There’s no secret to successful stock picking – it comes down to understanding the data, recognizing patterns, and seeing how the pieces fit together. The real challenge is that the market produces a vast amount of data.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Making sense of that ocean of information takes time and expertise, which is why professional analysts dedicate their careers to it, often narrowing their focus to specific industries or market segments. For everyone else, diving that deep into the numbers is rarely practical.

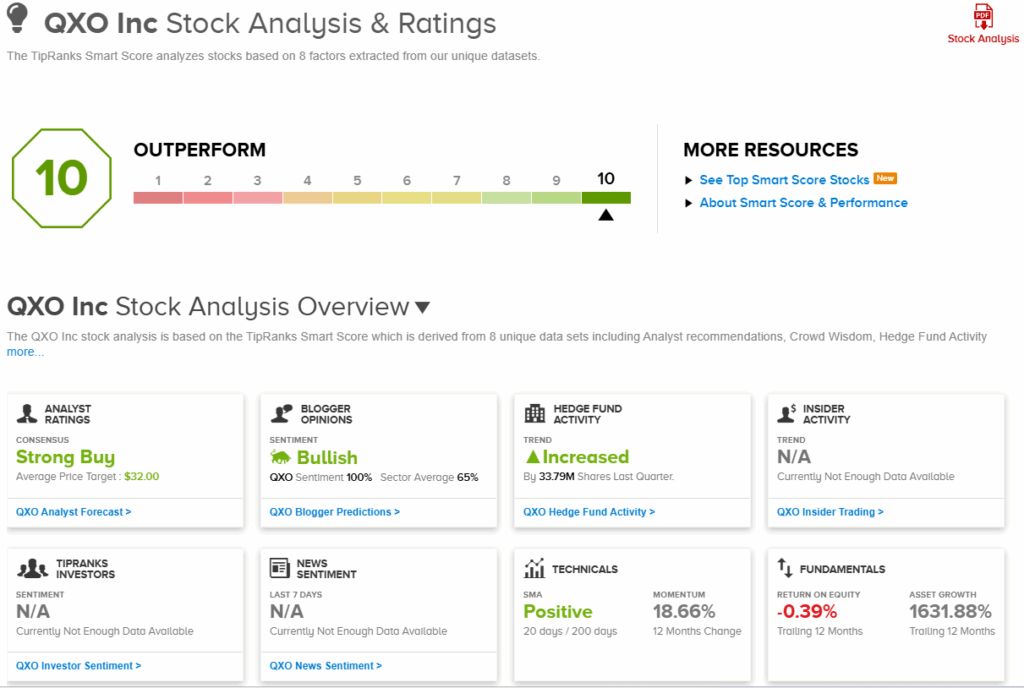

That’s where AI and TipRanks’ Smart Score step in. The Smart Score is an algorithm that applies artificial intelligence and natural language processing to evaluate every publicly traded stock. It analyzes a wide range of factors statistically linked to future outperformance and distills them into a simple 1-to-10 score.

Stocks that achieve a ‘Perfect 10’ stand out as particularly compelling – and when top Wall Street banks share that conviction, it’s a combination worth noticing.

We turned to the TipRanks database to find such names and identified two ‘Perfect 10’ stocks that also enjoy strong endorsements from major banks. Here’s a closer look.

QXO Inc. (QXO)

Up first on our list of ‘Perfect 10’ stocks is QXO, a distribution company working in the building materials sector. QXO offers lines of roofing, siding, waterproofing, and other related building and construction products in the North American market. The company has over 600 locations, and a fleet of over 3,000 trucks to facilitate product deliveries.

Getting into specifics, QXO’s products are divided into three segments: exterior materials, interior materials, and tools & supplies. On the first, the company offers such items as decks & railings, lumber & composites, windows, sidings, accessory fittings – to name just a few. Interior materials include such vitals as drywall and insulation, while tools and equipment include everything from nails and fasteners to hand tools and air-powered tools to personal safety gear such as hard hats.

However, QXO only recently became a building products distributor. In 2Q25, QXO finalized its acquisition of Beacon Roofing Supply, significantly expanding its presence in the building products distribution market, including roofing and related construction materials. Before the deal that transformed the company, QXO was a much smaller software and technology firm focused on digital platforms and tech-driven solutions.

