Since coming on the scene, cryptocurrencies have fired the imaginations of online traders, currency speculators, and mathematicians alike. The leading digital currency, bitcoin, is currently priced at approximately $26,550 per coin, representing a ~60% increase year-to-date. And it looks like bitcoin will see a strong upward pressure on that price over the next year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The bitcoin algorithm has a built-in halving mechanism, whereby the reward given to miners for solving a blockchain link is cut in half. The process takes place about every four years, and is next expected in May of 2024. The bitcoin halving has happened regularly since 2012, and has historically had a positive effect on the digital currency’s price, as well as on the share prices of bitcoin-related stocks.

That last gives investors a chance to get in early. The predictability and regularity of the bitcoin halving makes now the right time to start looking into bitcoin stocks, to find an attractive point of entry well before this catalyst takes place. Wall Street’s analysts can help with this; they’ve been pointing out solid choices among the bitcoin mining companies, anticipating a rise in price.

A quick look at the TipRanks data shows that their latest picks have several common attributes that should bring in investors. We’ll look at two bitcoin mining stocks, each currently priced under $5 per share, and boasting a ‘Strong Buy’ consensus rating. Additionally, some are projecting triple-digit upside potential for the coming year. Here are the details.

Bitfarms (BITF)

We’ll start with Bitfarms, a bitcoin mining company headquartered in Toronto, Ontario, and operating with 11 bitcoin mining facilities – farms, as the company calls them – located in 4 countries. The company has approximately 56,200 mining rigs deployed. Bitfarms can boast a hashrate of 5.6 EH/s, and generates an average of 12.4 bitcoins per day.

Bitcoin mining won’t happen without power, and bitcoin miners also operate the large-scale power generation facilities needed to support their data center operations. Bitfarms has 240 megawatts of power generation planned, and this past August the company announced the start of a 50 megawatt deployment plan, located in Paraguay, for the generation of hydroelectric power. The plan is the first phase from a set of contracts totaling 150 megawatts in hydropower development. The current phase is located near Bitfarms’ existing Paraguay facility, and is expected to go online in 1Q24.

In addition, Bitfarms is expanding its Argentina operations. The company added 3,150 modern mining rigs to its Rio Cuarto facility, and has planned deliveries for another 1,068 rigs, scheduled for installation this month.

Bitfarms’ activity to expand its power generation and farming network is bringing results. The company’s 2Q23 financial report showed that the company mined 1,223 bitcoins during the quarter, and its hashrate, as of June 30, was up 10% from Q1 and stood at 5.3 EH/s. That hashrate alone shows one measure of the company’s expansion – two months later, in August, the hashrate was up to 5.6 EH/s. The company has targeted a 7.0 EH/s hashrate for the first quarter of next year.

In a recent update for August’s production numbers, Bitfarms reported mining 383 bitcoins during the month. This was up from 378 mined in July, although it was down from 534 bitcoins generated in August of last year. The 383 figure was in-line with Bitfarms’ monthly production during the first 8 months of this year – and the year-to-date total of 3,281 bitcoins is higher than the equivalent figure, 3,252, from last year. Of the bitcoins mined in August, Bitfarms sold off 323, generating $9 million in total proceeds. The remaining 60 bitcoins were added to the company’s treasury, increasing its holding to 654 bitcoins. Bitfarms valued this holding at $17.8 million, based on the August 31 price.

According to Cantor Fitzgerald analyst Josh Siegler, Bitfarms has plenty of strength as it heads into next year, which investors might be overlooking right now. He writes, “We continue to believe the Bitfarms story may be under-appreciated by investors. The company has demonstrated substantial progress in establishing a clear line-of-sight for near-term growth and improving its cash expenses, in our view. With a strong balance sheet and higher visibility to energizing Argentina, we believe BITF may be unfairly receiving a discount on its valuation relative to peers. If Bitfarms achieves its near-term hash target … while demonstrating improved free cash flow and unit economics, we believe there may be significant upside to the stock price.”

Significant upside, indeed. Along with an Overweight (Buy) rating on the shares, Seigler’s $3 price target implies a robust upside potential of 168% for the next 12 months. (To watch Siegler’s track record, click here.)

