Are penny stocks a must-have or a must-avoid? Well, that depends on who you ask. There’s no middle ground when it comes to these tickers trading for less than $5 per share; those on the Street are either fans or harsh critics.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Both sides make sense. The naysayers argue that the bargain price is just too good to be true, with it potentially indicating there are problems hiding beneath the surface like weak fundamentals or overwhelming headwinds.

However, the investors that are pro-penny stocks just can’t get enough of them. Not only do the low prices mean that you get more bang for your buck, but also even minor share price appreciation can translate to huge percentage gains, and thus, major returns.

While incredibly enticing, the risk is clear. So, you have to do your homework. Using TipRanks’ database, we pinpointed two compelling penny stocks, as determined by Wall Street pros. Each has earned a “Strong Buy” consensus rating from the analyst community and could climb all the way to $10, or even more. We’re talking about triple-digit upside potential here.

Vor Biopharma (VOR)

We’ll start with Vor Biopharma, a medical research company working at the pre-clinical and early clinical stages in the development of new treatments for blood cancers. Vor “aims to change the standard of care” for patients suffering from these difficult-to-treat conditions, through the use of hematopoietic stem cells, genome engineering, and CAR-T cells.

The company currently has a diversified project pipeline, featuring potential treatments for acute myeloid leukemia (AML), myelodysplastic syndrome (MDS), and myeloproliferative neoplasm (MPN). The company’s approach to treating these dangerous cancers is to make hematopoietic stem cells, the precursors of many types of blood cells, resistant to cancer therapies, so that they can pass that resistance on to healthy blood cells while cancer cells can be destroyed. The result, hopefully, will allow the patient to better tolerate existing cancer therapies.

This approach has shown promise in the treatment of AML, particularly in post-transplant patients, and has curative potential. This is potentially game-changing for AML patients, as the disease has a poor prognosis under current treatment regimes.

The two leading programs in Vor’s pipeline both target AML. The drug candidate VCAR33 (ALLO), which uses allogenic healthy donor-derived cells, is the subject of VBP301, a Phase 1/2 clinical trial with initial data expected in the second half of 2024. Also in an active Phase 1/2 clinical trial is VCAR33 (AUTO), which is designed as an autologous monotherapy bridge-to-transplant for relapsed and/or refractory AML patients.

Currently priced at $2.05 per share, Vor’s stock has garnered attention from several members of the Street, who view the current valuation as an opportune entry point. Among them, Wedbush’s 5-star analyst David Nierengarten underscores the allure of VOR shares, particularly driven by the promising prospects of the VBP301 trial.

“We expect positive results in VBP301 later this year given the recent results from VCAR33AUTO, an autologous CD33 CAR T-cell therapy for children and young adults with r/r AML. In that investigator sponsored study, 2/19 patients achieved a CR with incomplete count recovery and two patients successfully bridged to an alloHSCT. Importantly, we believe VCAR33ALLO should improve outcomes compared to VCAR33AUTO by eliminating infusion delays and production failures associated with patients’ lymphopenia. Additionally, allo-derived cells are healthier than patient derived cells, which may translate to improved efficacy,” Nierengarten opined.

Turning this stance into a firm recommendation, Nierengarten puts an Outperform (i.e. Buy) rating on Vor shares, with an $11 price target that implies an enormous 437% potential gain for the stock in the next 12 months. (To watch Nierengarten’s track record, click here)