The acquisition led to huge growth in the firm’s last set of financial results, with net sales rising from just $14.5 million in 2Q24 to $1.91 billion in 2Q25, and beating the forecast by $32.7 million. At the bottom line, the company’s 11-cent non-GAAP EPS was 7 cents better than the forecast.

This stock has caught the attention of Morgan Stanley, one of the banking industry’s biggest names. MS analyst Christopher Snyder is impressed by the company’s growth and the opportunity offered in the building sector by lower interest rates, writing, “QXO is expected to compound EBITDA at a ~40% CAGR through decade — roughly 5x the peer group, yet shares trade at a discount… While the QXO value creation opportunity is not cycle dependent, it always helpful. After US construction stagnated in 2023-25 on higher rates, we are beginning to see signs of cycle momentum and potential NTM rate cuts would further aid the recovery into 2026. QXO also screens to benefit from Trump policy by shifting more investment into the US (ie structures that need roof) while Tariffs also bring higher industry price which would translate to higher profits for QXO as the company looks to expand its GM into 2026 and the higher price environment.”

These comments are accompanied by an Overweight (i.e., Buy) rating, as well as a $35 price target that suggests a robust one-year gain for the stock of 89%. (To watch Snyder’s track record, click here)

QXO’s Strong Buy consensus rating is based on 12 recent analyst reviews that feature a lopsided split of 11-to-1 in favor of Buy over Hold. The shares are trading for $18.50, and their $30.65 average target price implies an upside of 66% in the year ahead. (See QXO stock analysis)

SharkNinja (SN)

The second ‘Perfect 10’ stock we’ll look at is SharkNinja, a company in the home appliance segment. SharkNinja sells fun – its best-known products are its Ninja line of kitchen appliances and gadgets. These are innovative tools, including everything from home slushy makers to powerful blenders, and are designed to make cooking fun while fostering kitchen creativity.

On the Shark side, the company’s products are best known for the Shark line of vacuum cleaners, both cord and cordless models. Other products include steam mops, carpet cleaners, air purifiers, and fans & heaters, as well as various beauty products and gadgets, with a focus on facial care. Taken together, SharkNinja’s lines of branded products are designed to make the routine tasks of the home and kitchen fun as well as fast.

The company supports its product lines with engineering know-how. While the product lines are not essential devices – we can all live without them – they are designed with functionality and durability in mind, and SharkNinja pays careful attention to ensuring a quality build. The company has built its growth not just on solving consumer problems, but also on discovering new consumer needs.

SharkNinja traces its roots to 1994, and in the past 31 years has built itself into a $12.5 billion leader in the consumer product sector. In 2024, the company saw $5.53 billion in total revenue, a figure that was up 30% year-over-year. The most recent quarterly report covered 2Q25 and showed $1.44 billion in revenue. This figure represented 16% year-over-year growth and edged over the forecast by $60 million. The bottom-line figure, the non-GAAP EPS of 97 cents, was up from 71 cents in 2Q24 and was 17 cents per share better than had been anticipated.

We should note here that SN shares are down approximately 20% in the last three months, on worries that the shares are overvalued and that consumer spending may slow down. For JPMorgan analyst Andrea Teixeira, however, this represents a sound moment to buy in. She says of the company, “We believe the recent sell-off is a buy opportunity for medium to long term investors, despite the near term sales deceleration (mostly driven by shipment timing and innovation calendar)… This issue is not new as management had publicly stated it at a competitor conference in early September… We think demand continues to be strong and as investors look past the 3Q and 4Q dynamics, and focus on the likely solid pipeline of innovation in 2026, shares will likely rebound from current levels.”

Putting that outlook into quantifiable terms, Teixeira gives SN an Overweight (i.e., Buy) rating. Her price target, set at $131, implies a one-year upside potential of 47%. (To watch Teixeira’s track record, click here)

Overall, the 9 recent analyst reviews here include 8 Buys and 1 Hold for a Strong Buy consensus rating. The stock has a selling price of $89.20 and an average target price of $138.25, for a 55% potential upside on the one-year horizon. (See SN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.