Investors know that the key to profits is in the return – and that means, a willingness to shoulder risk. Risk is relative, of course, and tends to run hand-in-hand with the return potential. Find a stock with a giant return potential, and chances are, you’ve also found one with a higher risk profile.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The highest returns usually come along with the lowest share prices. After all, when a stock is priced for just pennies, even a small gain in share price translates into a huge return. Which means that penny stocks – usually seen as those equities priced under $5 – combine a perfect storm of market attractions: low share price, high return potential, and higher than usual risk.

How much are the potential rewards magnified? Well, some of the penny stock trading today have potential to triple or quadruple over the coming year – or even more. However, given the nature of these investments, Wall Street analysts recommend doing some due diligence before pulling the trigger, noting that not all penny stocks are bound for greatness.

With this in mind, we set out our own search for compelling investments that are set to boom. Using TipRanks’ database, we pulled two penny stocks that have amassed enough analyst support to earn a “Strong Buy” consensus rating. Adding to the good news, each pick boasts over 300% upside potential.

Checkpoint Therapeutics (CKPT)

The first stock we’ll look at is Checkpoint Therapeutics, a small-cap biopharma company with a focus on cancer treatments. Checkpoint has an active research pipeline featuring two leading drug candidates, cosibelimab and olafertinib, both of which are in late-stage clinical trials.

Of the two, cosibelimab is farther advanced, with three Phase 3 trials ongoing. In recent months, Checkpoint has released two important updates on cosibelimab’s progress in its trials. In the first, from this past December, the company initiated a Phase 3 trial (CONTERNO) of the drug candidate as a combination therapy with pemetrexed and platinum chemotherapy. The trial is evaluating the combo as a first-line treatment for patients with non-squamous non-small cell lung cancer (NSCLC), and will enroll up to 560 subjects. Endpoints for the study include overall survival, and progression-free survival, objective response rate, and safety.

The second announcement on cosibelimab, made in late January, was in regard to positive topline results from the recently completed registration-enabling clinical trial in squamous cell carcinoma. The study evaluated safety and efficacy of cosibelimab dosed at 800 mg every two weeks, with patients diagnosed with metastatic cutaneous squamous cell carcinoma (cSCC). The company reported meeting the primary endpoint objective response rate, as well as meeting safety and tolerability goals. Checkpoint expects to submit the Biologics Licensing Application for cosibelimab in this indication before the end of 2022.

At $1.65, several members of the Street believe that CKPT’s share price presents investors with a unique buying opportunity.

Covering Checkpoint for Ladenburg, analyst Matthew Kaplan sees significant value in cosibelimab, noting that the drug candidate is well positioned to be best in class.

“We are encouraged with the topline pivotal efficacy results and believe they favorably compare with both of the prior approved products… with a differentiated safety to support a potential best-in-class aPD-1/L1 profile of Cosibelimab in CSCC… Combining the emerging compelling efficacy and safety profile of Cosibelimab with highly competitive pricing once approved, we see strong potential for Cosibelimab to grab significant market share in the $1B+ CSCC and later $10B+ NSCLC market despite being later market. On the other hand, we see low likelihood for established big biopharma to match such competitive pricing which could impair their large overall sales significantly across indications. We see capturing only a small fraction of the growing aPD1/aPD-L1 markets translating into significant potential upside for CKPT,” Kaplan opined.

To this end, Kaplan rates this CKPT a Buy, and he backs it with an astounding price target. At $26, his target suggests a whopping 1,456% upside potential for the next 12 months. (To watch Kaplan’s track record, click here)

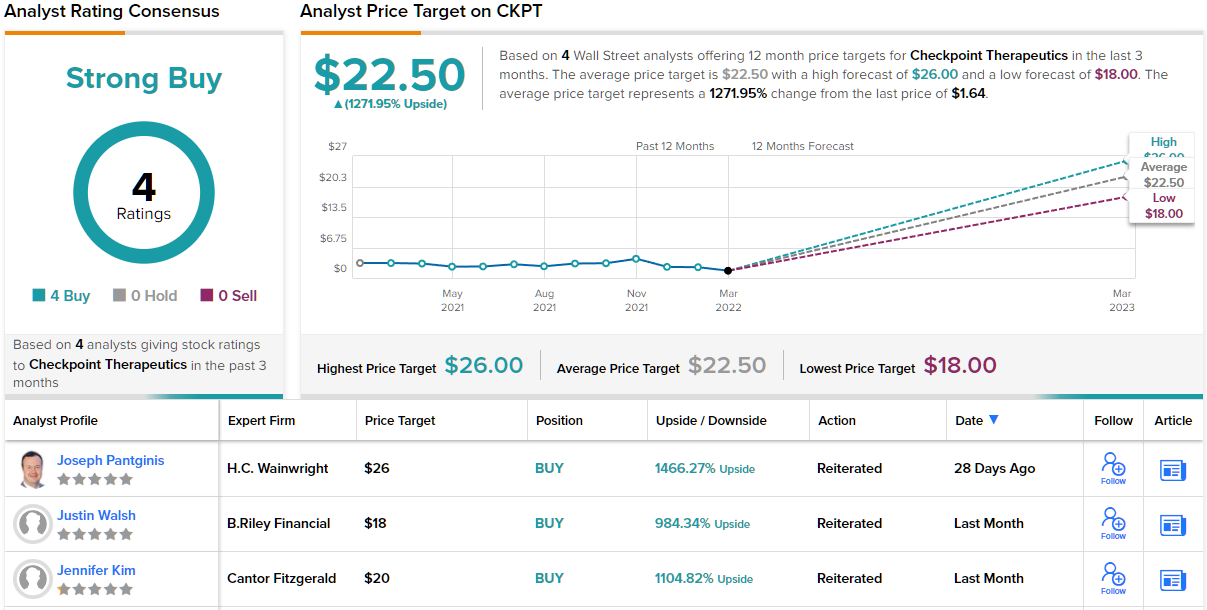

Kaplan is hardly the only bull on Checkpoint. The stock has 4 recent analyst reviews, and they all agree that it’s a Buy proposition – giving the shares a unanimous Strong Buy consensus rating. The average price target of $22.50 implies it has room for stratospheric growth, on the order of ~1,270%. (See CKPT stock forecast on TipRanks)

