Real estate mutual funds are managed funds that invest in REITs, real estate stocks, and indices. Investors looking to diversify their portfolios could consider real estate funds as they reduce transaction costs. Today, we have focused on two such funds, CSEIX and REINX, with over 10% upside potential projected by analysts in the next twelve months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a closer look at the two funds.

Cohen & Steers Real Estate Securities Fund, Inc. Class A (CSEIX)

The CSEIX mutual fund provides exposure to the real estate market through a diversified portfolio of securities such as real estate investment trusts (REITs) and other real estate-related companies. As a Class A fund, the fund may potentially have lower fees and expenses compared to other share classes of the same fund.

On TipRanks, the CSEIX has a Smart Score of eight, meaning it has the potential to outperform market expectations. As of today’s date, CSEIX has 45 holdings with total assets of over $6.5 billion. Interestingly, CSEIX has generated a return of 9.9% over the past three months.

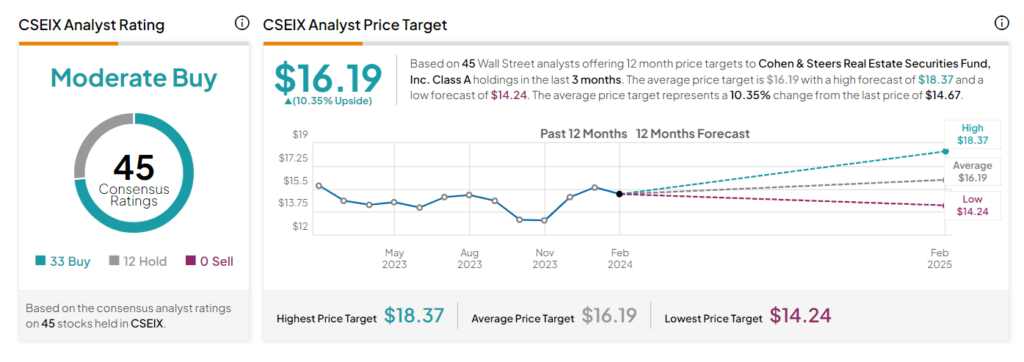

Overall, CSEIX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 45 stocks held, 33 have Buys and 12 have a Hold rating. The average CSEIX price target of $16.19 implies a 10.35% upside potential from the current levels.

Invesco Real Estate Fund Investor Class (REINX)

The Invesco Real Estate Fund Investor Class mutual fund aims to provide long-term capital appreciation. This fund invests in the securities of real estate companies, including REITs. Furthermore, it may also invest in debt securities, such as corporate debt obligations and commercial mortgage-backed securities, and non-investment-grade debt securities of real estate issuers.

The REINX also has a Smart Score of eight, which indicates it has the potential to beat the market average. As of today’s date, REINX has 33 holdings with total assets of $1.19 billion. REINX has returned about 7% over the past three months.

On TipRanks, REINX has a Moderate Buy consensus rating. This is based on 28 stocks with a Buy rating and five stocks with a Hold rating. The average REINX mutual fund price target of $17.94 implies 12.15% upside potential from the current levels.

Ending Note

Mutual funds, unlike individual stocks, offer diversification across multiple companies and thus lower risk. They also require a smaller initial investment and can be bought or sold quickly. However, it would be prudent to research different funds carefully before investing.