Everything in the stock market revolves around risk and reward. It’s a fair equation – the higher the risk, the bigger the reward. And for those with the stomach for such shenanigans, penny stocks – traditionally, tickers trading for less than $5 a piece – are the go-to segment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Given the capacity for huge returns, the inverse also holds true: these are risky bets, and the intrepid investor must tread carefully – as much as these names can gain in a short span of time, the losses can pile up just as fast.

So, due diligence is required in seeking out the penny stocks with the most potential and it certainly helps when Wall Street’s stock experts agree on the names that are worth the time of day.

With this in mind, we pulled out of the TipRanks database two penny stocks that get the thumbs up from the pros – the analyst consensus rates both as Strong Buys. And about those gains? There’s much of that in store – these have the potential to soar by over 300%, according to the analysts. So, let’s see why they are poised to do just that.

IO Biotech (IOBT)

The first penny stock we’re looking at is IO Biotech, a biopharmaceutical firm focusing on developing groundbreaking cancer vaccines using its T-win vaccine platform. The company touts the platform as representing an innovative strategy for cancer vaccines by stimulating T cells to specifically attack the most crucial immunosuppressive cells within the tumor microenvironment.

At the forefront of its drug development, the company is advancing clinical studies of lead cancer vaccine candidate, IO102-IO103, currently being assessed in several programs.

The most recent update caused a bit of a stir. Shares tanked by 25% in a single session yesterday after IO said it has now randomized 225 patients into the global Phase 3 study for IO102-IO103 in 1L advanced melanoma. The issues, though, lay elsewhere as the company also said it is expanding the study size from 300 patients to 380 patients. This could potentially speed up the time to get to the primary endpoint of progression-free survival.

However, H.C. Wainwright analyst Emily Bodnar thinks the sharp share price drop is down to investors now assuming IO won’t meet the primary endpoint based on the initial 300 patients, and that the company is increasing enrollment for a better chance at hitting the target. But following conversations with management, Bodnar believes the sell-off is unmerited.

“We spoke with the company following the update, and the company noted that it remains blinded to the data and the decision to increase the patient size was solely based on the quicker-than-expected enrollment in the Phase 3 trial. The company expects all the timelines to remain the same and that the additional patient number does not change the timeline for interim data or BLA submission, and it should not take longer to complete the study overall,” Bodnar noted.

“We believe the stock reaction is overdone, as the company has not seen the data, and that the milestone timelines have not changed. We note that the stock is trading below cash value, meaning essentially no value is being ascribed to IO102-IO103, which is a Phase 3 asset. We see significant upside potential on interim data as 1L advanced melanoma is a blockbuster opportunity and view risk/reward as highly favorable,” the analyst summed up.

Significant upside potential, indeed. Considering her $11 price target, Bodnar sees shares surging by a remarkable 562% over the coming year. No need to add, Bodner rates the shares as a Buy. (To watch Bodnar’s track record, click here)

It’s not as if Bodner is alone in having such high hopes. 3 other analysts have recently waded in with IOBT reviews and all are positive, making the consensus view here a Strong Buy. Moreover, with shares currently priced at $1.66, the $11.33 average target suggests the stock will deliver returns of 582% in the months ahead. (See IOBT stock forecast)

Nkarta (NKTX)

We won’t veer too far afield for our next penny stock. Nkarta is a clinical-stage biotech working on allogeneic, “off-the-shelf” natural killer (NK) cell therapies. By integrating the company’s cell expansion and cryopreservation platform with patented cell engineering techniques and CRISPR-based genome engineering abilities, the company is advancing a portfolio of cell therapies designed to exhibit potent anti-tumor effects, with the aim of making them widely accessible in outpatient treatment settings.

The latest update from the pipeline involved recent presentation of preliminary data from the Phase 1 dose escalation clinical study of NKX019 in patients with relapsed/refractory non-Hodgkin lymphoma (NHL). The data showed that 70% of patients (7 out of 10) attained complete response following treatment with the NKX019 monotherapy. The company intends on presenting more data in 2H23 from the ongoing Phase 1 trial.

Still to come this quarter is an anticipated readout of additional data from the phase 1 study assessing NKX101 (a NKG2D-targeting CAR-NK) as a multi-dose/multi-cycle monotherapy in relapsed/refractory AML patients.

NKTX shares have been on the backfoot for the past year and entirely excluded from 2023’s rally. That said, Stifel analyst Stephen Willey thinks the lackluster performance presents an opportunity for investors.

“We continue to believe the current sub-cash valuation – seemingly a byproduct of recent challenges experienced by both direct (and non-applicable to NKTX) CAR-NK competitors and, more broadly, sponsors of next-generation iterations of cell therapy – creates a favorable risk/reward profile into a 2Q23 single-agent NKX101 data update which is now anticipated to include incremental clinical data from >10 relapsed/refractory AML patients. We expect incremental 2H23 single-agent NKX019 data in CAR-T-naïve/experienced patients and the first NXK019/rituximab data to improve visibility into a potential longer-term development path forward,” Willey opined.

“We believe NKTX represents an attractive ‘ground-floor’ investment in an emerging therapeutic category,” the analyst summed up.

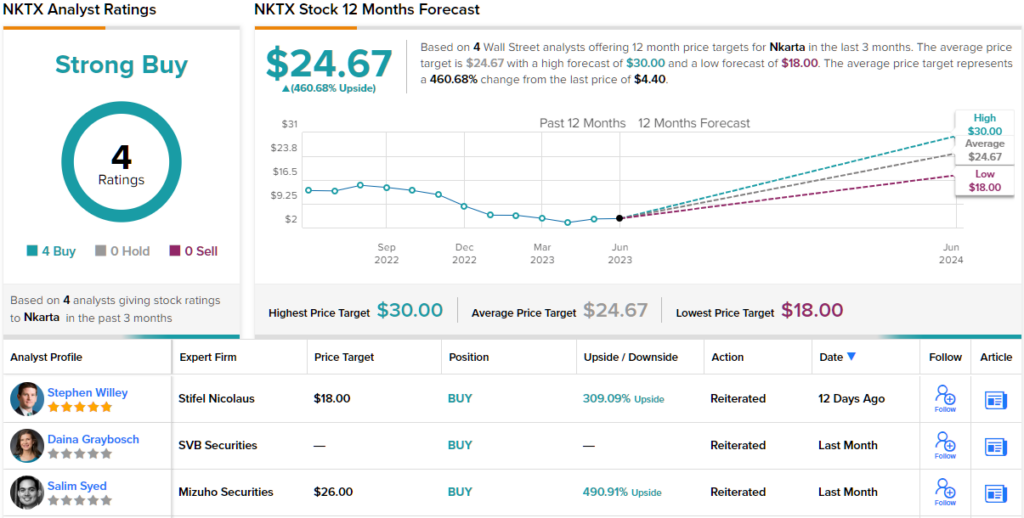

To this end, Willey rates NXTX a Buy to go alongside an $18 price target. Should the figure be met, investors will be pocketing gains of a handsome 308% a year from now. (To watch Willey’s track record, click here)

Overall, NXTX’s Strong Buy consensus rating is based on Buys only – 4, in total. The average target is even higher than Willey will allow; at $24.67, the figure represents 12-month upside of 460% from the current $4.40 share price. (See NKTX stock forecast)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Penny Stock Screener.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.