CorMedix (CRMD)

Next up is CorMedix, another biopharmaceutical research firm – but one taking a step into a unique niche with high potential. CorMedix is working on new drug candidates for the treatment and prevention of infectious and inflammatory diseases; this is a common approach for biopharmas, but CorMedix differentiates itself by focusing on these diseases as associated with central venous catheters in patients undergoing regular hemodialysis. This is a serious matter. Hemodialysis is a life-or-death treatment, but a permanent catheter provides an easy vector for bacterial and fungal infections – and patients with kidney problems requiring dialysis already have immunological problems. As can be seen, catheter safety creates a large addressable market for an unmet medical need.

CorMedix currently has one leading drug candidate, DefenCath, which has completed its Phase 3 clinical trials and in currently in the New Drug Application (NDA) regulatory stage. DefenCath, or taurolidine, is a synthetic broad-spectrum antimicrobial and antifungal agent, and also shows anti-inflammatory properties. The drug is under development as a preventative treatment for catheter-associated infections, especially in patients with end-stage kidney disease.

The last clinical trial, the Phase 3 LOCK-IT-100, met its primary and secondary endpoints, and showed clinically significant results in treating and preventing infection. DefenCath has been given the FDA’s Fast Track designation, as well as the Qualified Infection Disease Product designation. In early 2021, CorMedix received a Complete Response Letter (CRL) from the FDA on the DefenCath NDA, and in February of this year the company announced that it has completed the NDA resubmission to address the concerns the FDA’s letter.

In coverage for Needham, analyst Serge Belanger notes the regulatory update as a key catalyst, writing, “The timing of the DefenCath NDA resubmission is a nice surprise for CRMD and in-line with our base assumption of a 1H22 NDA resubmission and potential FDA approval in 2H22… We view the resubmission as the first step to removing the regulatory overhang that has suppressed CRMD’s valuation and reigniting investor interest in the DefenCath story.” Belanger goes on to point out the large size of DefenCath’s addressable market: “There are an estimated 600,000 ESRD patients undergoing hemodialysis in the U.S. The vast majority of these patients (~80%) will require a CVC [central venous catheter] during their course of treatment… We currently forecast Defencath peak U.S. sales in the $400MM-$500MM-rangeby 2029/2030.”

In line with these comments, Belanger rates CRMD a Buy, and his $20 price target implies room for a strong 375% upside potential in the year ahead. (To watch Belanger’s track record, click here.)

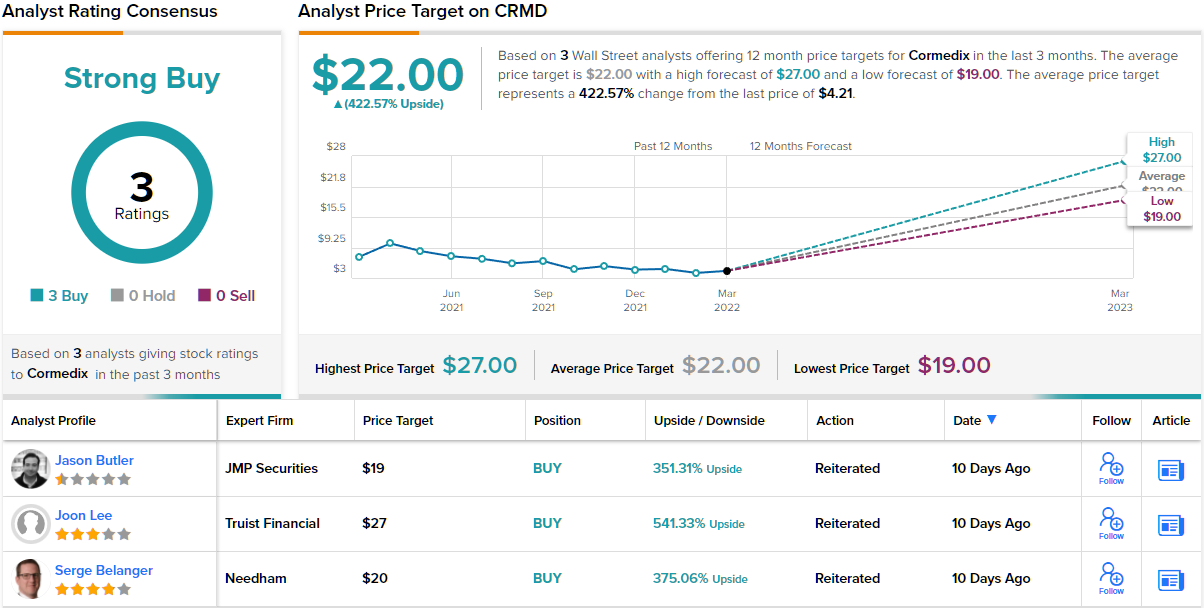

Belanger is not the only analyst to see a solid upside here; all three of this stock’s recent reviews are positive, for a Strong Buy consensus rating. The shares are priced at $4.37 and the $22 average target suggests an upside of ~420% from that level. (See CRMD stock forecast on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.