Initial public offerings (IPOs) rank among the most closely followed events in the stock market. They inject new opportunities, and often renewed excitement, into the trading landscape. As a result, when IPO activity accelerates, it’s widely viewed as a sign of market strength and investor confidence.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That momentum has clearly returned. By the third quarter of this year, IPO activity in the U.S. rebounded sharply, supported by a favorable mix of factors: improving investor sentiment, the Fed’s recent policy easing, and a solid corporate earnings season.

The numbers tell the story. U.S. markets saw 65 IPOs in Q3, raising a total of $15.7 billion, well above the 40 IPOs and $8.6 billion recorded in the same period last year.

Of particular note, the quarter featured five “unicorn” offerings, each raising over $1 billion, along with 18 others that brought in more than $100 million apiece. This strong appetite for large deals was a major contributor to the overall surge in activity.

Analysts at Bank of America have been keeping a close eye on the latest IPO wave. Among the recent debuts, they’ve singled out two names and crowned one as the better buy. Let’s dig in and see which stock wins BofA’s seal of approval and with some help from the TipRanks database, we can see if the rest of the Street agrees with the BofA take.

Alliance Laundry Holdings (ALH)

The first stock we’ll look at belongs to Alliance Laundry Holdings, a leader in the commercial laundry equipment business. The Wisconsin-based company traces its roots back to 1908, and with more than a century of experience in designing, manufacturing, and distributing commercial laundry machines, products, and solutions, it has built itself into a leader in the field.

Alliance boasts more than 3,500 employees, building commercial laundry products that are sold and used in more than 140 countries. These machines are sold under five brands, including Speed Queen, Primus, and IPSO; the first of these brands includes both commercial and residential models. Overall, Alliance’s product lines include washing machines, clothes dryers, and ironers.

Alliance stock opened for trading on Oct 9 under the ALH ticker. The company initially announced that it would sell 24,390,243 shares and that additional shares would be sold by an existing selling stockholder. In the Oct 10 closing announcement, Alliance disclosed that it had sold the 24,390,243 shares – and that the existing stockholder had sold 18,804,877. In addition, the underwriters exercised their option and purchased 5,634,146 shares at the IPO price of $22 each. In all, 43,195,120 shares of ALH were put on the market. Alliance did not realize any proceeds from the shares sold by the existing stockholder; the company’s gross proceeds from the IPO came to more than $536 million from the shares that it put up for sale. The company now has a market cap of ~$5.2 billion and has stated that it will use the proceeds to pay existing debt.

After the IPO, at the end of October, Alliance announced that it will, on November 13, release its first set of earnings as a public company. The release will cover 3Q25 and will be made public before the markets open that day.

This new stock caught the attention of Bank of America analyst Andrew Obin, a 5-star expert on industrial stocks. Obin looks at Alliance’s current state and expects to see the company continue to execute well going forward, as he writes, “While a new public company, Alliance starts with a large installed base of 8mn units, established distribution networks, strong brands, and scaled manufacturing footprint, and a solid pace of new margin- and revenue-enhancing products. ALH shares currently trade at 14x our 2026E adjusted EBITDA, below the peer average of 16x. ALH has above-peer margins and solid internal growth drivers, but has currently higher financial leverage and a limited history as a public company… Building a public record of execution, paying down debt, and a decrease in P.E. overhang should aid valuation multiple expansion over time, in our view.”

Obin opens his coverage of this new stock with a Buy and sets a $37 price target that points toward a one-year gain of 38% for the shares. (To watch Obin’s track record, click here)

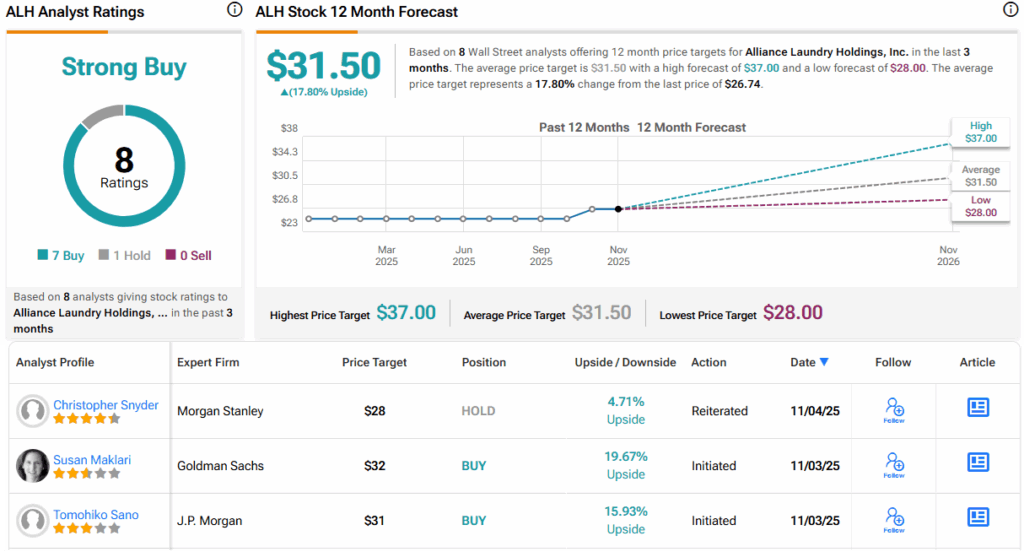

Since its IPO, Alliance has picked up 8 analyst reviews. Their split, 7 to 1 favoring Buy over Hold, supports the Strong Buy consensus rating. The stock’s trading price of $26.74 and average target price of $31.50 together suggest a gain of 18% in the next 12 months. (See ALH stock forecast)

