto services, health and beauty, insurance, cleaning services, moving and storage, legal services – Thryv has its hands in most business posts, and the company boasts over 350,000 business end-users.

Back in October, Thryv put its stock in the public realm through a direct listing on the NASDAQ. The shares opened at $14, and quickly fell to $11. Since then, the stock has approximately tripled in value, and the company boasts a market cap of $1.1 billion.

This past May, Thryv reported first quarter results for calendar year 2021, with the company generating revenue of $280.61 million. EPS, at $1.07 per share, grew 33% from the year-ago quarter. Both results were better than the consensus estimates.

Scott Berg, in his note on Thryv, points out the value of the company’s combination of legacy brands and new ventures, writing, “What makes Thryv unique among Marketing Software companies, is its legacy Marketing Services business, led by the well-known Yellow Pages brand. We think the legacy business represents a large, cash-generating, low-cost, customer acquisition channel that assures steady demand from established companies seeking more modern marketing solutions.”

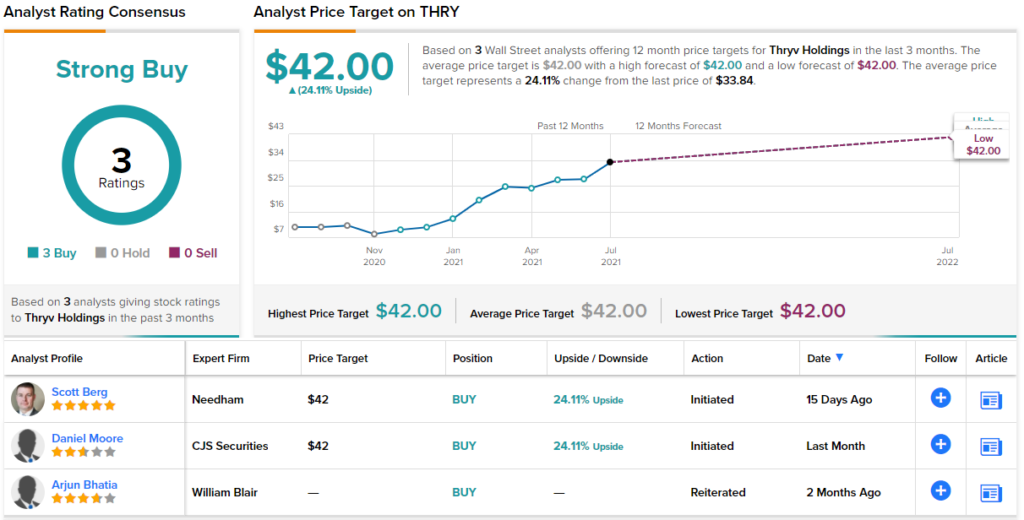

In line with his bullish view, Berg gives THRY a Buy rating along with a $42 price target, implying a 24% one-year upside potential.

It’s clear, from the unanimous Strong Buy consensus rating, based on 3 reviews, that Wall Street agrees with Berg on the quality of THRY shares. The stock’s $42 average target is the same as Berg’s. (See Thryv’s stock analysis at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.