Semiconductor exchange-traded funds (ETFs) present a transparent and affordable approach to capturing the growth potential of leading companies within this sector. Today, we have leveraged the TipRanks ETF Screener to scan for two semiconductor ETFs with more than 10% upside potential: SPDR S&P Semiconductor ETF (XSD) and Columbia Seligman Semiconductor and Technology ETF (SEMI).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s explore what Wall Street thinks about these two ETFs.

SPDR S&P Semiconductor ETF (XSD)

The SPDR S&P Semiconductor ETF is an equal-weighted fund and tracks the S&P Semiconductor Select Industry Index. XSD has $1.38 billion in assets under management (AUM), with the top 10 holdings contributing 30.16% of the portfolio. Meanwhile, the expense ratio of 0.35% is encouraging.

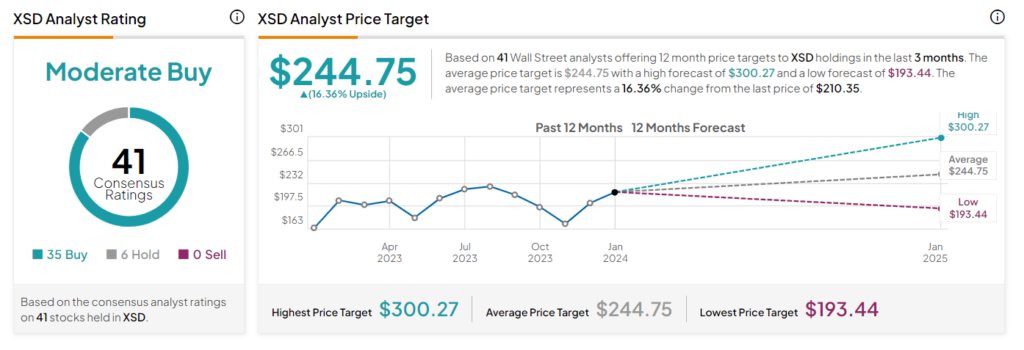

On TipRanks, XSD has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 41 stocks held, 35 have Buys, and six have a Hold rating. The average XSD ETF price forecast of $244.75 implies a 16.4% upside potential from the current levels. The XSD ETF has gained 12.9% in the past year.

Columbia Seligman Semiconductor and Technology ETF (SEMI)

The Columbia Seligman Semiconductor and Technology ETF targets long-term capital appreciation. SEMI is an actively managed, semi-transparent ETF that invests in the shares of semiconductor, semiconductor equipment, and related technology companies. SEMI has $29.36 million in AUM, with its top 10 holdings contributing 48.44% of the portfolio. Notably, its expense ratio stands at 0.75%.

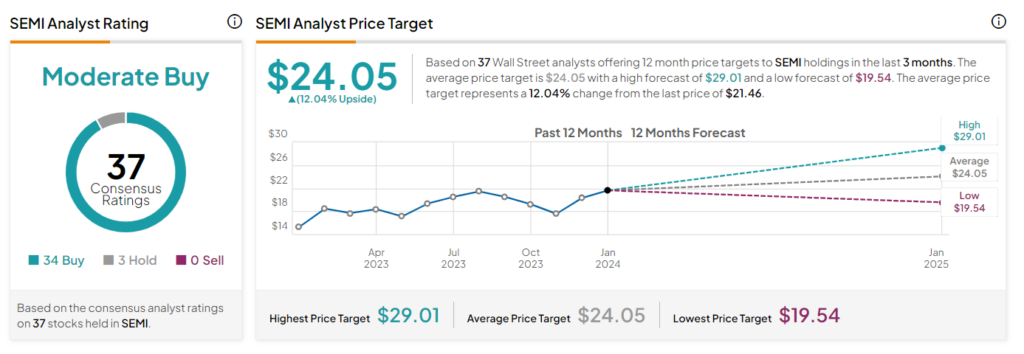

On TipRanks, SEMI has a Moderate Buy consensus rating. Of the 37 stocks held, 34 have Buys, and three have a Hold rating. The average SEMI ETF price target of $24.05 implies a 12% upside potential from the current levels. The ETF has gained 26.6% in the past year.

Ending Thoughts

Investing in sector-focused ETFs helps provide diversification and potential growth opportunities. Given the solid upside potential, XSD and SEMI ETFs may seem attractive to investors.