Neptune Insurance Holdings (NP)

Flooding is the most prevalent natural disaster, and one of the most dangerous. Most major cities are built in flood-prone areas – think about low-lying coastal regions or major river courses, and just how many large cities are located there. But insurance adjusters will point out that over 25% of flood claims come from low-risk areas – underscoring just how prevalent high water can be and how much damage it can do.

To start with, even a single inch of water coursing through a home can do tens of thousands of dollars’ worth of damage. Flooding is the costliest natural disaster in the US and the most frequent threat from severe weather. Many property owners are not sufficiently insured against it or may even believe that they don’t need flood insurance. This is where Neptune steps in.

The company specializes in providing high-quality flood insurance, backed by sound underwriting and an AI-powered platform that helps customers determine exactly what insurance they need and what fair rates to pay. Neptune provides flood insurance in the US market, with packages tailored for residential, commercial, and even condo building properties. The company can offer excess policies that provide coverage beyond what is required by NFIP policies, allowing customers to protect their homes and their businesses.

Neptune announced the pricing of its IPO in September and put 18,421,053 shares on the market at $20 each, the top end of the expected range. We should note that the company did not actually realize new capital from this sale – the stock shares were put on the market by “certain selling security holders.” Neptune’s IPO closed on October 2, and the underwriters exercised their option to purchase an additional 2,763,157 shares. Since peaking in early October, Neptune’s stock has fallen by more than 12%, but the company still boasts a market cap of ~$3.7 billion.

For analyst Joshua Shanker, who covers this new stock for Bank of America, the key point to consider is not Neptune’s success in its niche – but rather that its stock opened at too high a price. As Shanker explains it, “Neptune shares went public to much fanfare… At the current price, the Neptune enterprise value trades at ~33x our adj. EBITDA, and the stock trades at ~19x our expectations for 2026 revenue. This seems like a pretty thick valuation in absolute terms in a sector ambivalent sense (only seeming more so in the context of being ‘an insurance stock,’ where low valuations are the norm). Neptune, however, doesn’t have any precise comparable companies in public markets today (and certainly those differences become more pronounced when compared with companies in the insurance sector).”

The 5-star analyst starts his coverage here with an Underperform (i.e., Sell) rating and a price target of $21 that implies a one-year downside of 21%. (To watch Shanker’s track record, click here)

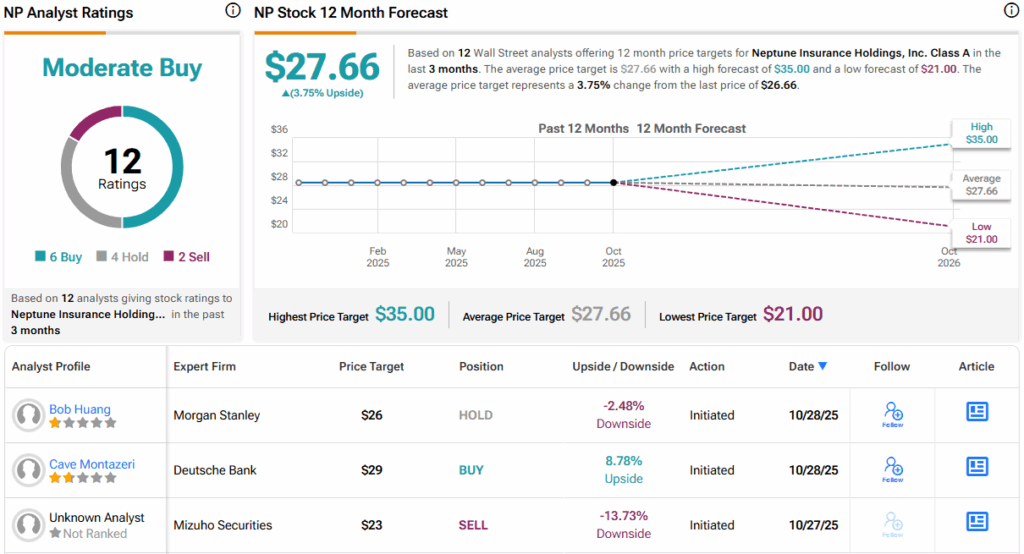

There are 12 ratings on record already for Neptune. These include 6 to Buy, 4 to Hold, and 2 to Sell, giving the stock a Moderate Buy consensus rating. NP shares are currently selling for $26.66, and the average target price of $27.66 suggests that the stock will appreciate by a modest 4% over the coming year. (See NP stock forecast)

IPOs may be hot, but they are not created equal – and Bank of America’s analysts clearly see ALH as the superior new IPO stock to buy right now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.