Despite their long-term tailwinds in the cloud, Microsoft (NASDAQ:MSFT) and Salesforce (NYSE:CRM) have felt the heavy impact of macro headwinds. As a recession becomes increasingly likely for 2023, it’s hard to tell where the bottom will be for the two blue-chip behemoths. Regardless, Microsoft and Salesforce are two very high-quality firms that Wall Street analysts expect upside from, even though high-growth plays may continue to go out of favor amid climbing interest rates through 2023.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

I also see numerous scenarios where MSFT and CRM escape 2023 with gains. Let’s see how the two “Strong Buy” software stocks stack up as they dive head-first into a potential recession.

Microsoft (NASDAQ:MSFT)

Microsoft is now down around 35% from its all-time high hit just over a year ago. Believe it or not, Microsoft stock has held up better than the broader basket of FAANG names, some of which shed more than 70% of their value from peak to trough. Still, a 35% plunge is quite a hit to the chin, especially for such a well-run tech giant that has one of the best managers out there.

Even the brilliant CEO Satya Nadella couldn’t steer Microsoft clear of industry headwinds.

Microsoft’s cloud business Azure has been incredibly robust over the years, but a recent downgrade from UBS put it in the spotlight. Indeed, a 2023 recession could cause Azure growth to sink further. Regardless, don’t expect Microsoft to take its foot off the brakes regarding forward-looking initiatives that could complement Azure at some point down the road.

Eventually, Azure will find its feet once macroeconomic headwinds fade. In the meantime, Microsoft is focusing on initiatives it can control. Beyond the cloud, it has been investing considerable sums in gaming and AI.

Microsoft continues to fight for the right to acquire game developer Activision Blizzard (NASDAQ:ATVI). The FTC seeks to block the deal, and though the move reduces the odds of a successful takeover by some amount, I still think a deal is very much plausible if the firm can prove its case in court.

If it goes through, Microsoft will be an even more powerful force in gaming. As the metaverse comes to fruition over the next decade, Microsoft may be one of the frontrunners, thanks to the dominance of its gaming division.

Whether or not Microsoft plays a role in metaverse hardware, it’s clear that few firms can stack up against the firm on the software front.

With OpenAI making noise amid its latest iteration of ChatGPT, Microsoft’s $1 billion investment in the firm has proved wise. With a foot in the door of next-generation AI, it’s clear that Microsoft is looking well ahead of a potential recession to tech trends that could lead it to grow for years after Azure runs out of gas.

What is the Price Target for MSFT Stock?

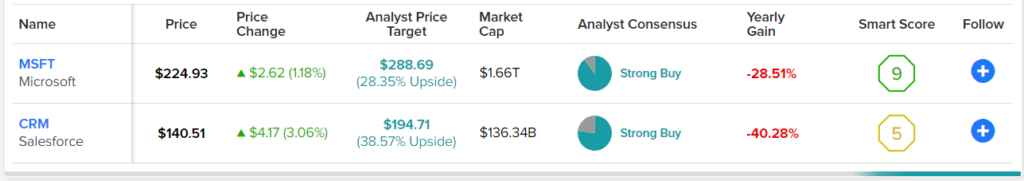

Microsoft has lots of support from Wall Street, with 25 Buys and three Hold ratings. The average MSFT stock price target of $288.69 suggests 28.35% upside from these levels.

Salesforce (NYSE:CRM)

Looking ahead, Salesforce will trim its workforce and re-adjust its capital structures to minimize impediments to innovation and productivity. The latest decision to cut 10% of its workforce came as a shocker to many. The news caused a modest rally in CRM stock. Still, not everyone was bullish.

The CRM stock rally reportedly surprised Big Short’s Michael Burry, who expected a violent plunge after such news. Undoubtedly, Salesforce is in a tough spot, with CEO Marc Benioff on his own again as the sole CEO.

The latest round of job cuts will help Salesforce hit a target of trimming costs by $3 billion to $5 billion. Such cuts could enhance margins but come at the expense of sales growth over the medium term.

Salesforce faces huge unknowns in 2023, but at a 4.5 times price/sales ratio, it’s one of the cheapest cloud software plays in the market. The stakes are high as the company looks to sail through an economic hurricane.

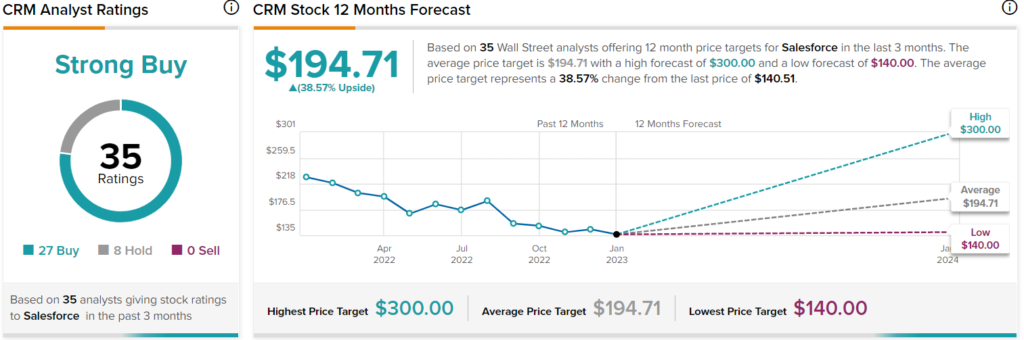

What is the Price Target for CRM Stock?

Wall Street loves Salesforce, with the average CRM stock price target of $194.71 implying 38.6% upside potential.

The Takeaway

Growth may not be in high demand as the Fed tightens further. However, I think both firms will be among the first to recover once any sort of dovish “pivot” is announced. It’s hard to be more hawkish than the Fed is right now after recently insisting on “more evidence” of falling inflation before pulling the brakes on rate hikes.

In any case, MSFT and CRM shares are terrific longer-term bets for investors willing to embrace further volatility en route to normalizing inflation and peak interest rates.