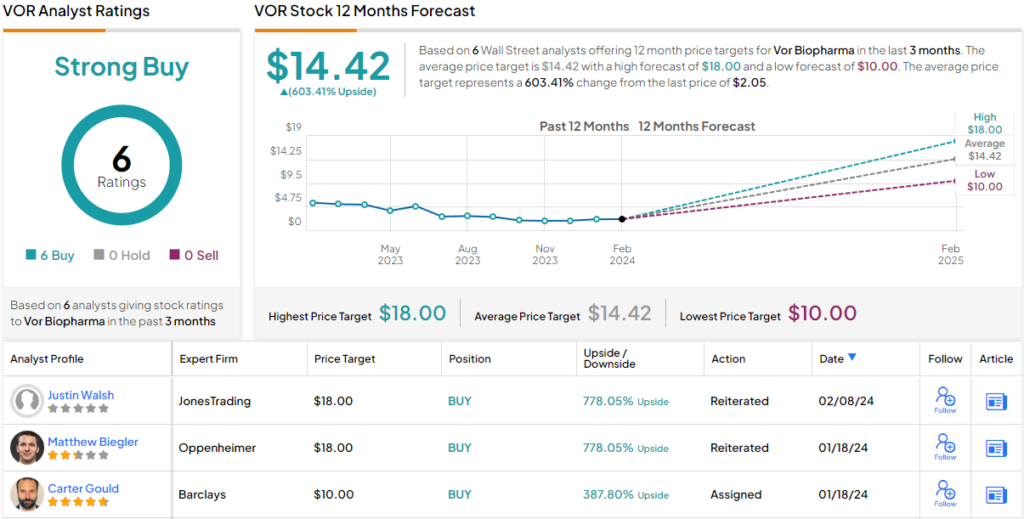

Turning now to the rest of the Street, other analysts echo Nierengarten’s sentiment. As only Buy recommendations have been published in the last three months, VOR earns a Strong Buy analyst consensus. With the average price target clocking in at $14.42, shares could soar 603% from current levels. (See VOR stock forecast)

Athira Pharma (ATHA)

The second penny stock we’ll look at is another cutting-edge biopharmaceutical firm. Athira Pharma is developing a line of novel small molecule compounds designed to target neuronal health. That is, the company is focused on the creation of therapeutic agents to treat a broad range of neurological diseases, by reducing inflammation, slowing neurodegenerations, and providing neuroprotection.

Athira’s small molecule therapeutic tracks have shown high potential in the clinic and offer the chance of substantially modifying the disease course for several high-profile conditions. Targeted neurological conditions include Alzheimer’s, Parkinson’s disease dementia, and dementia with Lewy bodies. The company has several late-stage clinical trials underway in the treatment of these diseases, featuring the lead product candidate ATH-107, also known as fosgonimeton or fosgo. This candidate operates through enhancement of the naturally occurring HGF/MET neurotrophic system, to promote neuronal health.

Fosgo’s therapeutic effect enhances the activities of hepatocyte growth factor (HGF) and its receptor, MET. These are a naturally occurring repair mechanism for a healthy nervous system, giving the drug candidate both reparative and protective effects on neuronal networks. The company currently has the Phase 2/3 LIFT-AD clinical trial of the drug underway – enrollment was completed in January – for the treatment of mild to moderate Alzheimer’s. Topline data is expected for release in 2H24.

Also of note, the company recently released data from the Phase 2 SHAPE clinical trial of fosgo in the treatment of Parkinson’s disease dementia and dementia with Lewy bodies. The trial showed clinically significant improvement in cognitive measures, and the SHAPE trial met its primary endpoint.

This drug candidate has caught the eye of sector expert Thomas Shrader, from BTIG. The analyst says of Athira’s leading product, “The core investment thesis for Fosgo in treating AD is that HGF/MET modulation will drive the repair and re-connection of impaired nerves, making it an ideal second drug following the removal of Aβ protein aggregates. In addition, one of the underappreciated aspects of Fosgo is that it may be effective in the mild-to-moderate AD population based on positive subsets in earlier trials. Efficacy in this later population is unlike Lecanemab and Donanemab which have meaningful benefits only in MCI and early AD patients. This benefit in later patients, if replicated, will also make Fosgo an important treatment for the millions of patients too advanced to benefit from plaque removal. Altogether, these considerations highlight the opportunity for Fosgo as a monotherapy.”

To this end, Shrader rates ATHA shares a Buy, and his $10 price target points toward an upside of 200% by the end of this year. (To watch Shrader’s track record, click here)

Overall, there are 4 recent analyst reviews of this stock and their 3 to 1 breakdown favoring Buy over Hold gives ATHA its Strong Buy consensus rating. The stock is selling for $3.34 and the $11.33 average price target suggests a one-year potential gain of 239%, even more bullish than the BTIG view. (See ATHA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.