The way couples meet has drastically changed since the rise of the Internet in the 1990s. A survey of 5,421 adults conducted by Stanford University showed that between 1995 and 2017, the percentage of people who met their partners online rose from a mere 2% to a gigantic 39%. Grand View Research estimates that the global online dating market was valued at $9.65 billion last year and is expected to grow at a compound annual growth rate of 7.4% through 2030. Therefore, using TipRanks’ comparison tool, let’s take a look at two online dating stocks with more than 30% upside potential, according to analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Match Group (NASDAQ:MTCH)

Match Group is an online dating industry pioneer and has helped hundreds of millions of people connect since its founding. It is the parent company of some of the world’s most popular platforms, including Tinder, Hinge, Match, OkCupid, Plenty of Fish, and Pairs.

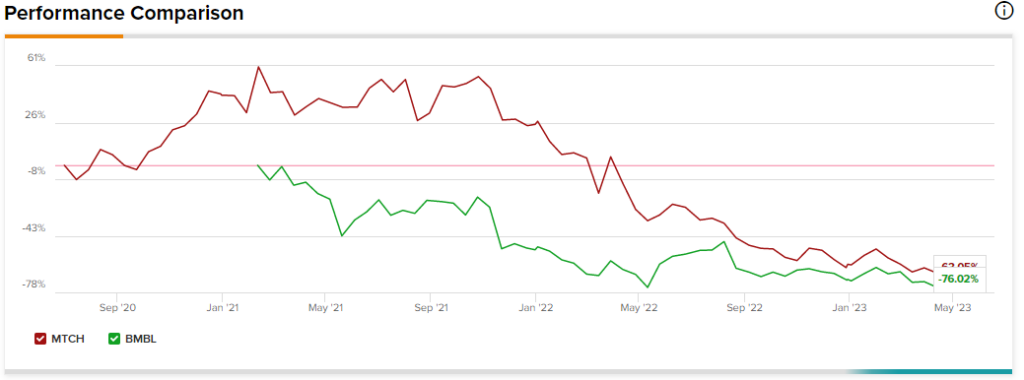

Match was a big winner during the pandemic run-up but has fallen over 75% from its all-time high and about 5% so far in 2023. However, analysts think the selling is overdone as the average MTCH stock price target sits at $53.42, reflecting upside potential of over 30% from the current level. Match stock is rated as a Moderate Buy based on 15 Buys, six Holds, and zero Sells.

The lack of growth at Match is the likely culprit of the downturn in its stock. In its first quarter ended March 31, 2023, its revenue fell 1% to $787 million, and its number of paid subscribers declined 3% to 15.9 million. However, the market is ignoring the cash flow — the company generated $101 million of free cash flow for the quarter, reflecting 12.8% of total revenue. Match expects to produce $800 million in free cash flow for the full year, meaning its stock trades at about 14 times this forward estimate (much less than its three-year average multiple of 33 times).

One final note on Match is that it continues to expand its family of brands, which will be a key to its growth in the future. Its most notable acquisitions in recent years include Hinge in 2019 and The League last year, and it is always on the lookout for more deals. It also develops concepts from within, such as Archer, which it launched earlier this month and could be a significant competitor to Grindr (NYSE:GRND) in relatively short order.

Match’s stock appears undervalued based on its free cash flow production, and the company anticipates more growth in the future, creating an ideal situation for patient investors.

Bumble (NASDAQ:BMBL)

Bumble is the parent company of Bumble, Badoo, and Fruitz. Bumble was one of the first dating apps built on the idea of giving women the first move, Badoo is a dating-focused social network, and Fruitz is one of the fastest-growing dating apps in Europe. It’s worth noting that Bumble was founded by Whitney Wolfe Herd, the co-founder and former Vice President of Marketing at Match Group’s Tinder.

Bumble’s stock peaked on the day of its IPO and has been moving in the wrong direction ever since. It’s currently down over 75% from its all-time high, including a decline of over 15% this year. Analysts think the selling has led to a buying opportunity as the average BMBL stock price target sits at $23.47, reflecting an upside of nearly 40% from today’s level. Further, Bumble stock is rated as a Moderate Buy based on 10 Buys, six Holds, and zero Sells.

The growth profile at Bumble has been better than Match of late, with revenue growth of 16% to $243 million and paid user growth of 15% to 3.5 million in its first quarter ended March 31, 2023. It, too, is cash flow positive, with free cash flow of $6.6 million in the quarter, representing about 3% of total revenue. Unfortunately, Bumble does not provide free cash flow guidance, but analysts anticipate the company to deliver about $192 million in Fiscal 2023, which would give the stock a forward multiple of just 12 based on this estimate.

Bumble has not been nearly as acquisitive as Match Group, but this may change in the years ahead. It acquired Fruitz last year and Official, a relationship-building app for couples, earlier this year. While there is still significant runway for each of its platforms, Bumble has to keep an eye out for deals to remain a top player in this highly-competitive industry.

Bumble has significantly fewer brands than Match, but nonetheless, it has become a powerhouse in the online dating industry.

Takeaway: Online Dating is Growing Too Quickly to Ignore

The online dating industry has boomed over the last 20 years, but it still has significant growth ahead of it. Analysts have named Match Group and Bumble two of the best ways for investors to gain exposure to this trend.