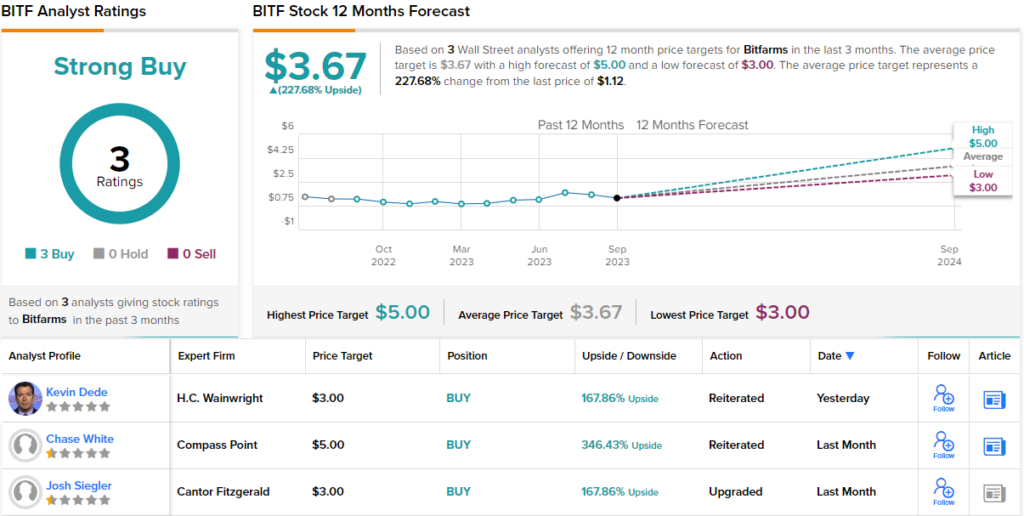

The Street would appear to be in agreement, as all 3 of the recent analyst reviews are positive, for a unanimous Strong Buy consensus rating. The shares are currently priced at $1.12, and the average price target of $3.67 is even more bullish than Siegler’s, indicating potential for a 228% gain over the coming year. (See Bitfarms’ stock forecast.)

Cipher Mining (CIFR)

Next up is Cipher Mining, another growing concern in the bitcoin mining industry. Cipher is a US-based firm currently in the process of building out its primary mining facility, in Odessa, Texas, which came online in November of last year. The facility is scheduled to reach completion before the end of this quarter, which will bring Cipher’s total bitcoin mining hashrate to 7.2 EH/s. The company reported a total hashrate of 6.8 EH/s as of the end of 2Q23.

Cipher has two additional mining facilities, both wind-powered, located in Alborz, Texas and Bear and Chief, Texas. These sites can operate at 40 and 20 megawatts respectively. Among its three active sites, the company has 68,000 miners deployed, and at the end of August this year had a potential capacity to mine as many as 16.1 bitcoins per day.

In the firm’s most recent production update, for August of this year, Cipher reported mining a total of 357 bitcoins. This was down 15% month-over-month, and after sales of 355 bitcoin, the company had an account balance of 519 bitcoin available. At an estimated price of $27,000 per bitcoin, this holding is worth over $14 million. Cipher management reports that the company is on track to meet its current expansion and production goals.

While Cipher’s core business is bitcoin mining, the company is also building out its power generation capacity – and that has caught the attention of BTIG analyst Gregory Lewis. He sees the company’s potential as a net-seller of electricity as a clear benefit, complementing the firm’s success at entering low-cost power contracts, and writes, “The company has a very low-cost fixed-price power purchase agreement at ~$0.027/kWh (expires 2027) with the ability to opportunistically sell electricity back to the grid. Cipher has one of the lowest cost structures in the BTC mining industry creating attractive unit economics allowing the business to operate through the cycle. In the near term, Cipher’s core business should remain BTC mining, but longer term we see the opportunity to become a more integrated player in the energy-generation space.”

Taking this forward, Lewis puts a Buy rating on CIFR, and his $6 price target points toward a potential one-year gain of 124% for the stock. (To watch Lewis’ track record, click here.)

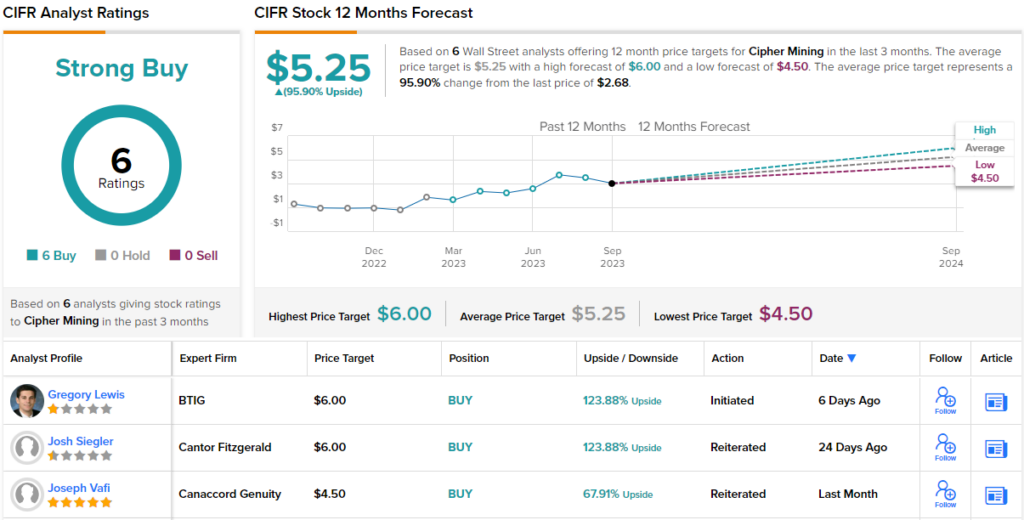

The analyst consensus view on Cipher is unanimous, a Strong Buy based on 6 positive ratings set over the past 3 months. The stock has a $5.25 average price target, suggesting a 96% increase from the current share price of $2.68. (See Cipher’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.