Successful stock picking is hardly mysterious. It’s not about finding hidden secrets or unlocking secret knowledge. Rather, it’s about the basics: understanding market data, finding patterns, and making sense of what you see.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The catch, of course, is that the market generates a lot of data. There are thousands of traders, dealing in thousands of stocks, leading to tens of millions of daily transactions, and that sheer volume of raw data presents a considerable challenge to the individual retail investor.

But there’s a tool that can help make sense of it all – the Smart Score, the popular AI-powered stock analysis tool from TipRanks. The Smart Score is designed to scour the market data, and to use it to compare every stock to a set of factors that have proven to be sound predictors of future share performance.

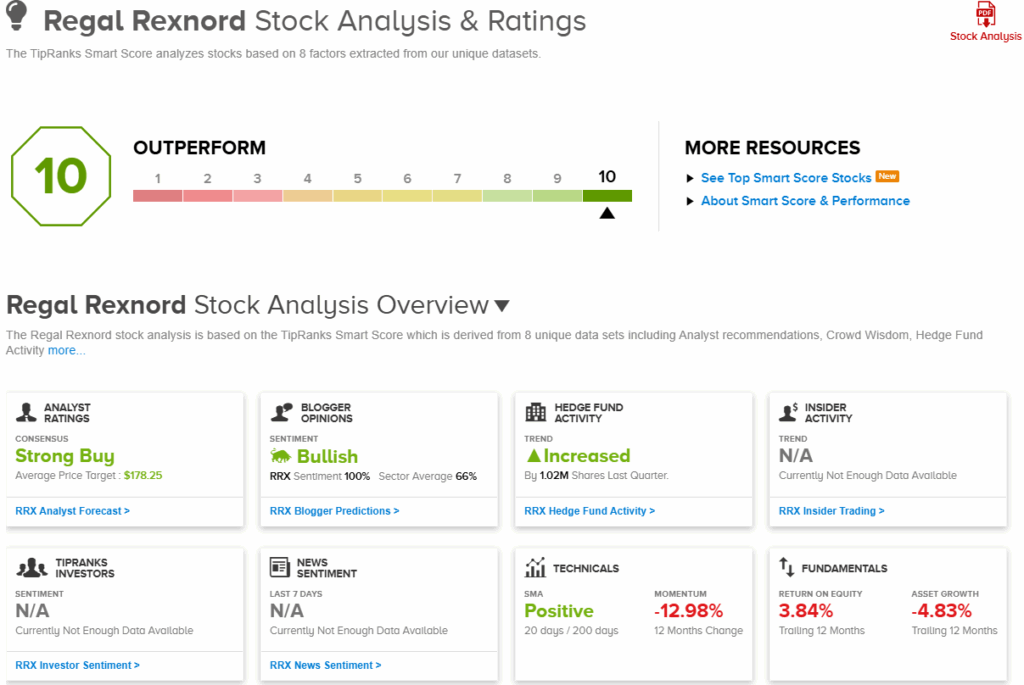

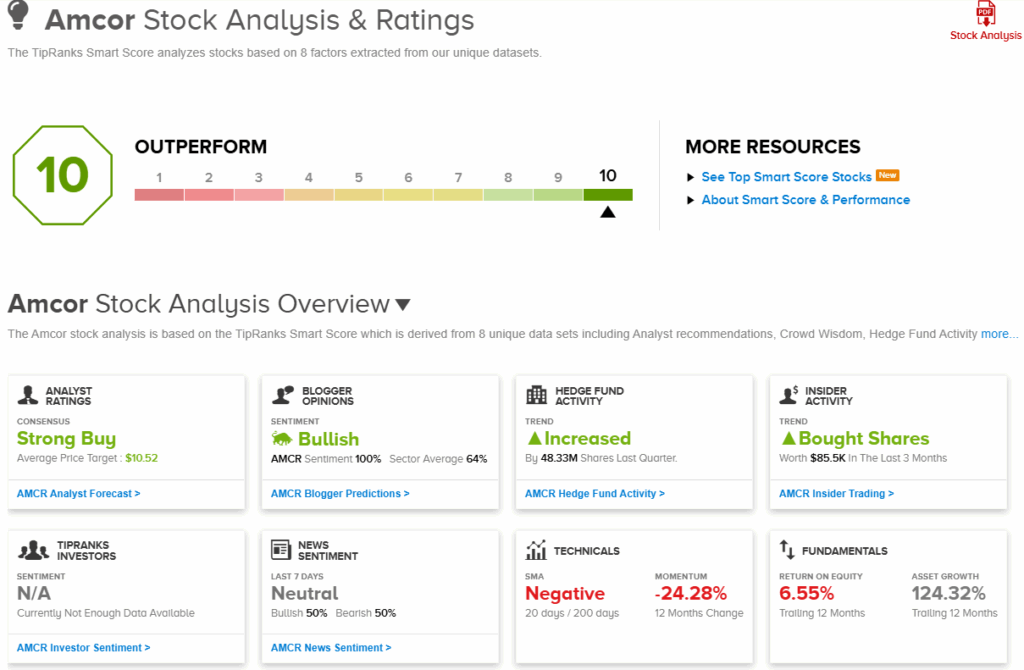

The Smart Score sums up its analysis by giving each stock a simple score on a scale of 1 to 10 – with the ‘Perfect 10s’ being stocks that deserve a closer look. And when those ‘Perfect 10s’ line up with the analysts’ recommendations – well, that’s just the best of both worlds.

Looking into the TipRanks database, we’ve found two stocks that have the coveted ‘Perfect 10’ Smart Score – and that have the thumbs up from JPMorgan’s analysts. Here are the details.

Regal Rexnord (RRX)

The first ‘Perfect 10’ stock on our radar here is Regal Rexnord, a stalwart of the industrial sector with 70 years’ experience in designing, manufacturing, and marketing the specialized tools and products that support power and transmission assemblies for moving systems. In simpler language, Regal Rexnord focuses on motion control. The company’s product lines include AC/DC controls and drives, mechanical power transmission components, gearings, industrial chain and sprocket assemblies, electric motors and components, clutches and brakes – it’s a long list, as motion control forms a vital niche in the modern industrial plant.

