Investing in exchange-traded funds (ETFs) offers exposure to various asset classes, sectors, or markets through a single investment vehicle. It also provides flexibility and lower investment costs in comparison to individual stocks or mutual funds. To help simplify your investment decision, we have leveraged the TipRanks ETF Screener to scan for ETFs with more than 20% upside potential. Today, we have focused on two pharma-sector ETFs: XPH and IHE.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s delve deeper.

SPDR S&P Pharmaceuticals ETF (XPH)

The SPDR S&P Pharmaceuticals ETF tracks an equal-weighted index of US pharmaceutical companies. XPH has $208.69 million in assets under management (AUM), with the top 10 holdings contributing 45.67% of the portfolio. Further, the ETF boasts a current dividend yield of 1.32%. Meanwhile, the expense ratio of 0.35% is one of the lowest in the industry.

On TipRanks, XPH has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 37 stocks held, 31 have Buys, five have a Hold, and one stock has a Sell rating. The average SPDR S&P Pharmaceuticals ETF price forecast of $58.24 implies a 44.1% upside potential from the current levels.

iShares U.S. Pharmaceuticals ETF (IHE)

The iShares U.S. Pharmaceuticals ETF tracks a broad-based, cap-weighted index of US pharmaceutical companies. The ETF generally invests about 80% of its funds in the healthcare sector. IHE has $600.41 million in AUM, with its top 10 holdings contributing 77.47% of the portfolio. Notably, IHE has a current dividend yield of 1.41%. Its expense ratio stands at 0.40%.

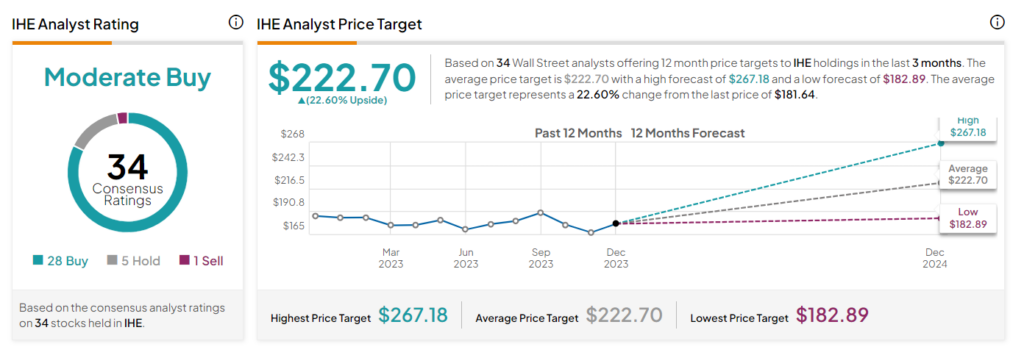

On TipRanks, IHE has a Moderate Buy consensus rating. Of the 34 stocks held, 28 have Buys, five have a Hold rating, and one stock has a Sell rating. The average iShares U.S. Pharmaceuticals ETF price target of $222.70 implies a 22.6% upside potential from the current levels.

Ending Thoughts

Investing in sector-focused ETFs offers a strategic way to gain exposure to specific industries, providing diversification and potential growth opportunities within chosen sectors. Given the solid upside potential expected by analysts, XPH and IHE ETFs might seem attractive to investors.