Unsurprisingly, Regal Rexnord’s products are used in a wide range of industries and applications. The company has connections and customers in the aerospace and automotive sectors, in cement manufacturing and stone quarrying, in commercial laundries, in farming and agriculture, and plenty more. Most modern industries rely on mechanically driven, repetitive motion, and that in turn requires motion control technology – which has been Regal Rexnord’s specialty since 1955.

In its 70 years of business, Regal Rexnord has built itself into a $9.55 billion industrial leader. The company has a global footprint, with customers around the world, and its workforce, 30,000 strong, handles everything from manufacturing and assembly to marketing and distribution to long-term support.

In August, Regal Rexnord released its 2Q25 results, during which the company saw quarterly sales of $1.5 billion; this was down 3.3% year-over-year, although it edged over the forecast by $1.8 million. At $2.48 per share, the non-GAAP earnings were 4 cents better than had been anticipated, and were up 8.3% from the prior year. The company reported that its adjusted free cash flow in the quarter came to $493 million; Regal Rexnord expects the full-year 2025 adjusted free cash flow to reach as high as $700 million.

For JPMorgan analyst Tomohiko Sano, Regal Rexnord presents multiple reasons for optimism. The analyst cites the continuing relevance of the firm’s product lines, even as the company shifts to a more modern focus, as well as its financial strength, among other attractive features. Sano writes, “The company is transitioning from a legacy parts vendor to an industrial solutions powerhouse, supported by significant margin expansion and a shift from components to integrated solutions through impactful M&A… Management is focused on reducing leverage through expanding free cash flow margins, addressing depressed trading multiples due to high leverage post-M&A. With >50% exposure to secular end markets, a strong and lengthening backlog, ~$250M in additional synergies, robust free cash flow, and net leverage on track to ~2.5x by 2026E, RRX is positioned for near-term re-rating and long-term value creation.”

Quantifying his stance here, the JPM analyst puts an Overweight (Buy) rating on the stock, and he complements that with a $200 price target that points toward an upside of 38.5% by the end of next year. (To watch Sano’s track record, click here.)

This industrial company has earned a Strong Buy rating from the analyst consensus, based on a unanimous 8 Buys. The shares are currently trading for $144.37 and their $178.25 average target price indicates room for a 23.5% gain in the next 12 months. (See RRX stock forecast.)

Amcor (AMCR)

For the next stock on our list of ‘Perfect 10s,’ we’ll shift our focus to the industrial packaging industry – specifically, to an industrial company that manufactures a wide array of packaging products. Amcor was founded in Australia way back in 1896, and today the company is a leader in the global packaging industry.

The company boasts that it has a presence in 40 countries around the world, and generated $15 billion worth of sales in its fiscal year 2025, which ended this past June 30. The company operates through more than 400 locations globally, and employs ~75,000 people. The company boasts a market cap of $18.6 billion.

Amcor is known for using recycled and recyclable materials in its products. These include resealable food pouches, vacuum sealable bags, portion control films for foodservice providers, sterile barrier pouches used in the healthcare field, single-portion food containers, a wide range of recyclable plastic bottles, roll-fed product labels – the company even produces and markets the machinery used to fill its packaging items with the end-use products. We don’t usually think about the packaging industry, but it touches almost every aspect of our daily lives – and Amcor holds a strong position in this large field.

In April of this year, Amcor finished its acquisition of Berry Global, a US-based global provider of plastic packaging products. The acquisition, which was announced last November, was valued at $8.4 billion. The transaction was conducted as an all-stock deal.

As noted, Amcor finished its fiscal year 2025 this past June, recording $15 billion in sales for the 12-month period for an 11% year-over-year increase. For the final quarter of fiscal 2025, however, Amcor’s stock fell sharply in mid-August after the fiscal 4Q25 numbers were released.

At the top line, Amcor reported $5.08 billion in sales for the quarter, for a 43.5% year-over-year increase, reflecting the completion of the Berry acquisition. However, the quarterly revenue missed expectations by $99.1 million. Amcor’s earnings for the period came to $0.20 per share by non-GAAP measures, missing the forecast by 2 cents per share. The company had an adjusted free cash flow in fiscal year 2025 of $926 million, a figure that was in-line with the previously published guidance. For the year ahead, Amcor is guiding toward a free cash flow of $1.8 billion to $1.9 billion.

Of interest to dividend-minded investors, Amcor maintains a dividend policy. The current payment – sent out on September 25 at 12.75 cents per common share – annualizes to 51 cents per share and gives a forward yield of 6.3%, well above the prevailing rate of inflation.

Analyst Jeffrey Zekauskas, covering this stock for JPM, expects that Amcor will deliver strong results now that the Berry acquisition is complete. He believes that the company has set realistic targets, and he expects the free cash flow to see substantial growth. Laying out his case, Zekauskas writes, “We view the combined Amcor as a strong generator of free cash flow and view its synergy targets as reasonable and achievable. We believe that free cash flow should lift nicely in F2027 with the absence of cash outlays to achieve synergies and the extraction of procurement as well as SG&A and operational efficiencies. We think there’s room for multiple expansion as these synergies are achieved and Amcor delivers its balance sheet, and investors collect a 6% dividend yield while they wait.”

Zekauskas goes on to rate AMCR shares as Overweight (Buy). He complements that rating with a $10 price target that suggests a one-year upside potential of 23%. (To watch Zekauskas’s track record, click here.)

This industrial stock has a Strong Buy consensus rating on the Street, based on 8 reviews that break down to 6 Buys and 2 Holds. AMCR shares have a current trading price of $8.14 and an average price target of $10.52, implying a gain for the year ahead of 29%. (See AMCR stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.